An Announcement, A Visit, A Stock Pitch

Introducing Tactile Fund, hitting the road, and a look at Cementos Argos

Hello! Lots to talk about today. After months of preparation, I am finally ready to introduce our new fund: Tactile Fund LP.

Tactile makes long-term investments in companies with extraordinary physical assets. These are companies with unassailable economic moats, offering products and services that satisfy timeless human wants and needs. Tactile invests in the best of them from across the globe, participating in their growth over decades.

Tactile Fund LP is a Rule 506(c) public offering open to accredited investors only.

Here is a one-page summary of the strategy.

And here is a pitch book with more of the nitty-gritty.

Tactile Fund LP launches January 1 and is accepting subscriptions from limited partners now. If you would like to know more, please reach out to me directly via email or use the new Tactile inbox at info@tactilefund.com. You can also visit Tactile’s website at tactilefund.com.

I would be absolutely delighted to tell you more about Tactile Fund. I could not be more excited.

A Visit

I am happy as can be in my little town outside Pittsburgh, but it’s been too long since I visited New York. So I’m making the trip next week, November 18-20. Please let me know if you’re interested in meeting up. I have to prioritize meetings with current clients and partners and those potentially interested in Tactile Fund, but it would be wonderful to meet some blog readers as well and chat about investing!

And As Advertised, A Stock Pitch

What’s the worst kind of stock pitch? For my money, it’s “sum of the parts.” We have all run across situations where a company appears to trade at a large discount to the value of its assets, whether those assets are operating companies, real estate, or a mysterious third thing. Quite often the thesis goes something like:

“ABC Corp. has an enterprise value of 4X. I think the company’s mature, cash-flowing business is worth 3X, while its fast-growing new segment is worth 2X. The company also has excess cash and securities worth 1X, so the business is worth 6X and its shares have 50% upside.”

If it were only that simple. Most of the time, if a company trades at a discount to the value of its parts, there’s a very good reason. Perhaps the parts aren’t truly independent and rely on some common infrastructure or key staff. Perhaps the fast-growing asset is actually being subsidized by the mature asset and if separated, its growth would slow rapidly. And then there are scenarios where a company really does have independent, separable assets worth far more than its enterprise value, but management has absolutely no intention of engaging in sales or spin-offs to unlock value.

Pitfalls like these are why I typically dismiss sum of the parts stock pitches out of hand, unless there is a firm catalyst like a pending asset sale or management initiatives to highlight value. With that, I present Cementos Argos SA.

Cementos Argos SA is a Colombian holding company with interests in cement and aggregates companies in South and Central America and the Caribbean Basin, as well as financial investments and a large strategic holding in NYSE-listed Summit Materials. Cementos Argos shares trade well below asset value, but there are multiple upcoming catalysts that could cause shares to move higher. Cementos Argos trades in Bogota with good daily volume of USD $1-3 million. There is also an extremely illiquid OTC-traded ADR, ticker CMTOY, with each ADR share representing 5 local common shares. (Please be extremely cautious if you attempt to trade in the ADR. Though there is more liquidity than appears in the public order book, it is still a very illiquid instrument.)

Cementos Argos made headlines in 2023 when it agreed to sell its US assets to Summit Materials for cash and stock. The deal closed in January 2024 with Cementos Argos receiving cash and 54.7 million Summit shares. Cementos Argos used the cash proceeds to pay down debt and retained the Summit Materials shares as a strategic holding. Cementos Argos shares trade for less than the value of its Summit Materials shares, let alone its substantial non-US operating businesses and investments.

As we walk through what Cementos Argos owns today, I’ll use US Dollars. Cementos Argos operates in multiple regional currencies and reports in Colombian Pesos, but provides USD-equivalent figures in its English language investor materials. Ordinarily I would be cautious about owning anything denominated in an inflationary frontier market currency like Colombian Pesos, but the risk is effectively mitigated by Cementos Argos’s large USD investment in Summit Materials.

Summit Materials

Cementos Argos owns 54.7 million shares of Summit Materials, a mid-cap cement and aggregates producer with production sites and terminals in the US Southeast. At $50.30 per share, this investment is worth $2,887 million to Cementos Argos. The company indicates it intends to hold these Summit shares as a long-term strategic investment, but the choice may not be up to Cementos Argos. Summit Materials has been approached by the largest US producer of packaged concrete, Quikrete. If Quikrete is successful in acquiring Summit Materials, Cementos Argos would suddenly receive a gigantic cash windfall. Alternatively, Quikrete could acquire Summit using stock or allow Cementos Argos to roll its stake into the combined entity, but there are no indications Quikrete wishes to be a public entity or expand its ownership.

There is no guarantee that Quikrete acquires Summit. If it does not, Summit shares likely head back to the $40s. Still, knowing that Summit Materials is open to being acquired could invite another bidder.

Operating Companies

Cementos Argos owns a variety of operating assets in Colombia, Panama, Honduras, Guatemala, the Dominican Republic, and the Antilles. These businesses serve a mix of local customers and export markets.

Cementos Argos expects these businesses to produce 2024 EBITDA of USD 253-264 million. I think a fair multiple for frontier market cement producers is 6x EBITDA, a >40% discount to US valuations. That would value the company’s operating businesses at $1,551 million using the EBITDA midpoint.

