Alliance Semiconductor Is A Liquidation Gone Wrong, But Potential Remains - ALSC

Alliance Semiconductor is the story of a liquidation gone wrong. In 2005, after years of poor performance, the company found itself targeted by activist investors seeking liquidation. After agreeing to dismantle itself, Alliance set about selling off its portfolio of venture investments and shareholdings in other companies. In the largest of these transactions, QTV Capital paid $123.6 million for nearly all of Alliance's venture capital holdings.

Flush from asset sales, Alliance paid special dividends totaling $4.35 per share through July 1, 2008. In September, the company announced its board of directors announced its intentions to begin liquidation proceedings. On September 5, 2008, Alliance Semiconductor filed to deregister its stock.

That's when the trouble started. Seeking to maximize yield on its remaining cash, Alliance had invested nearly $60 million in auction-rate securities issued by AMBAC. A good explanation of these securities is available here, but two features of these securities are salient to the Alliance Semiconductor story:

Liquidity - Rates on the AMBAC auction-rate securities purchased by Alliance were to be reset in frequent auctions, which would also provide liquidity to holders. Outside of these auctions, liquidity for these securities was extremely limited.

Put Rights - Under certain conditions, AMBAC possessed the right to force the auction rate securities trusts to purchase AMBAC preferred stock, effectively converting these auction-rate securities into AMBAC preferred stock.

In October 2008, Lehman Brothers failed and the entire financial world plunged into crisis. The auction process for auction-rate securities failed, and transactions in these securities virtually ceased. Worse, for Alliance Semiconductors, AMBAC was decimated by losses suffered on the sub-prime mortgage products and derivatives it insured.

Instead of holding the safe, liquid cash alternatives Alliance Semiconductor thought it had purchased, the company now held $60 million worth of completely illiquid securities issued by a distressed sub-prime insurer. Interest on these securities was still being paid, but the company found itself unable to continue its liquidation as scheduled.

Alliance Semiconductor's management certainly bears the blame for investing nearly all its cash in these auction-rate securities, but they were hardly the only ones to make the mistake. Before the crisis, auction-rate securities were widely considered to be cash alternatives. A failure of the auction market for these securities was nearly unimaginable.

Faced with an outcry from the many business and individuals who had purchased auction-rate securities, many banks and investment banks repurchased these securities at par value in 2008. Alliance Semiconductors was not so fortunate. According to a bankruptcy attorney in San Diego, reeling from losses and facing the threat of bankruptcy, AMBAC was in no position to repurchase these securities and instead exercised its right to exchange these auction-rate securities for preferred shares.

As can be determined from this filing, AMBAC swapped each $25,000 worth of auction-rate securities for a share of AMBAC preferred stock with a par value of $25,000. Alliance received 2,277 shares. Due to AMBAC's distressed status, market value for these preferred shares was nowhere near par value, causing Alliance to suffer large losses. AMBAC eventually declared bankruptcy in November, 2010.

In the following years, Alliance Semiconductor pursued legal channels to receive full value for its former auction-rate securities. The company filed a claim with FINRA against JP Morgan, alleging the risks of the securities were not fully explained prior to Alliance's purchase. FINRA, however, disagreed, denying all of Alliance's complaints in November, 2011.

Deregistration, the losses on the auction-rate securities conversion and a near-complete lack of communication with shareholders lead Alliance's share to dip to a low of 10 cents in mid-2012. Little hope seemed to remain for shareholders, as the company's legal efforts were denied and AMBAC's bankruptcy seemed to indicate the AMBAC preferred shares would wind up worthless as well.

But on Friday, after market close, Alliance filed a new quarterly report indicating its AMBAC preferred shares do have value after all!

As of December 31, 2012, Alliance still held 2,277 shares of AMBAC preferred stock and listed these as having a value of $11.95 million, or $5,250 each. Even better, the company sold 80 of these shares for $6,750 each on February 4.

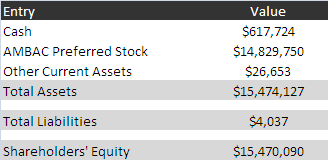

Assuming the market price of these shares still stands at $6,750, Alliance's balance sheet is as follows, and it's very simple:

All of Alliance Semiconductor's assets and liabilities are current. With $15.47 million in adjusted equity and 33.05 million shares outstanding, Alliance has 46.8 cents per share in net current assets/equity. Alliance stock last closed at 27 cents, a 42.3% discount to net current assets. The company also has $71.8 million in NOLs, capital loss carryforwards and unrealized losses, all of which are currently fully reserved against.

This calculation comes with a few caveats. For one, the market price of the AMBAC preferred stock may be volatile and could easily decline. (Anyone with access to a current quote on these $25,000 par securities is encouraged to contact me!) Another significant issue with non-operating companies is cash burn. Fortunately, Alliance is consuming only about $60,000 per quarter. A third issue is strategy. Alliance may trade at a large discount to net current assets, but what if management decides to retain cash and make a bad acquisition? Or what if liquidating the remaining assets takes another five years, killing the IRR? There is some indication that the process might linger on, as the company's tax filings for the years 2008-2012 remain open to IRS scrutiny.

Investors should be aware of these factors and discount Alliance Semiconductor accordingly. However, if a final liquidation happens sooner rather than later, the current share price offers material upside.

Disclosure: No position.