Avangardco's Rock-Bottom Valuation and Dividend Initiation Could Send Shares Higher, But Risks Remain - London:AVGR

Hello, and happy New Year! To start 2014 off right, I'll be profiling Avangardco Investments Public Ltd, the top producer of eggs and egg products in Ukraine and the surrounding region. Despite great operational success and strong growth, Avangardco trades at an absurdly low multiple of earnings and assets. Avangardco is set to begin paying dividends in 2014, which may cause the market to re-evaluate the company's prospects. Despite its strong fundamentals, Avangardco also carries substantial risks. The company's primary place of business is Ukraine, not one of the world's more stable economies. Avangardo's leading export markets are various Middle Eastern nations, including Iraq and Syria. Finally, the company is nearly 80%-owned by a Ukrainian billionaire, Oleg Bakhmatyuk. No worrisome related-party transactions are disclosed by the company, but Mr. Bakhmatyuk seems to be a "colorful" character based on some googling. Given the reputation of Eastern European and Russian billionaires, the risk of corruption and management pocket-lining is elevated.

Background

Avangardco's business operations are located in Ukraine. Ukraine has historically been one of the world's most agriculturally productive nations, earning the nation the nickname "The breadbasket of Europe." While the USSR was in existence, Ukraine was responsible for 25% of total Soviet agricultural output. Today, Ukraine remains a major food exporter to Russia, the European Union and the Middle East.

Ukraine's tax policies strongly encourage the expansion of the agricultural industry. Companies that earn 75% or more of their revenues through agriculture are no subject to corporate income tax, but instead pay a de minimus Fixed Agricultural Tax based on farm acreage owned or rented. Agricultural business are also not required to remit Value-Added Tax revenue to the government, but can instead retain it for use in developing additional capacity. This special VAT treatment is scheduled to continue until 2018. For more information on Avangardco's tax treatment, check out this PDF from Deloitte.

While Ukraine's fertile lands and highly advantageous tax regime make it an attractive place to do business, the unstable political atmosphere should lead investors to approach with caution. Ukraine is locked in an ideological struggle between those who would look Westward and make progress toward greater unity with the West and eventual EU membership, and those who would have closer ties with Ukraine's ancient sometimes-ally, sometimes-enemy, Russia. Until the struggle is resolved, investors will rightfully apply a political risk discount to Ukrainian assets. If the struggle ends in a move toward Russia and Russian-style oligarchy and klepto-capitalism, this discount may become permanent.

Avangardco went public in 2010, offering 1.39 million new shares for proceeds of $208 million. These proceeds were used to fund capacity expansion. The company had previously been re-structured in 2009, when crushingly bad economic conditions and a high debt load necessitated a debt for equity swap. Avangardo's GDRs stake on the London Stock Exchange with the ticker AVGR.

Business Operations

In 2012, Avangardco's flock included 27.5 million hens which produced 6.3 billion eggs. The company included several interesting charts in recent reports which sum things up better than I ever could, so I am reproducing them below.

Avangardco's vertically-integrated structure reduces costs and makes the company the low-cost producer in its markets.

Avangardco is Ukraine's market share leader in all of its markets, both domestic and export. The company has a near monopoly in dry egg products, and is responsible for 90% of Ukraine's egg and egg products exports.

Avangardco's export operations have really picked up steam, climbing from 18% of sales in the first nine months of 2012 to 32% in the first nine months of 2013.

Since 2009, Avangardco has expanded its export operations to 33 international markets.

Financial Results

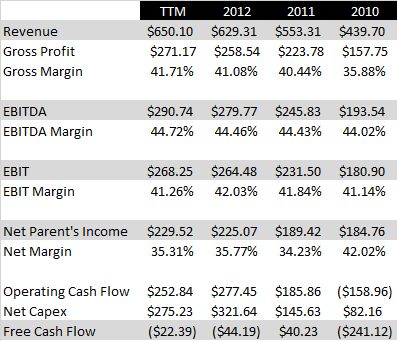

Since its 2010 IPO, Avangardco has produced impressive growth in revenue and profits, while maintaining strong margins. (Reported EBITDA is higher than reported gross margin because the VAT credit the company receives is added back to EBITDA.)

Despite its strong profits, free cash flow has been consistently negative since the IPO. While ordinarily this negative free cash flow would be a concern, Avangardco has had a strong set of growth opportunities which have required significant capital expenditure. That capital expenditure has proven fruitful, with revenue growth of 47.8% and net income growth of 24.2% since 2010. The full benefit of Avangardco's capital program has yet to been fully reflected in results, as the company is working to complete three projects: the Avis egg production complex, the Chornobaivske egg production complex, and the Imperovo Foods egg processing plant. Once these projects have been completed, Avangardco will be able to house 30.1 million egg-laying hens and will increase its egg production capacity by 36.5% to 8.6 billion per year.

Despite the large capital expenditure program, Avangardco's balance sheet remains healthy and net debt is only 0.63x EBITDA. Liquidity is very good with a current ratio of 4.45, and equity represents 77.8% of total capital.

Valuation

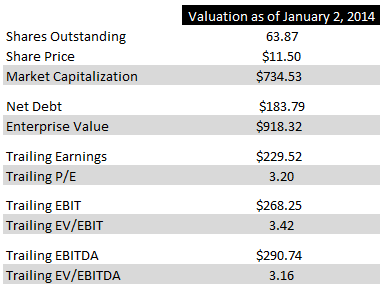

Avangardco's valuation is among the lowest I have encountered. The company's P/E ratio on trailing earnings is 3.20, and its EV/EBITDA ratio is 3.16.

As cheap as Avangardco appears to be on an earnings basis, the company is just as cheap on an asset basis. Avangardco's book value per share is $20.29, and virtually all of that is tangible. At the closing trade of $11.50, Avangardco trades at a discount to book value of 43%.

Even with its potential risks, a little over 3x earnings/EBIT/EBITDA appears far too cheap for a growing enterprise with a dominant market position and little financial risk. Investors may begin to overlook some of their fears once Avangardco begins paying out dividends. In September, the company announced it had decided to adopt a dividend policy and to pay out 15-40% of earnings each year, subject to the availability of cash and striving for long-term dividend stability and growth. At the same meeting, the company elected to set 2014 dividends at 25% of 2013 net income.

If next quarter's results are in line with previous quarters, Avangardco will earn $229.52 million this year, or $3.59 per share. 25% of that figure would be $0.90 per share in dividends, good for a yield of 7.8%.

In Summary

Avangardco's risks are real and include a potentially unstable Ukrainian economy, a high-risk majority owner and a dependence on nations in conflict as major export customers. However, the company also possesses a leading market position, great growth potential and firm financial footing. Combined with a rock-bottom valuation, a dividend initiation at a healthy yield and increased earnings from completed projects, Avangardco's shares could move much higher in 2014.

An account I manage holds shares of Avangardco Investments Public Ltd.