BFC Financial/BBX Capital Part Two – Value in Complexity

Time for part two of my discussion of BFC Financial and BBX Capital, two related and complex companies. These companies possess significant value in the form of cash, loans, and real estate, shared ownership of a very valuable timeshare company, Bluegreen, and over one billion in NOLs. Due to the complicated ownership structure and a litigation overhang, the market has priced these companies at a massive discount to a conservative reckoning of their assets and earnings power.

Valuation

In part one, I estimated BBX Capital's valuation at $631.6 million, or $39.46 per share. Valuing BFC Financial is actually a little easier. BFC's value consists of some corporate cash, its 51% stake in BBX Capital, its 54% stake in Woodbridge/Bluegreen, and its NOLs. Since I already examined the value of BBX and Woodbridge/Bluegreen in the previous post, all that remains is to analyze BFC's corporate cash and NOLs.

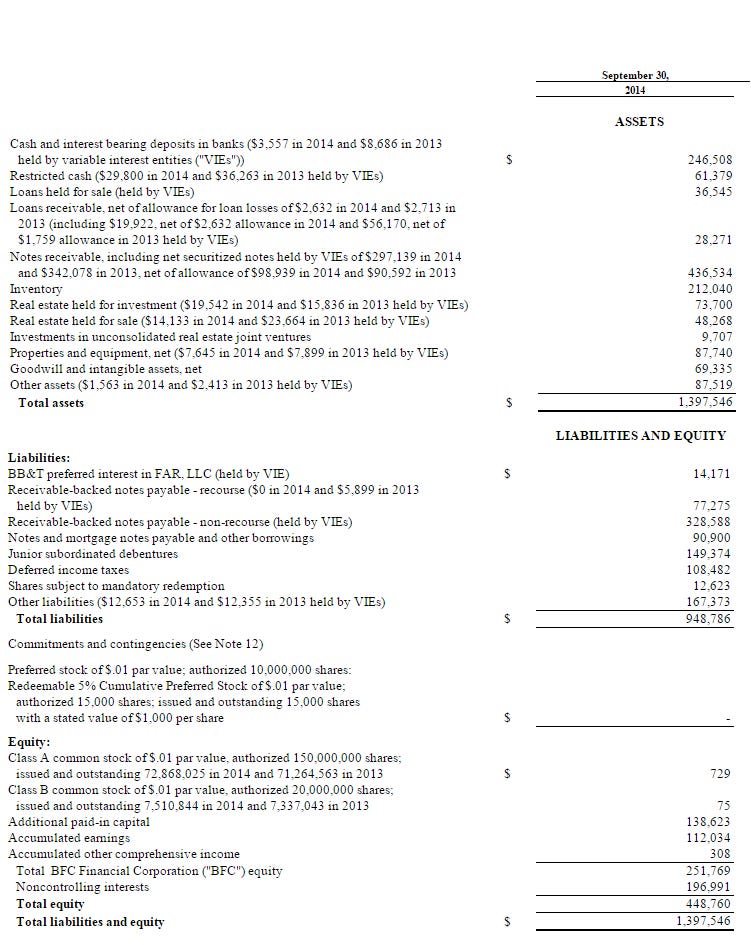

Due to consolidation, BFC's balance sheet looks much more complex than BBX Capital's.

In truth, it's not so bad. Most of the confusing entries belong to Woodbridge/Bluegreen or BBX Capital. Once those are removed, the picture becomes much clearer. For example, BFC's balance sheet lists cash of $246.5 million. But of that, $160.2 million belongs to Woodbridge/Bluegreen, and $56.6 million belongs to BBX Capital/FAR, LLC. That leaves $29.7 million in cash at the BFC Financial level. (This excludes restricted cash, which I am ignoring for the purpose of this analysis.) Much of the remaining assets can also be ignored. All the various loans and real estate assets belong to BBX, and the notes receivable are associated with the Bluegreen timeshare business. Much of the property and equipment is as well, and the remainder is not material to BFC's valuation. (Some of the property & equipment is attributable to some minor businesses the complex owns, which I am also ignoring for the scope of this analysis.)

