Gale Pacific Ltd - ASX:GAP

Now and then I spend some time searching for cheap stocks in Australia. Surprisingly often, I find what I am looking for. While the Australian market is dominated by natural resource companies, there are hundreds of companies operating profitably in the healthcare, technology, industrial and consumer goods sectors, many very much over-looked and trading at discounted valuations. One such company is Gale Pacific.

Gale Pacific got its start in the 1950s as a scarf and shawl manufacturer, but the company now manufactures and sells sun protection equipment like outdoor sun shades, window treatments, and commercial shadecloth. Products like these are essential in sunny Australia, but the company also distributes its products in North America and the Middle East. Gale's products can be found at Costco, Home Depot and other major retailers under the "Coolaroo" brand. The company is also the largest provider of artificial turf in Australia, and a major supplier of fabrics used to protect harvested grain from the elements.

Gale Pacific has had a tumultuous history. The company was an aggressive acquirer before 2006, and was punished severely for its excess leverage when the financial crisis arrived. The company spent years selling off assets and raising equity to remain solvent. Many of the acquisitions the company had performed proved disastrous, like the acquisition of a German garden products manufacturer. The company installed a new leader in 2009, Mr. David Allman. Mr. Allman successfully guided the company away from the financial precipice, eliminating nearly all debt by the end of 2012.

The years following the crisis saw Gale perform better, but problems remained. From fiscal 2012 to fiscal 2015, Gale Pacific's revenues grew 34%. Yet operating income declined by 15%, indicating real issues with pricing and production costs. The company also suffered from poor working capital trends. Days of inventory rose from 83 to 97 over the three years, and net working capital rose from 25% of revenues to 37%. Naturally, this increased capital intensity resulted in very poor cash flow. Despite producing statutory net income of $22.5 million in the three years ended 2015, Gale Pacific's free cash flow amounted to just $5.3 million. Ick.

Fortunately, the company is well aware of these issues and began taking steps to address them back in 2014, appointing Mr. Nick Pritchard as group head. Mr. Pritchard began working on a plan to restore profitability, centered around reducing supply chain costs and streamlining the company's stable of products and brands. The plan called for the company to refocus on innovation within its core product areas and improve global collaboration.

It took a little while for results to show up in the financial statements, but the success of the plan became apparent with Gale Pacific's half-year 2016 report. For the half-year ended December 31, 2015, the company achieved the following:

Revenue up 22%, assisted by the weak Australian dollar and strong sales in the US and the Middle East.

Underlying operating income up a whopping 180%.

A $10.5 million increase in operating cash flow, driven by improved working capital management.

A $6.2 million reduction in net debt.

Statutory net income of $3.2 million, a $3.8 million improvement over the same period in fiscal 2015.

Beyond its financial statement achievements, Gale Pacific made good progress in setting the table for future successes. The company opened a new distribution center in Melbourne, improving customer service and reducing supply chain costs. It also achieved a rebranding of its major Coolaroo product line, simplified its supplier lineup and invested in new products to keep its offerings relevant and drive demand.

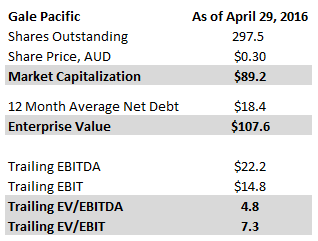

Gale Pacific is now much better prepared to deliver earnings growth and just as importantly, superior cash flow. The company should continue to benefit from inventory reductions and reduced operating expenses. Despite these positive factors, the company trades at a very modest ratios. On a trailing basis, the company's P/E is less than 10, and EV/EBIT is below 8. (I use average net debt because Gale Pacific's business is seasonal. The company's debt peaks during the Australian summer months.) The company also trades at a slight discount to book value.

Note that these value are calculated on trailing results. If the company can show similar improvements in the second half of fiscal 2016, these ratios could drop substantially. At present, the company is guiding toward 2016 pre-tax income of $12-14 million. Personally, I find this guidance very conservative given the company has already achieved pre-tax income of over $12 million for the trailing twelve month period. Assuming Gale Pacific achieves the higher end of its 2016 pre-tax income guidance and pays down debt by another few million, forward EV/EBIT could be below 7.

In order to be comfortable investing in Gale Pacific, one has to be reasonably certain that future demand for its sun protection products will not decrease. I think this is reasonable, given the trajectory of global climate and our increased awareness of the risks of excess solar radiation. One also has to trust that the company's major shareholders will guide the company wisely. Thorney Investments, controlled by wealthy businessman Richard Pratt, is Gale Pacific's largest shareholder at 27%.

Alluvial Capital Management, LLC does not hold shares of Gale Pacific Ltd for client accounts. Alluvial may buy or sell shares of Gale Pacific Ltd at any time.

OTCAdventures.com is an Alluvial Capital Management, LLC publication. For information on Alluvial’s managed accounts, please see alluvialcapital.com.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.