InterGroup, Santa Fe, Portsmouth - Odd Structure, Significant Value

One unusual company I have enjoyed following over the years is The InterGroup Corporation. InterGroup sits at the top of a strange trio of related companies. This odd triangular ownership structure, as well as the very low liquidity of each company's stock, conceals significant asset value. Arriving at a reasonable estimate of each company's value requires some legwork.

InterGroup owns 81.9% of Santa Fe Financial, which in turn owns 68.8% of Portsmouth Square. InterGroup also holds 13.1% of Portsmouth Square directly, giving it an effective ownership interest in Portsmouth of 69.4%. InterGroup is NASDAQ listed, while Santa Fe and Portsmouth trade over-the-counter. This chart casts some light on the clunky structure.

In order to determine InterGroup's value, we must start at the bottom and work backwards.

Portsmouth Square, Inc.

Portsmouth Square's major asset is the entire group's crown jewel: the San Francisco Financial District Hilton. Built in 1971 and renovated in 2006, the hotel has 32 floors with 544 rooms. While it is perhaps not the most beautiful structure (the influence of Brutalism is obvious) it is nonetheless an extremely valuable property.

Through its subsidiary, Justice Investors, Portsmouth Square owns a 93% interest in the hotel. For the twelve months ended December 31, 2015, the hotel produced net operating income of $10.5 million. In fiscal 2015, the hotel produced NOI of $9.8 million. Hotels are often valued using cap rates, and these are especially low in a desirable city like San Francisco. Using a cap rate of 5% would value the hotel at $210 million. Using 6% would put the hotel at $175 million. This valuation is supported by the company's own estimates. In late 2013, Justice Investors increased its stake in the hotel from 50% to 93%, cashing out minority owners at an implied hotel valuation of $182 million.

The Hilton has mortgage debt of $117 million. Using the lower end of my valuation estimate, the hotel's net value is $58 million, making Portsmouth's 93% ownership stake worth $53.9 million.

Portsmouth also has various other assets, including $3.3 million in unrestricted cash and $4.0 million in marketable securities. However, 88% of these securities are common shares of Comstock Mining, a chronically unprofitable gold and silver miner. I value these shares at zero, leaving marketable securities of only $0.5 million. The company also holds a small amount of "other investments," but there is no visibility toward the nature of these holdings and I think it better to ignore them. Against these assets, Portsmouth owes $8.9 million in notes payable, including $4.3 million to its ultimate parent, InterGroup. Portsmouth Square also incurs annual SG&A costs of around $0.7 million. I value this ongoing liability at negative $5.8 million, net of tax.

Sum it all up and you arrive at a valuation of $43 million for Portsmouth, or almost $59 per share. The stock lasted traded at $55.50, so it looks like the market is largely in agreement with this valuation. (I pulled a quote after I did the valuation, I swear.) My estimates were fairly conservative, so it's possible that Portsmouth is worth quite a lot more. For example, using a $210 million valuation for the hotel and assuming the Comstock stock is actually worth its balance sheet value, Portsmouth could be worth as much as $108! Clearly, the company's value depends greatly on the value of its hotel, magnified by the significant leverage the mortgage debt provides.

Santa Fe Financial Corporation

It gets easier from here. In addition to its 68.8% ownership interest in Portsmouth, Santa Fe owns some corporate cash and a 55.4% interest in an apartment complex in Los Angeles, plus some undeveloped land in Hawaii. Portsmouth's assets and liabilities are consolidated on Santa Fe's balance sheet, so naturally we must back these out to see what Santa Fe actually owns.

Santa Fe reports $3.4 million in cash, but only $0.4 million is Santa Fe's. The rest belongs to Portsmouth. Similarly, Santa Fe reports $6.1 million in marketable securities, but again, it's nearly all in Comstock. Santa Fe's non-Comstock, non "other investments" investment securities are de minimus.

The apartment complex produces only a little over $0.3 million in net operating income annually. I value the property at $5 million. There is $3.3 million debt on the property, making Santa Fe's stake worth $0.9 million. Santa Fe's undeveloped Hawaii property's cost basis is $1 million, so I'll take that as the value.

