Bonal International: Boring Products and Amazing Margins - BONL

Bonal International is a tiny Michigan-based manufacturing company that dominates its niche. Bonal creates products that use"Meta-Lax Vibration Stress Relief Technology" to reduce internal stresses and extend the life of metal components. According to Bonal's website, the vibration treatment provides 80-90% of the benefits of traditional heat treatment, but saves 65-95% of the time and expense of heat treatments. The company boasts an impressive list of customers including Northrop Grumman, Boeing, the US Army and Navy and more.

62% of Bonal's shares outstanding are owned by the Hebel Family or a trust for the benefit of the CEO, A George Hebel III. The Hebels recently attempted to sell the company, but the offer was insultingly low and shareholders rejected it. At 70 years of age, it seems Mr. Hebel is looking to sell the company and provide liquidity for himself and his family members. Perhaps an improved offer will forthcoming? Regardless, Bonal's valuation and market position make it an intriguing company and possibly an attractive investment.

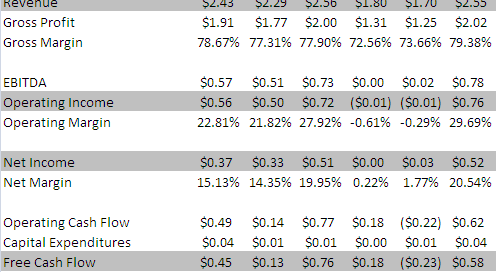

First, a look at recent results. Dollar amounts are in millions.

Aside from tough years like 2008 and 2009, Bonal produces consistent profits and free cash flow. That's great, but the truly astounding statistic is Bonal's gross margin. In the five trailing full fiscal years, Bonal averaged a 76.2% gross margin. That's practically unheard of! By comparison, Apple's gross margin this year was 38.6%. Tiffany & Co.'s was 59.0% and Coach's was 72.1%. Bonal's products retail for more in comparison to production costs than stylish computers or designer jewelry and handbags.

The fact that Bonal's customers will pay such a markup really says something about their faith in the products. It also indicates the Bonal faces practically no competition and does not have to compete on price. But will these margins endure? Who's to say another company will not roll out a competing product that costs 30% less and destroy Bonal's margins? It's unlikely, and the reason is simple. The market for Bonal's products is not growing. Sales over the last twelve months were up from fiscal 2012, but are still slightly lower than 2008's figures. Given the limited size of the market, it's probably not worth the trouble for another company to invest in a new product line in order to capture not even $2 million in gross margin. Bonal is likely to hum along for years to come earning excess these incredible margins, but unable to increase gross profit significantly in dollar terms.

Another notable line item is Bonal's capital expenditures, which are absurdly low. In fiscal 2012, Bonal spent only 0.3 cents per dollar of revenue on capital expenditures. This has been the pattern for several years, resulting in lower and lower book value for the company's property and equipment. As of the third quarter of fiscal 2013, Bonal showed only a net $48,609 in property and equipment versus a cost basis of $389,964. Bonal's fixed assets are 88% depreciated, yet production continues. The extent of this book value depreciation is probably exaggerated, yet it seems Bonal will eventually have to shell out for new machinery. Free cash flow has averaged 11% of sales since 2008, but will be pressured if Bonal's capital expenditures increase in coming years.

Onward to the balance sheet. Bonal's assets total just $1.77 million, $1.48 of which is equity. The company holds just under $1 million in cash and near-cash investments and carries no debt. Liquidity is excellent, with total liabilities at just 17% of current assets. Bonal has long carried large cash reserves and eschewed debt, resulting in a balance sheet that is as pristine as they come. Despite the large amount of excess capital on the balance sheet, Bonal still produces great returns on equity, averaging 22% since 2008.

The market gives Bonal little credit for its excess cash or high returns on assets. As of the close of trading on March 20, Bonal's market cap is $2.40 million. Trailing P/E is 6.5 and price to book value is 1.6. Assuming half the company's cash is excess, an acquirer at the current price is paying just 5.2 times earnings for a highly profitable operator.

Bonal's biggest challenge is its limited opportunities for reinvestment in the business. Rather than engage in poorly-planned investments or mergers, Bonal has an excellent record of returning cash to shareholders through dividends. Since fiscal 2006, Bonal has paid out over half its market capitalization in dividends, 30 cents per share in 2012 alone.

As a niche operator with excellent margins and an aging CEO and founding family, Bonal would make a great acquisition for a smaller manufacturing company or even a wealthy individual. Bonal's consistent free cash flows could be harvested for reinvestment in other productive businesses. Whether or not an acquisition happens in the near future, investors will benefit from Bonal's continued profitability and dividend habit.

Disclosure: I hold shares in Bonal International.