I am back with 20 more odd ducks from the OTC Markets. I could not believe how much you readers enjoyed the first 20 from back in January, but the message was clear: give the people what they want.

So without further ado, I present:

Meritage Hospitality Group - MHGU. I’m not a big fast food guy, but now and then you just need a burger and fries, right? Maybe a Frosty to dip those fries in? Wendy’s has you covered. And Meritage Hospitality owns 374 Wendy’s units, mainly in the Midwest and Southeast regions, making them one of the Wendy’s system’s largest franchisees. Alluvial once owned a good bit of Meritage, but we sold over concerns related to leverage and operating cost pressures in the post-COVID environment. That turned out to be prudent as Meritage has struggled in recent years. But the Meritage’s valuation on a per-restaurant basis has fallen to around $1.9 million, lease liabilities included. That is well below the cost of a newly-built Wendy’s unit, so maybe Meritage is worth a look here?

Bonal International - BONL. I’m always intrigued at just how many niche industrial processes and equipment it takes to make the world run. Bonal International sells machines that use vibration to reduce stress in metals. Not many of them, mind you. Even in a good year, Bonal manages less than $2 million in revenue. But they do eke out a profit and at last trade, were valued at less than net current assets. Anyone want to own a tiny Michigan manufacturer?

Tofutti Brands Inc. - TOFB. Tofutti makes vegan food. I am told the company has a loyal fanbase, but I can’t recall seeing their vegan ice cream sandwiches in the freezer aisle. Sadly, the fanbase seems to be shrinking and revenues are down by one third since 2022. There are more options for the vegan community than there used to be, and perhaps that is why Tofutti is suffering. Still, gross profits were $2.3 million in 2024, and the IP might be valuable to some larger food company. Tofutti trades at 1.2x net current assets.

Avoca LLC - AVOA. If you daydream of owning Louisiana marshland, this is the company for you. Avoca owns 16,000 acres, nearly the entirety of Avoca Island.

Avoca Island is apparently good for duck hunting, and the Avoca Duck Club holds a lease expiring in 2029. Otherwise, Avoca LLS generates some revenue from oil and gas royalties and environmental remediation credits. Frankly, I am a little surprised to see Avoca trade at a $10 million market cap. There does not seem to be much long-term development potential or other potential revenue sources. Interestingly, Hancock Whitney Corporation, a bank, (ticker: HWB) is the majority shareholder.

Prologis Inc. Series D preferred - PLDGP. Pricing gets wonky on the OTC markets, and this is a prime example. Prologis is a massive and sophisticated self storage REIT, yet this series of preferred shares trades OTC for some reason. This pref is callable in November 2026 at $50 per share. Seeing as Prologis has called every other series of preferred stock it has, including those with much lower coupons, it seems highly likely that Prologis will call the series D preferred, resulting in an IRR of less than 4%. Not a terrible place to park cash, I suppose, but not great.