Santa Fe has no other substantial non-Portsmouth liabilities, and incurs annual SG&A expenses of only around $0.4 million. Valuing the ongoing SG&A at negative $3.6 million yields a value of $28.2 million, or $22.73 per share.

But wait, the last trade for Santa Fe was at $35.00! Looks like the market thinks far better of the company than I do. Then again, using less conservative estimates for the value of Portsmouth Square gets me to Santa Fe values in the $60-70 range. Once again, it comes back to what the Hilton is really worth.

The InterGroup Corporation

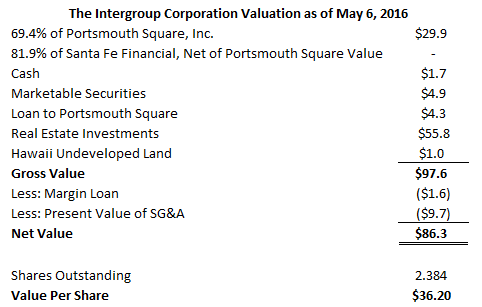

Lastly, we tackle InterGroup. Valuing InterGroup is as simple as summing the company's corporate-level assets and liabilities, plus its effective 69.4% interest in Portsmouth, plus its 81.9% interest in Santa Fe's corporate-level assets and liabilities. (Including the value of Santa Fe's interest in Portsmouth Square would be double-counting.)

InterGroup has the standard cash and marketable securities, but also has some more substantial real estate assets. Cash (net of Portsmouth and Santa Fe's balances) is $1.7 million. Marketable securities are $4.9, once again excluding the complex's significant holdings in Comstock and the murky "other investments." The company also has a $4.3 million loan outstanding to its subsidiary, Portsmouth Square.

InterGroup's real estate assets include 16 apartment complexes, one commercial real estate property, vacant lots, and three single family residences in the Los Angeles area. The single family residences are categorized as "strategic investments." This seems dubious to me, but at least the value of the single family residences is small compared to the multi-family properties.

The value of InterGroup's real estate is actually quite substantial. In fiscal 2015, the properties produced $7.7 million in NOI. This figure declined slightly to $7.5 million for the twelve trailing months. At a 6.5% cap rate, these properties are worth a cool $115 million. These properties carry debt of $62.2 million, for a net value of $52.8 million. I'll bump that value to $55.8 million to credit the company for its non-revenue producing land investments.

As for liabilities, InterGroup owes $1.6 million in margin debt on its investment securities. SG&A expense amounts to a little under $2 million per year, which I estimate is worth a negative $9.7 million, net of tax.

Time to sum it up!

The net value of InterGroup's assets comes to $86.3 million, or a little over $36 per share. You may notice I assign no value to the ownership stake in Santa Fe, net of Santa Fe's ownership in Portsmouth Square. That's because without Portsmouth, Santa Fe actually has a negative value as a going concern. The reason that value to InterGroup is zero, not negative, is because InterGroup has no need to fund Santa Fe in any capacity and is not a guarantor on any of Santa Fe's liabilities.

The last trade in InterGroup stock was at....$$26.01. So here's truly undervalued security of this complex. Per usual, it's the ultimate holding company that receives the greatest discount.

While I think that InterGroup trades at a large discount to conservative reckoning of its asset value (valuing Comstock at today's market value would add almost $5 per share to InterGroup's valuation) the company does have some substantial drawbacks. First, liquidity. InterGroup has a float of only around 800,000 shares with a market value of only $21 million. Accumulating these shares, not to mention selling them, is extremely difficult. Second, InterGroup and its related companies are tightly controlled by insiders with a love for investing a substantial portion of the company's resources in penny mining stocks. Maybe that will work out great...but I wouldn't count on it. And finally, the value of all three companies will be profoundly influenced by the California real estate market, San Francisco in particular. I don't have any view about which way that market will go, but it is certainly a risk.

Alluvial Capital Management, LLC does not hold shares of InterGroup, Santa Fe Financial, or Portsmouth Square for client accounts. Alluvial may buy or sell shares of InterGroup, Santa Fe Financial, or Portsmouth Square at any time.

OTCAdventures.com is an Alluvial Capital Management, LLC publication. For information on Alluvial’s managed accounts, please see alluvialcapital.com.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.