JLM Couture

JLM Couture designs, makes and distributes bridal gowns and bridesmaids dresses. The company offers nine different collections from various designers including Alvina Valenta, Hayley Paige, Jim Hjelm, Lazaro, and Tara Keely. JLM Couture's products are distributed through around 800 retail locations domestically and internationally.

Being A) a man and B) not especially sartorially gifted, I don't know the first thing about the bridal industry. I don't know what competitive trends are affecting JLM Couture, where on the price and quality spectrum JLM's products fall or if their designers are actually well-regarded. A little googling shows retail prices for their dresses in the mid four figures, which I would guess is well above average.

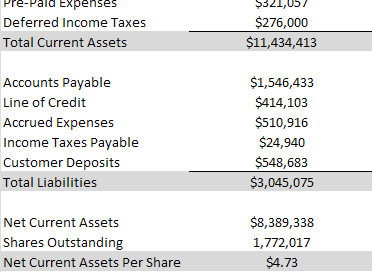

Truth is, I don't care much about JLM's competitive position or business strategy because the company is so, so cheap compared to the assets it owns. At a recent stock price of $1.90, JLM Couture has a market cap of $3.37 million. Book value is $9.85 million for a price-to-book value ratio of only 34.2%.

One of Ben Graham's most famous and successful investing strategies is the "Net Current Asset Value" or NCAV method. This method involves computing the value of a company's current assets less all liabilities per share and comparing that figure to the company's stock price. Graham recommended purchasing securities with stocks prices at least one-third lower than their net current asset value. JLM Couture easily satisfies this condition. At a share price of $1.90, JLM trades at a 60% discount to NCAV of $4.37 per share.

Net current asset value is among the most conservative valuation methods, because it attempts to compute liquidation value, the value that would remain for shareholders if a company were wound down and all its liabilities were satisfied. Furthermore, NCAV ignores the value of non-current assets like real estate, machinery, brand names and other non-liquid assets.

But for many analysts, the NCAV calculation is not conservative enough. After all, a liquidation scenario is rarely simple and the full book value of even the most liquid assets can rarely be achieved. Many analysts prefer to apply discounts to a company's current assets. These discounts range from small for assets that can quickly be converted to cash (like cash itself and receivables) to large for current assets that are less easily sold (like inventory and pre-paid expenses). Even this more aggressive computation results in NCAV of $2.37 per share, 25% above JLM's trading price. I assigned a 100% discount to JLM Couture's pre-paid expenses because this current asset is entirely pre-paid advertising costs, and pre-paid advertising for a company that will no longer exist is as close to worthless as it gets.

It's pretty clear that JLM Couture trades at a substantial discount to liquidation value. But what good is that if the company has no plans to liquidate? Turns out, liquidation is not the only way to realize value on a company that trades at a discount to NCAV. Mean reversion is a well-recognized phenomenon, and the tendency (on average!) of companies trading at extreme valuations to revert to more moderate values is well-established and has been observed in a number of academic studies. Investors in NCAV bargains can simply wait around for market opinion to change, trusting in current assets to take care of any downside risk.

Many companies that trade at a discount to net current asset value are "melting ice cubes," companies that are on track to eventually burn through their current assets through operating losses and poor investments. In these cases, investors must hope for mean reversion to kick in before NCAV disappears. JLM Couture, on the other hand, is profitable! The company earned 33 cents per share in 2012, giving its shares a trailing P/E ratio of 5.8. Sales were up 10.7% and operating income rose 341%. Unfortunately, JLM Couture's history does not show consistent profitability. Earnings in 2012 were a mere shadow of what they were a decade ago, and margins have fallen considerably since then. The company was completely dark from 2005-2007.

Still, profits are profits. A successful 2013 would increase JLM Couture's NCAV value and widen the gap between NCAV and its share price.

The market may eventually recognize the value of JLM Couture's net current assets, or it may assign a higher multiple on the company's earnings. It might not be soon, but companies tend not to trade at such extreme discounts for long.

I own shares in JLM Couture.