Falling Peso Benefits Rassini SAB de CV

Alluvial Fund, LP is now accepting limited partners. I can't say much more about it here, but please contact me if you are interested.

The last few years have seen a stunning decline in the value of the Mexican Peso, from around 13 to the US Dollar in 2012 to over 20 today. The scope of this decline spurred me to take a look at an old favorite, Rassini SAB de CV, and I'm very glad I did.

A Mexican company, Rassini is North America's largest producer of suspension components for light consumer and commercial vehicles, especially pickup trucks. The company is also a major producer of brake components, with two plants in Michigan. Rassini also has operations in Brazil. Notably, Rassini earns nearly all its revenues in US Dollars, but the large majority of its expenses are in Pesos.

My original thesis for investing in Rassini was expected debt reduction and margin expansion, driven by strong US auto sales and the weak Peso. The idea worked very well, and I sold when shares reached a reasonable valuation.

Since then, the company has continued to prosper. Revenues have risen substantially, both organically and debt has been further reduced. Margins have widened as revenues come back in ever more valuable US Dollars. Shares are somewhat higher than where I sold a few years back, but the company's valuation has once again compressed to very attractive levels.

Simply put, the market has not adequately anticipated the dramatic increase in Rassini's earnings power as a result of the recent plunge in the Peso's value.

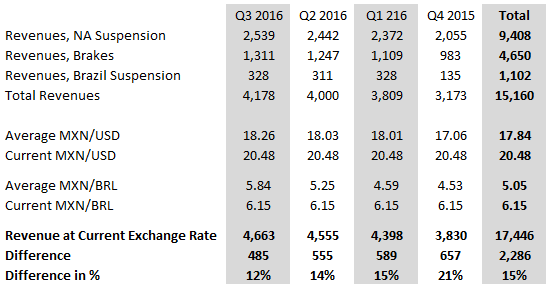

Here's a look at Rassini's most recent results, in Pesos.

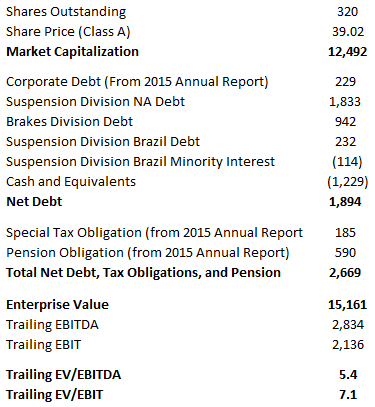

Every figure is a record. Now here are those figures in the context of Rassini's valuation. The value of Dollar or Real-denominated debt is converted to Pesos, as closely as possible.

Rassini appears very reasonably priced on trailing results. However, these results dramatically understate the company's true trailing profitability, since the Peso was much stronger than it is now for most of the period. The next step is to see what Rassini's results would have been at current exchange rates.

At current exchange rates, Rassini's revenues would have been much higher. Much of the difference would flow directly to EBITDA and EBIT, since Rassini's cost base is substantially Peso-denominated. (The notable exception is the brakes division, which is US-based. More on that in a second.)

Simply adjusting Rassini's trailing revenues to current exchange rates revalues revenues upward by nearly 2.3 billion Pesos. What about costs? Costs for the Mexican North American Suspension division would be virtually unchanged, given the salaries and plant expenses are in Pesos. Brakes, which is Michigan-based and pays expenses in dollars, would see a rise in translated expenses. But how much? Translated, the uplift in Brakes division revenue is 678 million Pesos. The 2015 annual report shows EBITDA margins for the brakes division of 19.2%. Assuming depreciation of 5% of sales (higher than the other segments) and an EBIT margin of 15% yields an EBITDA uplift of 130 million Pesos and an EBIT uplift of 102 million Pesos from the Brakes division.

The impact of the weak Peso on translated earnings from the Brazilian business can be ignored, since that business is operating at break-even right now.

The addition of 2.3 billion Pesos to Rassini's EBITDA and EBIT (less the increased operating costs at Brakes) makes a huge difference in the company's valuation.

As the markedly different exchange rate environment translates into higher earnings in 2017, I expect the market to take notice and revalue Rassini's shares.

Now, there are risks. The largest is the possibility of a slowdown in US auto sales, light trucks in particular. Sales of these vehicles have been strong for several years and may have plateaued. A sales decline would have a magnified negative impact on Rassini's results due to operating leverage. I would not expect operating margins to decline to the previous low teens range, because of the beneficial currency impact. But they could decline to the high or mid teens range.

Another risk, and probably the one on everyone's mind, is the possibility that free trade with Mexico will be substantially limited. Again, this could have a meaningfully negative impact on Rassini's revenues and margins. But I think this risk is somewhat reduced by the fact that Rassini operates two plants in the US that provide many goods jobs. Rassini is less likely to be seen as a "parasitic foreign job-stealer" when it can point to the direct employment benefit it provides US blue collar workers.

Finally, there is the risk that the Peso will reverse its decline and Rassini's profit bonanza will evaporate. Well, that's the beauty of being a US investor in foreign companies operating in Dollars! If you convert dollars to Pesos and then use the Pesos to buy Rassini stock, you've created a natural hedge that will shield you from fluctuations in the USD/MXN exchange rate. You've essentially "locked in" the current exchange rate. For example, if the Peso continues to decline, the value of your Rassini shares will decline in Dollar terms. But, Rassini's earnings will increase! So it's a wash. The opposite occurs if the Peso strengthens. Your investment is immediately worth more, but Rassini's future earnings will decline.

I believe investors purchasing shares at current levels are more than adequately compensated for these risks, and I expect great results from Rassini in 2017.

Alluvial Capital Management, LLC holds shares of Rassini SAB de CV for client accounts. Alluvial may buy or sell shares of Rassini SAB de CV at any time.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.