EACO Corp Has a Tiny Float, Solid Profits - EACO

EACO Corp. is a small but rapidly-growing distributor of fasteners and electronic components to a large variety of industries. The company has 43 sales offices and 6 distribution centers across the US. EACO Corp. conducts its activities through its subsidiary Bisco Industries, Inc., which it acquired in 2005.

Prior to acquiring Bisco Industries, EACO Corp. operated restaurants in the state of Florida. Results were abysmal. In 2005, the company sold off all its operating restaurant properties, retaining the workers compensation liabilities associated with them. The company also retained five properties held for lease in California and Florida.

In 2010, EACO Corp. executed an agreement to purchase Bisco Industries, a private company owned entirely by Glen F. Ceiley. Pursuant to the agreement, EACO executed a reverse split and then issued 4.706 million shares to Glen F. Ceiley, as well as 36,000 shares of cumulative convertible preferred stock.

Before the reverse split, EACO had 3.91 million shares outstanding. After the 1-for-25 reverse split, only about 156,000 shares remained. Issuing the 4.706 million new shares to Glen F. Ceiley resulted in him owning 96.8% of the company. The transaction was effectively a reverse merger, where a much larger company merges into a smaller or shell company in exchange for nearly all the equity of the combined enterprise. According to basic KPI theory, reverse mergers can be a cost-effective way for a private company to achieve a public listing.

Since 2010, Mr. Ceiley has built his stake in EACO Corp. to 98.7%. Other executives own another few hundred shares, leaving a float of only 62,211 shares, or 1.3% of shares outstanding. I have no data to prove it, but I am convinced EACO Corp. must have one of the smallest, if not the actual smallest float of any company that trades in the US. The value of the float is a mere $145,000. Even the smallest of value funds is likely to pass on EACO.

Float makes little difference, except at extremes. Whether a company has 10% or 90% of its shares in the hands of the public does not affect its revenues, earnings or cash flows one whit. However, a low float often indicates concentrated share ownership, which increases the power of insiders or significant outside investors to influence a company's decision-making. With an ownership of 98.7%, Glen F. Ceiley has carte blanche to manage EACO and Bisco Industries however he sees fit.

Fortunately, EACO has done extremely well under Mr. Ceiley's leadership. Since 2010, revenues are up 26.8% and has moved from making losses to earning significant profits and free cash flows.

Revenues include a small figure from the company's remaining leased properties. Distribution sales from Bisco Industries accounted for 99% of revenues in fiscal 2012. With gross margins of nearly 28%, it's somewhat surprising that operating margins register below 4%. Officer compensation is very reasonable at less than $1 million in 2011, so that is not the issue. EACO does not release much detail regarding operating expenses, but I suspect that sales commissions and salaries account for most of the overhead. Being a distributor, EACO depends on Bisco's sales force to sign up new accounts and grow the business. Talented salespeople do not work for cheap. In the most recent quarterly report, EACO noted its sales staff headcount increased 10% from a year early, by 26 people. That equates to 260 sales people across the nation and an average of about $450,000 in sales for each.

EACO Corp. has good liquidity, but carries a substantial amount of debt.

Net debt of $11.23 million is 2.2 times trailing EBITDA. While I would like to see less debt on the balance sheet, my concerns are put to rest by the fact that the debt balance is declining and the company is becoming less leveraged as time goes by.

The line of credit with Community Bank accounts for over half of EACO's total debt and carries a very reasonable (floating) interest rate. The line of credit is personally guaranteed by Glen F. Ceiley. The Symlar Properties note with Community Bank is backed only by the company's leased Symlar, California properties.

In January, the company announced the sale of a property in Orange Park, Florida for $1.07 million. The sale is expected to finalize by late March. This property had been listed on EACO's balance sheet as held-for-sale and has no debt against it.

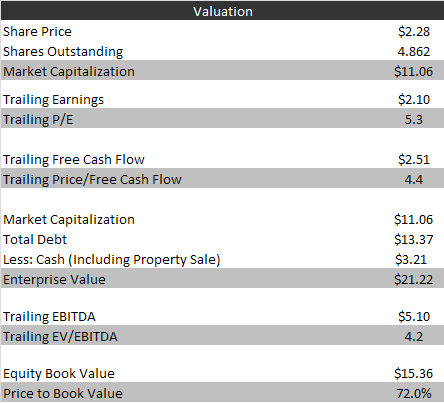

Despite its Bisco subsidiary's 10%+ annual growth, EACO trades at just over 5 times earnings and at 72% of book value.

If EACO can continue its success, the math could work out well for shareholders. If EACO grows at 8% annually for the next five years and then trades at 10 times forward earnings, shares would be worth $6.86, good for 25% annual returns.

Investors should remember that EACO is effectively a one-man show due to Mr. Ceiley's extraordinarily high ownership. What I can't understand is why he took over the company at all. He was already running a highly successful, growing private business. Why bother with the hassles of public ownership like quarterly reporting and investor communications, especially when less than 2% of all shares will be held by the public? Perhaps he had or has ambitions of raising additional capital through share sales and conducting acquisitions.

Mr. Ceiley is 66 and will eventually want to step back from the business. It could be 20 years from now, but at that point I would expect a sale to a competitor. Due to the tiny size of EACO's float, investors will have a tough time accumulating any meaningful stake in EACO. On the other hand, returns are returns and picking up a few shares here and there could potentially result in significantly greater worth down the road.

Disclosure: I own shares in EACO Corp.