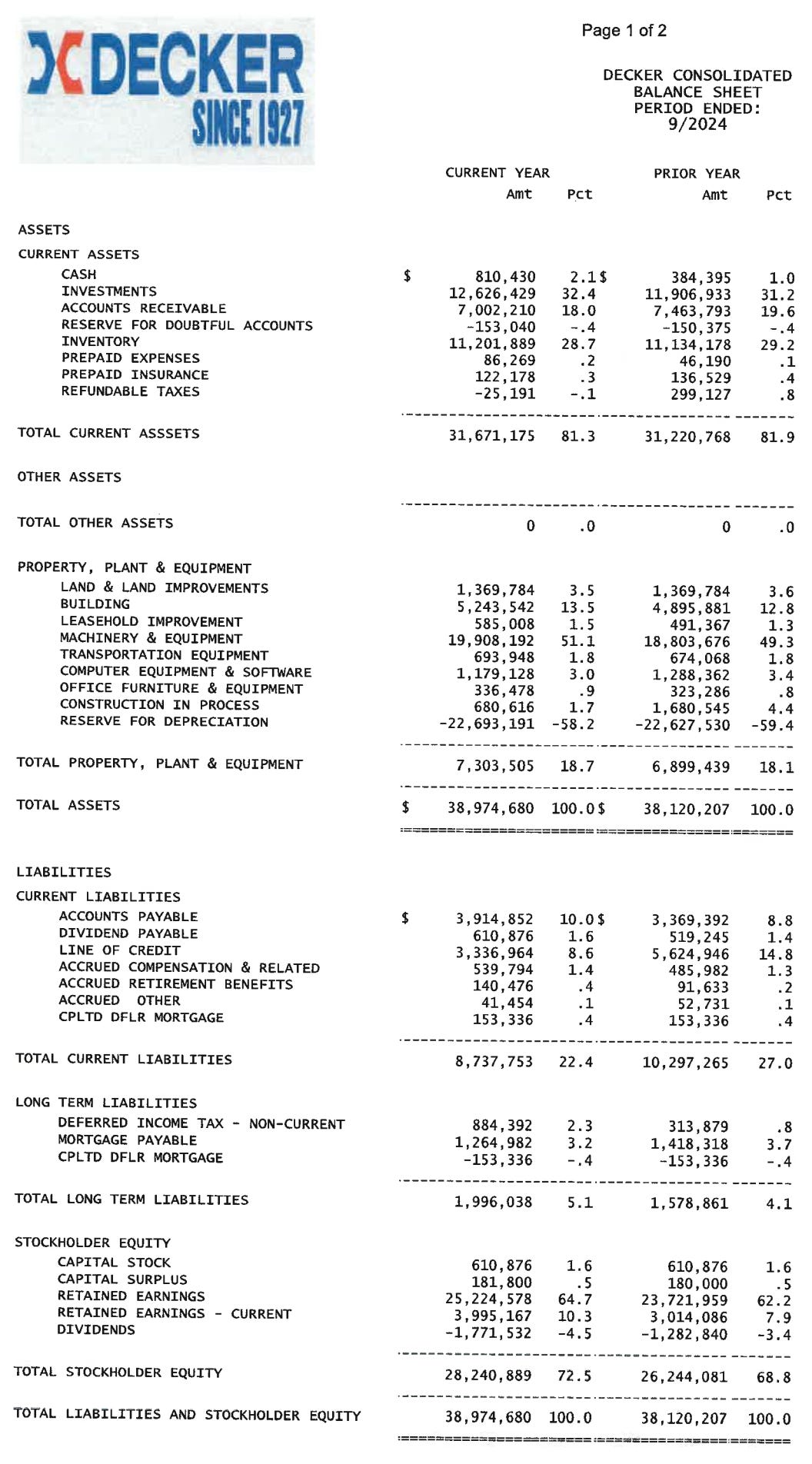

Decker Manufacturing - DMFG. Nuts and bolts hold the world together. Decker Manufacturing produces both, as well as the best vibes on the entire OTC markets. Just look at this quarterly statement, clearly a scanned version of the printout from an accounting system installed in the 1990s.

McRae Industries - MCRAA/MCRAB. McRae makes boots. Army boots, and also Western-style boots with the fancy tooled leather. Most of the time, boots are a fairly good business. McRae makes plenty of money, but unfortunately they allow most of the cash to sit on the balance sheet or they use it to buy real estate. If they would just give it back, this could really be a nice little opportunity.

Boss Holdings, Inc. - BSHI. Another serious oddball, Boss Holdings offers pet products, party balloons, and those questionable phone chargers and the like that you find at gas stations and rest stops. Previously, Boss had a line of work gloves and protective wear, but it sold this business a few years ago. Things have gone rather poorly since. The latest incident was a cyber-attack that cost the company $2.5 million. Thankfully, $2 million was covered by insurance, but the incident caused a significant operating loss for the 3rd quarter of 2024. On the plus side, the company has a substantial balance in cash and treasuries, which gives them breathing room as they try to right the ship.

George Risk Industries - RISKIA. George Risk makes security products, mainly access control and alarm systems. These are used to secure commercial facilities, pools, etc. It’s a good business and the company is quite profitable. Unfortunately, rather than distribute or reinvest their profits, George Risk has built a substantial cash and investment portfolio equal to half its market cap. The company does pay a good dividend, but the lazy balance sheet has probably cost shareholders returns over time. I will say the company has a fantastic Mid-Century Modern logo and I hope they never change it.

BAB, Inc. - BABB. BAB is a franchisor of “Big Apple Bagels” stores, plus a few others. They have 65 units across 18 states, but I can’t say I have ever seen one. This is one of these companies that I check in on yearly or so and every time I think “I can’t believe they are still in business.” But being a franchisor is a fairly high margin, capital light business, and though BAB doesn’t really grow, it does produce a reliable $600k or so in operating earnings every year. The company pays out nearly all its earnings as dividends. Could be worse!

The Stephan Co. - SPCO. Stephan is a fun little company that acquires barbering supply businesses. They are attempting to drive margins through scale, but so far profits and sustained top-line growth have been a little hard to come by. Results did improve in 2024, and the company eked out a $6,000 profit. Sales were down 6%, but gross profit rose 8% thanks to operating efficiencies. I am rooting for this business, but it goes to show just how hard it is to be a tiny public company.

Mike Lindell Media Corp. - MLMC. Yes, it’s the My Pillow guy. Famous for his political involvement and now his legal troubles. I’m not a fan, but it’s fascinating that he managed to get his media business merged into an OTC shell company. The board of directors includes such luminaries as Rudy Giuliani and former Cleveland baseball player Rob Rogers. The company’s OTC markets disclosures are highly amusing. Just check out this one, which includes allegations of threatening text messages by a former COO/director and theft of intellectual property.

