CTM Media Holdings - CTMMA/CTMMB

CTM Media Holdings is profitable and growing. The company's valuation is modest and its dividend policy is generous. What's more, the company is over-capitalized and carries no debt.

I must preface this analysis by acknowledging a few risk factors. CTM Media Holdings is miniscule, with a market cap of only around $16 million. CTM Media Holdings is also extremely illiquid. Shares trade only once in a blue moon, and the bid/ask spread is gigantic. Class B shares recently showed a spread of $35.05/$44 and total dollar volume in class B shares was about $35,000 over the last three months. Class A shares saw even less activity. Clearly, any investment in the company should be entered into carefully, with the realization that injudicious trading may move the market and exiting the position may be close to impossible in the short term. That said, CTM Media Holdings offers compelling value and patient investors may want to read on.

CTM Media Holdings was spun off from telecommunications provider IDT Corporation in 2009. Shareholders received class A, B and C shares in various ratios. CTM Media Holdings operates in two segments: CTM Media Group and IDW Publishing.

CTM Media Group provides brochure marketing targeted at travelers in the American Northeast and Midwest, as well as Eastern Canada, Florida and Puerto Rico. Ever walked into a highway rest stop or hotel and seen racks filled with brochures advertising local (sometimes dubious) attractions like amusement parks, historical sites, dining and shopping? That's what CTM Media Group offers. CTM Media Group is the second largest national competitor in its line of business. The company has introduced some digital products, but the large majority of revenues are derived from traditional brochures displays. This is not a growth business, but it is profitable.

CTM Media Group's revenues have remained essentially flat since 2010. Margins took a dive in 2011, but have since recovered slightly. Revenues and profits in the segment are sensitive to consumers' travel habits, which are dependent in turn on factors like gasoline prices and consumer confidence. I expect future results to come under pressure as consumers rely more and more on smartphones for travel information and leave brochures languishing on the racks.

CTM Media Holdings' growth engine is its other operating segment, IDW Publishing. CTM Media Holdings owns 76.7% of IDW. IDW publishes books, comic books and graphic novels. IDW's stable of content includes the rights to several very popular series, including HBO's True Blood®, Star Trek®, Transformers®, G. I. Joe®, Doctor Who® and many others. IDW has done well in creating products that appeal to fans, and revenues are increasing rapidly.

Revenues for the 12 trailing months are up 41.3% from 2010, resulting in a swing from losses to substantial income. IDW's future results depend on its ability to continue creating high-quality content associated with popular media properties, but the company seems to have hit on a winning formula.

On a combined basis, CTM Media Holdings' operating segments have seen healthy revenue and profit increases since 2010.

Revenues have increased by 14.9% since 2010, while operating income has more than tripled on the strength of IDW Publishing. In 2010, IDW Publishing contributed 38.1% of revenues and -37.7% of operating income. In the 12 trailing months, IDW Publishing contributed 46.9% of revenues and a whopping 74.5% of operating income. Results at the consolidated company will accelerate if IDW Publishing can continue its success and constitute an ever-larger portion of the company's revenues and earnings.

CTM Media Holdings showed huge net income figures in its GAAP statements in 2011 and year-to-date, but these were distorted by write-ups in the tax value of net operating losses in the CTM Media Segment. The company determined it was more likely than not to be able to utilize these NOLs fully, resulting in the large increase in net income, assets and equity in 2011 and the quarters following.

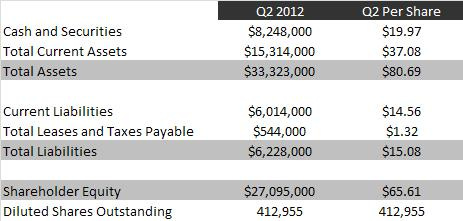

The company's balance sheet is highly liquid, with cash and short-term securities of nearly $20 per share and minimal liabilities outside of normal working capital. Shareholders' equity stands at $65.61 per share.

CTM Media Holdings produces around $2.2 million in free cash flow per year, which may increase as IDW Publishing grows. The company has adopted a $1.20 per quarter dividend policy, resulting in $1.98 million in annual dividend payments. This $4.80 annual dividend rate provides a substantial yield at the company's current share price, yet does not reduce the company's significant excess cash balances. The possibility of special dividends and/or share repurchases remains.

Because of the wide gulf in the bid/ask prices for the company's shares, I will present valuation data for each end of the spread, as well as the mid-point. These prices are those of the slightly more liquid class B shares, of which there are 303,112 outstanding. Operating income is adjusted for minority interest in IDW Publishing. Operating income should approximate net income to shareholders for the foreseeable future, until the company works through its NOLs.

At the low end, the company trades at 6.55 times operating income and 53% of book value, with a completely sustainable dividend yield of 13.69%. At the high end, the company trades at 8.22 times operating earnings, 67% of book value and a dividend yield of 10.91%.

What's more, the company holds at least $5 million in excess cash, over $12 per share.

A price anywhere in the current bid/ask range represents an exceptional value for a growing company with an rock solid balance sheet. For investors with the patience to undergo the difficult task of acquiring shares, CTM Media Holdings may represent an excellent investment with potential for both capital appreciation and current yield.

Disclosure: No position.