Awilco Drilling's Upcoming Double Digit Yield - AWLCF

Awilco Drilling Plc owns two semi-submersible drill ships that operate in the North Sea. Awilco acquired these ships from Transocean in 2009 and spent the following years completing upgrades on the ships and signing contracts with oil drillers. Now that its fleet is fully utilized, Awilco has announced it will begin paying out all free cash flow to investors. At the current share price, this could represent a yield of over 20% and may lead to substantial appreciation.

The first of Awilco's rigs is the WilHunter, pictured below.

The WilHunter was built in 1983 and upgraded in 1999 and 2011. The ship is capable of operating in water depths of 1,500 feet and can drill 25,000 feet. WilHunter is contracted to Hess until November 2015, with options to extend the contract another 275 days. The dayrate is $360,000, increasing to $385,000 in May 2014.

Awilco's second rig is the WilPhoenix.

The WilPhoenix was built in 1982 and upgraded in 2011. It can operate in water depths 1,200 feet and drill 25,000 feet. WilPhoenix is contracted to Premier Oil until May 2014, with options to extend the contract another 180 days. The day rate is $315,000, increasing to $351,000 in October 2013, then returning to $315,000 in March 2014.

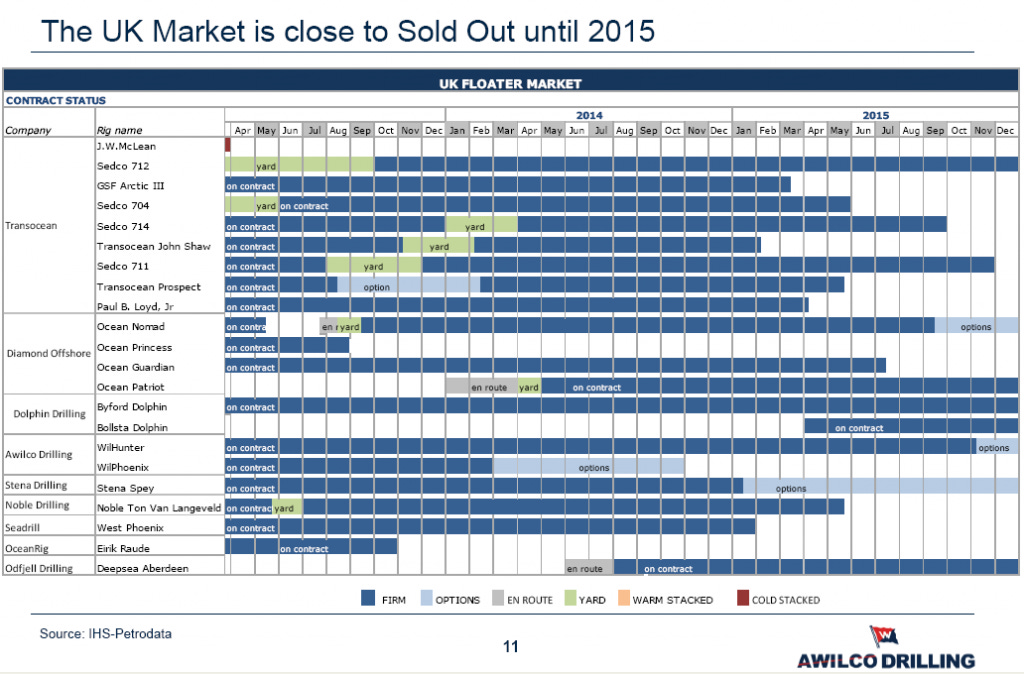

Awilco is highly profitable at current dayrates, but tight rig supply and persistently high oil prices may bring even higher rates in years to come. When WilPhoenix's contract ends in mid or late 2014, it will be one of the few rigs available. In its April 2013 presentation to shareholders, Awilco included a chart illustrating the supply situation.

The company also provided a helpful chart showing historical dayrates and supply trends.

If these images are difficult to read, simply click for the full-sized versions.

Awilco's performance in the fourth quarter of 2012 was its best yet, based on higher dayrates and full utilization of its fleet. For the quarter, the company earned $0.76 per share on revenue of $52.8 million and produced $32.6 million of EBITDA. This EBITDA figure included $3.56 million in provisions for doubtful debt, which will presumably not be a repeating expense. EBITDA excluding the charge was $36.2 million.

With its rigs fully contracted for the next year, its not stretch to assume Awilco can produce earnings of at least $3.04 per share and EBITDA of at least $144.8 million. I say "at least" because these figures exclude the increased dayrate WilPhoenix will earn beginning in October 2013. These projected earnings also exclude benefits from debt reduction and the absence of future doubtful debt charges. Earnings in future years could be even higher if rig supply remains constrained or if oil prices rise.

In the face of these projections, Awilco's valuation is extremely low. (Again I'll emphasize these projections are not pie in the sky figures based on breathlessly optimistic assumptions, they are based on Awilco's actual signed contracts with oil majors.) Awilco has 30,031,500 shares outstanding. The recent trade price of $14.10 yields a market capitalization of $423.4 million. Net debt is $97.7 million. P/E based on conservatively estimated $3.04 per share earnings is 4.6 and EV/EBITDA based on EBITDA of $144.8 is 3.6.

Using these projections and assuming free cash flow approximates net income, Awilco's annual dividend will be $3.04 per share for a yield of 21.6% on the current share price. Now, the dividend may not reach these heights immediately. Awilco has said it will retain a $35 million cash buffer for operational and capex needs, and it may take time to build this reserve. The company also indicated it will not allow the dividend policy to keep it from pursuing worthy growth opportunities, but said it will continue to pay a healthy dividend even if it engages in an acquisition or another initiative.

Cheap stocks are great, but cheap stocks with a catalyst are better. In a yield-starved world, a 20%+ yielder that is not an MREIT or a wasting asset like a royalty trust will turn some heads. Awilco will pay its first dividend in the first half of 2013. At that time, the company will no longer fly under the radar.

Awilco Drilling does bear substantial risks. Chief among them is the company's concentration. Because it has only two drill ships, the company is vulnerable to a host of potential issues like operational problems, damage or disputes with the contracting oil companies. With only two revenue streams, a disruption in either would affect earnings severely. Awilco is also exposed to mid-water dayrates, over which it has absolutely no control. Rates have been very strong, but high rates may eventually attract competitors. Alternatively, oil prices could crash and dayrates could tank.

Another issue Awilco faces is the age of its ships. Though they were upgraded in 2011, each ship is three decades old and won't last forever. In its 2011 annual report, Awilco lists the expected life of each ship as 20 years. As they age, these ships may command lower dayrates or require expensive upgrades.

Awilco's illiquidity should also be considered. Though it has a market capitalization of $423.4 million, only just over $50 million worth of shares are available for trading. The remainder are held by a variety of banks and pension funds. A related company, Awilco Drilling AS, holds 48.73% of Awilco Drilling. Awilco's US ADR is traded on the grey market, with a few thousand shares trading hands on a typical day. The company's primary listing is the Oslo Exchange, where it is slightly more liquid.

I have a position in Awilco Drilling.