Marketing Alliance - MAAL. Marketing Alliance is an intriguing little holding company. Its main business is in insurance agencies, while it also has a construction business and owns securities. The company once owned a children’s entertainment center business, but it failed during COVID. In recent years, the insurance business has been in slow decline, with profits under pressure from falling revenue and rising costs. But the segment remains profitable. I will be watching to see if the insurance business can recover and if the construction business, now only marginally profitable, can be a real contributor.

Portsmouth Square - PRSI. Portsmouth Square is part of a convoluted complex of related businesses, but the more notable feature is the real estate the company controls: the 544 room San Francisco Financial District Hilton. It’s a large and valuable property. Unfortunately, the hotel is not currently profitable and is quite indebted, making it doubtful that Portsmouth Square will ever realize much value from owning it. In fact, the company nearly lost the hotel to foreclosure earlier this year before managing to refinance the hotel subsidiary’s debt. Still, things look dicey.

Reeds, Inc. - REED. There are plenty of examples of businesses with good products, but the company just can’t figure out how to make money. Take Reed’s. Reed’s brand ginger beer is delicious, in your Dark ‘n’ Stormy or by itself. At least, it was last time I had some several years ago. I should buy some more. Maybe I am part of the problem? Reed’s manages $38 million in annual revenue and gross profit of $11 million, but its operating costs are out of control. They really should sell the brand to a larger consumer company. No idea why they haven’t after all these years.

First Acceptance Corp. - FACO. How do you make money selling insurance to bad drivers? Well, you had better charge them a lot. Auto insurers have been hit hard in recent years by rising repair and replacement costs, but First Acceptance has thrived. The company has grown quickly in the non-standard (read: risky) auto insurance sector, nearly doubling its annual premiums received since 2021. Now, a rapidly growing insurer can be a dangerous thing. After all, anyone can write a ton of policies just by under-pricing them. But so far, First Acceptance has kept its combined ratios well below the magical 100. The company’s investment portfolio is standard for an insurer, dominated by treasuries, corporate bonds, and agency debt. First Assurance’s leadership has a good track record at larger insurers. Maybe there’s something here?

Looksmart Group, Inc. - LKST. I’m showing my age here, but a generation ago a host of Web 1.0 search engines competed for users. Google, of course, won out, leaving competitors like Lycos, Altavista, and AskJeeves only footnotes in the history of the internet. Looksmart was one of these search engines. In fact, in 1999 it was the 12th most-visited website. It IPOed in August 1999 and by October had achieved a $2.5 billion valuation. But it all ended in tears. Looksmart bounced through various owners, finally merging with a subsidiary of Pyxis Tankers (of all things) in 2015. Today, Looksmart somehow persists as a programmatic advertising seller. Are they profitable? No. Do they have a positive tangible net worth? Also, no. Yet, somehow this relic of a bygone era persists.

Scheid Vineyards - SVIN. Watching Scheid for years is how I learned that while owning vineyards and leasing them to someone else can be quite lucrative, being a vintner is a tough, tough business. Scheid is (mostly) the latter. Scheid makes mass consumption wines. In other words, cheaper wines for the less discerning or more budget-conscious consumer. Mass market wine is a highly commoditized business, and higher-cost producers like Scheid really struggle against their bigger competitors. Scheid has tried to muddle through by selling off excess land and cutting costs, but I fear the company’s rising debt load will prove its undoing.

Huntwicke Capital Group - HCGI. Here is another true eccentric of the OTC markets! Huntwicke is $25 million market cap company that dabbles in securities brokerage and portfolio management, real estate, brewing, and a soccer skills academy. You might ask what the synergies are among these businesses and believe me, I am wondering the same thing. Whatever the logic or lack thereof, I am glad that the OTC markets can still be a home for truly odd constructions like this.

Federal Screw Works - FSCR. Maybe it’s because I am from Pittsburgh, but I have such a soft spot for old-line industrial companies. Federal Screw works is a Michigan manufacturer with a $9 million market cap. For 108 years now, the company has sold its screws and fasteners to the automotive industry. Federal Screw is an inconsistent earner, and carries substantial debt and post-retirement liabilities. It amazes me that the company’s gross property, plant, and equipment is carried at $143 million and only $28 million net of accumulated depreciation. It should be noted that Federal Screw owns buildings with square footage of 347,000 on 25 acres. The land and buildings are carried at essentially $0 on the balance sheet, but could have significant value in a sale. Unlikely, but possible.

Thanks for reading and I hope you enjoyed learning about a few more of the OTC markets oddities that still exist. There are fewer and fewer as time goes by, but they still offer great entertainment potential for us real nerds, as well as occasional investment opportunities. Happy to discuss!

Alluvial Capital Management, LLC holds shares of Decker Manufacturing Corp. for client accounts it manages. Alluvial Capital Management, LLC may hold any securities mentioned on this blog and may buy or sell these securities at any time. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com

Ah, SVIN reminded me of the Crimson Wine Group spinoff (CWGL) from Leucadia ... hadn't thought about that one in years! They should just merge.

great work. not enough people sharing their list of oddity assets.

im a fan of the cheese bank in Italy - CE.MI