The liabilities are much the same. The BB&T interest belongs to BBX's FAR, LLC and the notes payable are Bluegreen's, as are the junior subordinated debentures. (As discussed in the last post, $85 million worth of the debentures are Woodbridge obligations.) That leaves only the deferred taxes, share redemption liability, preferred stock and the ever-mysterious "other liabilities." With the exception of the share redemption liability and the preferred stock, it's somewhat unclear exactly what amount of "other liabilities" and deferred income taxes are obligations of BFC versus Woodbridge/Bluegreen or BBX. I don't believe that BFC's other liabilities require any ongoing cash flow to service or amortize, making them largely irrelevant to this valuation.

BFC possesses over $300 million NOL state and federal NOLs. However, around $80 million are limited by the company's 2013 merger with Woodbridge. Estimating value of the NOLs is tough because BFC doesn't reveal how much are state and how much are federal. For that reason, I'm ignoring their value entirely, even though they are certainly worth something. For the NOLs, I am including only 54% of those of Woodbridge and Bluegreen, which I value at $12 million using very conservative estimates.

All that's left is to add up the values of BFC's assets and liabilities.

I estimate the value of BFC shares at $9.62. Just like with my BBX estimate, this value is intended to be conservative and could be markedly higher if Bluegreen is worth more than 8x pre-tax income, or the companies utilize their net operating losses well.

So why, if these companies really possess so much value, are they trading at 35%-40% of my estimates? It all comes back to one thing....

Litigation

The CEO of both BFC Financial and BBX Capital is Alan B. Levan. Mr. Levan is a colorful character, to put it lightly. As chief of BFC Financial and BBX, he's pulled off a number of successful deals and transactions, but he's also managed to anger many minority shareholders in businesses he has purchased. On more than one occasion, these shareholders have brought lawsuits.

In 2012, the SEC brought charges against Levan his actions during the financial crisis. The SEC alleged Levan and BankAtlantic had failed to write down loans in distress and had made misleading statements about the company's financial standing to investors. As is typical for cases like this, the SEC and company attorneys battled in court for months and filings flew, but the case gradually crept forward.

In the meantime, Levan revealed plans to merge BBX and BFC Financial together, with BBX Capital shareholders receiving 5.39 shares of BFC for each share of BBX. Following the transaction, BFC would uplist to a major exchange. The benefits to shareholders would be significant. No longer would investors have to look at two different companies to see the value of Bluegreen, and no longer would each company's balance sheet show many confusing items and minority interests. With better visibility, clearer financials and an increased market cap, it's not hard to imagine a new set of investors coming on board and pushing the share price upward.

With the planned merger in progress, the SEC's case moved to trial. A summary of the SEC's case and the counts against BBX and Levan can be found here. The trial took six weeks, but just last week the jury made its decision: guilty.

The monetary penalties won't amount to much. The maximum civil penalty to BBX Capital for each charge is only $500,000. And there's even a chance the decision will eventually be vacated. Previously, a judge reversed a jury's finding on private litigation brought on roughly the same issues. The company's statement in response to the guilty verdict is here.

Though the monetary cost of the guilty verdict is small, the harm to shareholders is large, for a few reasons. First, the planned merger between BFC and BBX is off for the time being. This means markets will continue to be presented with two complex and confusing entities, and will likely continue to undervalue them. Second, Levan and the companies will undertake an expensive and drawn out appeals process, which could result in years of legal fees and continued uncertainty. Levan seems to honestly believe himself above reproach in his conduct, and will fight hard to be allowed to continue to lead his companies.

So, investors in both BBX and BFC may have to exercise some patience. Their disappointment with the verdict and the merger cancellation are obvious by the share price movements, but the values of the company's assets are unchanged and growing. The litigation will eventually be resolved (with or without Levan remaining at the helm) and the companies will be merged or otherwise resolved into one entity. Assuming leadership avoids any disastrous decisions and the economy in general avoids a financial crisis redux, patient shareholders should eventually realize an excellent return from today's share prices.

Alluvial Capital Management, LLC holds shares of BBX Capital Corporation and BFC Financial Corporation for client accounts.

OTCAdventures.com is an Alluvial Capital Management, LLC publication. For information on Alluvial’s managed accounts, please see alluvialcapital.com.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.