Burnham Holdings Heats The Nation - BURCA/BURCB

Burnham Holdings is a classic example of a small, profitable business that has been ticking along without much fanfare for years and years. Burnham's fourteen subsidiaries manufacture boilers, the critical but hardly sexy machinery that keeps our homes and businesses warm when cold weather arrives. Burnham also manufactures various other heating and cooling products. Burnham was founded in 1905 and is headquartered in Lancaster, Pennsylvania.

Burnham Holdings' financial results are heavily dependent on the state of the real estate market, both residential and commercial. Hot markets increase demand for Burnham's products as new construction and remodeling activity surges. Poor real estate markets hurt results as property owners delay replacing old boilers and equipment.

In 2003, Burnham achieved record profits of $2.28 per share and paid dividends of $1.06 per share. Dividends reached $1.16 per share in 2005, though profits had peaked in 2003. Shares peaked in 2004 at $29 per share. When cracks first appeared in the American real estate market in 2006, Burnham was hit hard and reported a loss for the year. The dividend was slashed to 76 cents per share, breaking a string of 24 consecutive years of dividend increases.

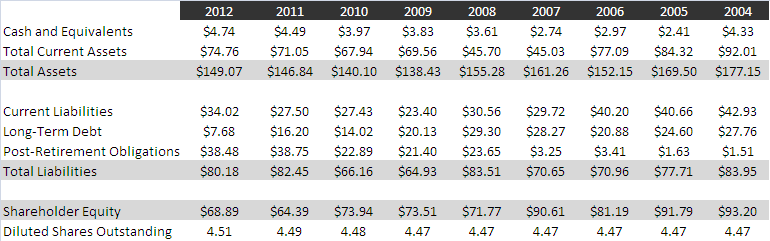

Burnham's fortunes hit a trough in 2009. Revenues for the year were $190 million, down 24% from 2004's record $250 million. Impressively, Burnham was able to cut costs aggressively and recorded a profit of over $1 per share even in the worst years of the financial crisis. Here's a look at the company's results going back to 2004, the year before the trouble started.

Revenues have not yet recovered to previous highs. However, revenue trends have been encouraging since 2010 and Burnham's increases in efficiency allowed the company to produce $18.43 million of EBITDA in 2012. Burnham's free cash flow generation is worth noting. Even in a period of sluggish demand for its core products, Burnham Holdings produced an average of $1.36 per share in free cash flow from 2004 to 2012.

Burnham has devoted significant free cash flow to paying generous dividends, but has also focused on debt reduction. Since hitting nearly $30 million in 2008, long-term debt has been reduced to less than $8 million.

While long-term debt is under control, Burnham's post-retirement obligations are another story. Since 2004, the book value of these obligations has increased by $37 million! In the 2011 annual report, Burnham assures investors that the funding status of its pensions are well above ERISA minimums. The company also discloses that the pension plan is currently closed to non-union employees hired after June 5, 2003.

Pension plans are among the thorniest balance sheet entries. Any net pension deficit or surplus is, at best, a rough estimate of the actual present value of benefits to be paid less the pension plan's assets. A complete treatment of pensions would require another post (or perhaps even another blog!) but there are a few data points investors can examine to determine whether a pension deficit or surplus is likely to be understated or overstated.

Expected Return on Plan Assets - A company is required to assume a rate of return on the assets within a pension plan. This rate is often based on a blend of actual historical performance and future projections based on the asset allocation of the fund. By examining this figure, investors can determine how aggressively invested the pension fund is and/or how realistic the company is being. Some companies are optimistic to the point of delusion, projecting 10% or greater returns on portfolio assets. Since pensions nearly always include an allocation to fixed income, a 10% return assumption would require equities to earn well in excess of 10% annually. Extremely unlikely. High return assumptions will understate pension liabilities.

Discount Rate on Plan Liabilities - Expected benefits to pension beneficiaries are discounted to present value using long-term interest rates. Pension benefits can be thought of as a bond. When interest rates are low, the present value of these benefits is high. When rates are high, the present value of these benefits is low. With interest rates near historic lows, the present value of pension obligations is very high. If interest rates eventually revert to historical averages, the present value of pension benefits will decline. However, fixed income assets in pension plan accounts will also decline in value as interest rates rise.

Burnham's pension accounting is a mixed bag. Burnham's return assumption for its pension assets is 8.5%. This is very aggressive, especially considering only 30% of plan assets were invested in US equities as of 2011. (Another 17% were listed as "other," which may include foreign equities.) Given the low yields on investment-grade debt, the plan's assets will be hard-pressed to earn 8.5% annually without taking on extreme risk. On the other hand, the discount rate on pension plan obligations was just 4.25% in 2011. A return to higher interest rates would reduce the present value of plan obligations.

In 2012, Burnham contributed $3.35 million to its pension funds to improve their funded status. So long as the net pension obligation does not grow, Burnham's free cash flow should be relatility unaffected. However, a significant downturn in the stock market or a continued decrease in interest rates would further increase the funding gap.

While Burnham's pension liabilities may be larger than they first appear, Burnham's balance sheet also conceals a significant asset. Burnham accounts for inventories using LIFO. Many older manufacturing companies have large LIFO reserves, and Burnham is one of them. In 2011, the size of this LIFO reserve stood at $19.4 million, or $4.3 per share. Inventories declined just slightly in 2012, meaning the size of the LIFO reserve is likely little-changed.

Burnham's valuation looks reasonable, both in terms of multiples to earnings and cash flow and in terms of book value.

At 9 times trailing earnings, Burnham may be a reasonably-priced play on a real estate recovery. While Burnham Holdings trades at a 16% discount to book value adjusted for inventory, the company is probably not worth more than book value. Burnham earned an return on average equity north of 10% just once since 2004, hitting 12.35% in 2012. Once equity is adjusted for inventory, returns on equity are even worse. Asset intensity is the culprit here, as asset turns averaged just 1.37 since 2004. If the company could find a way to shed excess assets, returns to shareholders would improve greatly.

Burnham pays dividends per share of 80 cents, offering a 4.9% yield at current prices. Burnham also has a series of preferred shares outstanding that yield 7.5% at the current $40 bid. However, these preferred shares are extremely illiquid and trade only rarely.

While Burnham's valuation is reasonable, I will be taking a pass for now. While the company's free cash flow and exposure to the real estate market is attractive, I am put off by the aggressive pension return assumptions and the sluggish returns on equity. I would reconsider Burnham if the company took steps to streamline its assets and got more realistic about its pension obligation, or if the share price took a tumble if the US economy falters.

Disclosure: No position.