AutoInfo - AUTO

AutoInfo is a transportation and logistics broker. The company operates primarily through its subsidiary, Sunteck Transport Group. Though AutoInfo plays the role of middleman, its services improve efficiency and reduce costs for both providers and purchasers. Smaller businesses often have irregular and sporadic shipping needs, so contacting Sunteck when the need arises may be cheaper than keeping a shipping manager on staff. Truckers, especially owner-operators, may not have the time to seek out clients and are always looking to reduce zero-revenue miles between loading points, so having Sunteck serve as dispatcher benefits them as well.

AutoInfo is non-asset-based, meaning it does not own trucks or other transport equipment. Instead, it employs a network of sales agents who contract with businesses and transportation providers in return for commissions. The model is extremely asset-light and requires little capital expenditure.

The model is also successful. From 2002 to 2012, the company grew revenues from $18.86 million to nearly $300 million, profiting in every year. Even after this tremendous growth, the company remains a tiny player in the highly fragmented $200+ billion freight industry. The company creates growth by hiring additional sales agents in new markets and incentivizing its existing agents to increase revenues. Since sales agents are compensated entirely by commission, adding additional agents creates nearly no additional overhead expenses.

A look at the company's recent results follows. (2011 and twelve trailing months figures are adjusted for the acquisition and subsequent disposal of a contract with a significant sales agent in 2011. The company was able to unwind the contract without any material loss and provided pro forma financial data in the most recent quarterly report.)

Twelve trailing months revenues, operating income and net income are the highest in the company's history. Earnings per share grew 22.8% annually since 2007.

The company has managed its balance sheet well. Since peaking in 2010, total indebtedness has been reduced to the lowest level since 2007. Book value has growth at a healthy rate from $0.39 per share in 2007 to $0.75 per share at present, or 15.75% annualized. Diluted shares outstanding have seen only a modest increase over the time period.

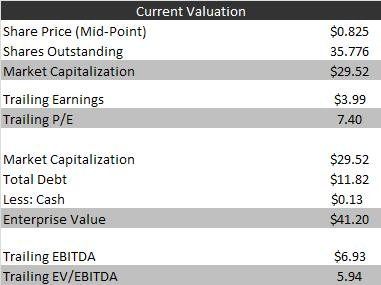

Despite a strong history of revenue and earnings growth and a healthy balance sheet, AutoInfo's valuation is modest.

A trailing P/E of 7.40 is appropriate for a slow-growing, highly indebted or deeply cyclical company, not AutoInfo. What's more, the company trades at just 1.10 times book value despite consistently increasing book value per share at a mid-teens rate.

AutoInfo's officers and directors own 26.9% of shares outstanding, giving them plenty of motivation to grow the firm's market value. Investors James T. Martin and Kinderhook Partners, LP own another 34.9%. Activist investors Baker Street Capital and Khrom Capital Management own 13.4% of shares outstanding and have filed a 13D. In the 13D filing, these activist investors urge management to consider a sale, noting positive acquisition trends in the freight broking industry.

AutoInfo is not without a few drawbacks. Management's compensation is high and the low float limits liquidity. The company competes with many much larger and better-known firms, though so far is has fared well. A national recession or sharp increase in fuel prices would reduce its demand for services as well as its available suppliers.

On the whole, AutoInfo presents an opportunity to buy a growth company at a value multiple. If the company is successful in executing its plans for growth, investors may be rewarded when the market eventually appreciates AutoInfo's results, or when the company is sold to a larger competitor.

Disclosure: No position.