Financial Investments and Cash

Cementos Argos has an 8.9% ownership interest in another listed Colombian holding company, Grupo de Inversiones Suramericana S.A. “Grupo Sura” is broadly diversified with interests in insurance, asset management, and banking. Funnily enough, it also holds an indirect interest in Cementos Argos as a large shareholder of Cementos Argos’s largest shareholder. Who doesn’t love a South American analogue of notable byzantine French conglomerate Bolloré? Wait, don’t answer that.

Grupo Sura itself trades at a big discount to the value of its holdings and is taking steps to unwind the discount. But at current trading prices, Cementos Argos’s stake in Grupo Sura is worth $289 million.

Cementos Argos has corporate cash of $475 million.

Liabilities

Cementos Argos used the sale of its US assets to reduce debt. High leverage had been a drag on the company for years, particularly in Colombia’s high interest rate environment. Following the pay down, Cementos Argos has total debt of $1,030 million. Importantly, 97% of the company’s debt is denominated in Colombian Pesos.

Valuation

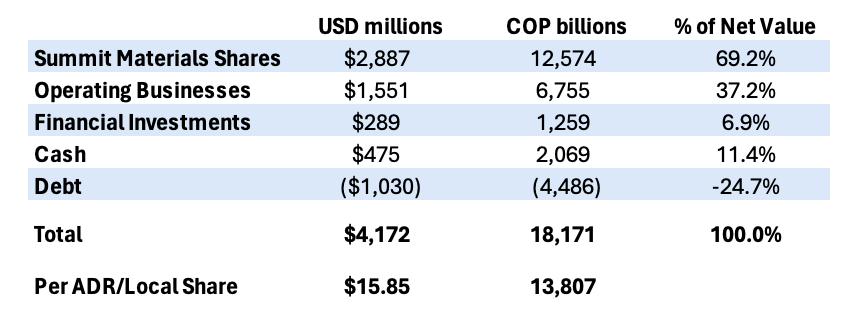

Putting it all together, I arrive at a valuation of $4,172 million. This works out to COP 13,807 per local share, or $15.85 per USD, 66% upside from current trading prices.

I include this chart as an illustration of the components of Cementos Argos’s net asset value. Summit Materials is by far the largest determinant of value, so anyone poking around this situation must form a view on the value of those shares. The value of the company’s operating businesses is also significant. Taken together, the net value of the company’s financial investments, cash, and debt add only modest leverage to changes in net asset value.

In Sum

OK, so it looks like the value of Cementos Argos’s assets exceeds its trading value. So what? Companies trading below NAV are a dime a dozen, especially in frontier markets. A discount to NAV is nice, but I’m really only interested if there are reasons to believe a company’s management is actually interested in closing the gap. In Cementos Argos’s case, I believe this to be true for three reasons.

The company is committed to returning capital. Through the first nine months of 2024, Cementos Argos repurchased COP 300 billion of shares and paid COP 380 billion in dividends, 30% higher than last year. For the full year, the company’s distribution yield will exceed 8%. If the market is not valuing a company’s assets fairly, putting those assets into shareholders’ hands via returning capital is a great move.

The company is making its shares more investable. Earlier this year, holders of preferred shares converted nearly all their shares to common shares, collapsing the dual share class structure. The company hired a market maker to reduce trading spreads and improve share liquidity, and the company successfully positioned itself for inclusion in multiple global equity indexes, entering FTSE and MSCI indexes in August and September. The resulting increase in trading volume makes it easier for larger buyers enter and exit positions in the stock, opening up ownership to a bigger pool of global investors.

More broadly, the Colombian stock market seems to be in the early stages of important reforms and structural changes that will invite more attention and foreign investment. Two of the exchange’s largest components are diversified conglomerates with Japan-style crossholdings, but they are evaluating moves to increase independence and unwind their interlocking structure. See “Colombian conglomerates Argos, SURA begin to study possible ownership split.” from Reuters. And yes, both of these companies are in Cementos Argos’s ownership structure. I believe that reducing the complexity of these and other Colombian companies will have a positive impact on corporate governance and valuations. Also, the Colombian Stock Exchange is taking steps in cooperation with the Peruvian and Chilean exchanges to create a unified regional trading platform.

Bottom line, the Cementos Argos of the future will have better assets, a less levered balance sheet, more liquid shares, and a higher profile than the company of yesterday. If Quikrete buys Summit Materials, the company will be sitting on a mountain of cash. In any case, I think Cementos Argos shares are primed to trade closer to net asset value over the next 12-18 months.

Alluvial Capital Management, LLC holds shares of Cementos Argos S.A. for client accounts it manages. Alluvial Capital Management, LLC may hold any securities mentioned on this blog and may buy or sell these securities at any time. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com

About Cementos, we have Pacasmayos in Peru that I reviewed quite a few times but never pulled the trigger as it does not seem cheap enough or quality enough.

I am not sure about SOTP ideas unless they are clearly defined as a holding company; they never really rerate and trade on earnings multiples so the parts have to produce an equity income, which depends on the accounting method and country of the business.

Congrats on the new fund!