Can Ohio Art Sketch Out a Turnaround? - OART

Remember the Etch A Sketch? That shiny red toy that allowed one to create line art as intricate as one's patience would allow and then clear the slate with a shake? While I can't remember picking one up in many years, I do recall being engrossed by the one my grandparents had when I was a child. Try as I might, I could never quite translate what was in my head onto the screen via those two knobs and that unforgiving line.

Investors may be surprised to learn that the maker of Etch A Sketch, The Ohio Art Company, is public and trades on the pink sheets. Ohio Art is a dark company and does not report any news or financial information to the public. The company has two divisions: toys and lithography.

I bought one share in August 2011 and received my first annual report in May 2012. I opened the report with excitement, hoping to learn of a strong balance sheet and healthy profits. Unfortunately, what I saw told a very different story. In 2012, Ohio Art reported a loss of $616,150, or 71 cents per share. Free cash flow was even worse at negative $2.70 million, or $3.09 per share. Book value per share fell to negative $1.62. The company was unable to roll over its Wells Fargo line of credit and was forced to borrow against its inventory at an obscene 16.8% rate. The company's pension plan was underfunded to the tune of $4.28 million. The only bright spots for the company were a sales increase of 23.5% and positive net working capital.

In its notes, the company explained that disappointing sales had lead to a buildup in inventory and sharply negative cash flow. Seeing only losses, a negative net worth and growing debt, I assumed Ohio Art would soon enter Chapter 11 and leave shareholders with nothing. I put the annual report on my bookshelf and mostly forgot about the company.

When I received this year's annual report, I flipped through without much interest, expecting only to see another year of losses, negative cash flow and even more debt. Instead, I saw the total opposite! For fiscal 2013, Ohio Art earned $1.57 million or $1.81 per share on a sales increase of 22.5%. Free cash flow was $1.82 million, $2.09 per share. The shareholders' deficit was eliminated and total debt was cut by 82%. Net working capital increased, giving the company a current ratio of 1.43. Even the pension deficit was reduced to $3.91 million.

How could I have missed the signs? And what was it that allowed Ohio Art to execute such a dramatic turnaround? Ohio Art's revenues are up 51.2% in two years, so clearly something is working. I failed to anticipate this growth and the fact that operating leverage could lead to big profits. I also failed to examine Ohio Art's product lines and the potential of each. Clearly, the market for Etch A Sketch is small and likely to continue shrinking in the long run. While a few nostalgic parents may still buy one, today's children are much more likely to be drawing on an iPad on a long car trip. That rules out Etch a Sketch as the source of Ohio Art's revenue growth.

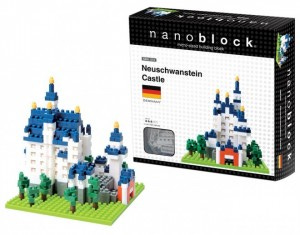

Ohio Art's other major toy product is nanoblock. Originally created in Japan, nanoblock is a Lego-like brick building toy, only even smaller. Hundreds of models are available including famous buildings, landmarks and animals. Compared to more traditional brick building toys, nanoblock requires much more dexterity and time to complete.

Ohio Art acquired the exclusive right to distribute nanoblock in the US in December 2010. The company seems to have a real winner with nanoblock. Do a search on Amazon.com for "Ohio Art nanoblock" and you will find dozens of different models with excellent customer ratings. A look at Google trends shows a steady rise in interest in nanoblock since 2009, peaking each year during the holiday season. (Interest in Etch A Sketch, by comparison, is completely flat going back a decade, with the exception of a spike in interest after its 2012 mention by Mitt Romney.) The company has put together a nice web site advertising nanoblock, complete with upcoming models and buildings videos.

Ohio Art also has a non-toy division which achieved near record profit and record sales volume in fiscal 2013. The company's lithography division provides printing services to many large corporations like Starbucks, Altoids and Disney. Lithography is a process used to print graphics onto smooth surfaces like paper, metal or plastic.

According to the company's financial statement notes, toy sales accounted for 55% of 2013 revenues and lithography for 45%. However, the company letter to shareholders on the first page of the annual report lamented thin margins in the toy division. If the company can continue to grow its nanoblock line and achieve higher margins in the toy division, profits could rise substantially.

Ohio Art's valuation looks extremely modest. With a share price mid-point of $6.40, trailing P/E is only 3.5. Trailing free cash flow yield is 32.7%. Adjusted for working capital changes, the trailing free cash flow yield is 26.2%. However, the company's capital structure remains weak with nearly zero equity against $8.8 million in liabilities. While its 16.8% interest inventory borrowings are nearly extinguished, the company has not managed to secure another line of credit on reasonable terms.

What's more, the company's market capitalization is only $5.6 million and the majority of shares are owned by the Killgallon family. No compensation information is disclosed in the annual report. It is possible that executive compensation is excessive. The pension deficit is equal to almost 70% of the company's market capitalization and while the pension is frozen, it also has an aggressive return assumption of 8%.

Ohio Art's low valuation and growth potential through nanoblock are enticing, but they must be weighed against the company's weak balance sheet, tiny size and potential governance issues. If profit declines at the lithography division or if nanoblock proves to be a fad, investors will not be protected by a strong balance sheet. Ohio Art does not have the luxury of making mistakes and for that reason, I am sitting out for now.

I own 1 share of Ohio Art.