Armanino Foods of Distinction - AMNF

Ever have a stock that "got away?" You did the research and liked what you saw. Modest valuation, positive business trends, high returns on capital and even a dividend, but for some reason you never pulled the trigger and eventually forgot about it? That's my story with Armanino Foods of Distinction.

Armanino, headquartered in Hayward, California, manufactures and markets frozen Italian specialty foods. Its chief product is a basil pesto, but it also creates other flavors of pesto as well as sauces, pastas and meatballs. Armanino's products are completely natural and do not contain preservatives. The company's products are marketed to grocers in the Western United States.

I first looked at Armanino back in 2010, when shares were changing hands for around 50 cents. I was impressed with the company's consistent sales growth and commitment to returning capital to shareholders. Not as impressed as I should have been, however, because I never got around to purchasing any shares. Undoubtedly, I purchased some marginal, forgettable company instead and paid the price in missed returns.

If any pink sheets company can be considered a "blue chip," Armanino is one. The company has paid regular dividends for 49 consecutive quarters, plus 10 special dividends along the way. Annual revenues have increased every year since 2004. The company has virtually no debt. Here's a look at the company's 5 year results.

Since 2007, the company's revenues have grown at 7.6% annually. With size has come efficiency. Armanino's operating margins more than doubled over the time period. The company has also succeeded in holding down manufacturing costs and introducing higher margin products, resulting in improved gross margins. The result has been annual earnings growth of 26.2% since 2007.

Armanino's track record of growth and profitability is impressive, but even more impressive is the company's record of returning capital to shareholders. From the end of 2007 to the end of 2011, the company produced $6.96 million in profits, but returned $7.23 million to shareholders through dividends and net share repurchases. During this period, revenues rose 30.3% and earnings rose 162.6%.

The significance of these figures should not be underestimated. Nearly all companies require reinvestment in order to grow and create higher profits in the future. Companies retain a portion of earnings in order to invest in marketing, research and development, plant & equipment and other productive assets, all with the goal of increasing future profits. Armanino retained absolutely none of its earnings from 2007 through 2011, yet increased earnings significantly. A company that can grow with no additional shareholder investment is a rare find.

To illustrate this advantage more simply, imagine an investor who buys a laundromat in a busy neighborhood for $250,000 in cash. After running the laundromat for a year, the happy owner has made a profit of $50,000 after all costs, including depreciation and taxes. Return on equity is 20%. At this point, the owner has a choice. He can pay himself a $50,000 dividend and go on running the laundromat as is, expecting to make another $50,000 (give or take) next year. Or, the owner can reinvest profits to create growth. Maybe the owner pays himself a dividend of $25,000 and uses the remaining $25,000 to upgrade the laundromat's lighting, install a few shiny new high efficiency washers and buy ads on a billboard along a crowded local highway. If these new investments return 20% after taxes, the owner will make $55,000 next year, an improvement of 10%. Return on equity remains at 20%.

But what if the owner pays himself the entire $50,000 year one earnings as a dividend and the laundromat's profits still increase to $55,000 next year? And year after year the owner pays himself a dividend of 100% of earnings, only to see earnings increase again the next year? It might be due to pleased customers advising their friends to become patrons, or perhaps the neighborhood's population is growing. Regardless of the cause, the business is accruing intangible assets (call it goodwill or an economic moat or whatever you please) and the business's return on equity and market value are growing without any additional investment by the owner.

This is the ideal scenario for an investor, and it is what has happened to Armanino Foods of Distinction. In 2007, the company produced a return on equity of 16.4%. In 2011, return on equity was 39.3%, all with net negative additional shareholder investment in the interim.

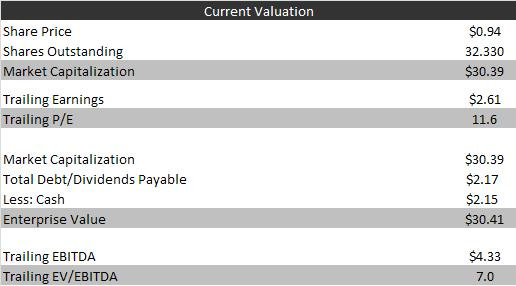

Armanino's valuation is reasonable for a company with such an attractive growth trajectory and minimal reinvestment need.

At 11.6 times trailing earnings, Armanino has an earnings yield of 8.6%. The dividend yield is 6.4%, including the recent special dividend.

Risks to Armanino's future profits include its highly concentrated customer base and its reliance on the domestic economy. In each of the past three years, about 50% of the company's sales were to a single, unidentified distributor. 77% of accounts receivable at the close of 2011 were owed by just two customers. In 2011, only 10% of the company's sales were to international customers. The company's fortunes also depend on the continued popularity of basil and pesto, but I am not too concerned about that.

I regret not buying shares in Armanino at 50 cents, but I still view the company as attractively valued at 94 cents. If the company can continue to execute like it has in recent history, investors should expect higher profits and a healthy dividend each quarter.

Disclosure: No position.