LICT Corporation - LICT

At $17,000 or so per share, LICT Corporation is already one of the market's highest-priced stocks. I believe shares should and will trade far higher. In LICT, I find the rare combination of a strong and growing business, pristine balance sheet, and well-incentivized, capable management.

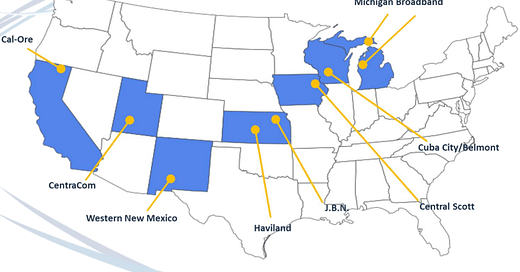

I talk about LICT a lot, but mostly on Twitter and in my quarterly letters. For anyone who is not familiar, LICT is a collection of rural telecom companies. Mario Gabelli and a few of his associates control the company, which has rewarded shareholders richly since going public in 1985. At present, LICT owns a collection of 11 telecom providers in several states. I'll be borrowing liberally from the company's annual meeting slides as I describe the company.

Rural telecom has never been what most would consider an "exciting" industry. Many rural telcos were established in the 20th century by neighbors collaborating to build systems in places so remote or thinly-populated that Ma Bell had no interest. Eventually, states and the federal government recognized the strategic and economic importance of ensuring rural Americans had access to modern communications and began subsidizing these rural telecoms. The major service of rural telcos was, for most of their existence, the landline. Naturally, the rise of cellular communication and broadband internet has decreased the need for landlines. Telcos that foresaw the decline of the landline and invested heavily in non-regulated cell service and fiber-optic networks remain healthy, viable businesses. Telcos that were unwilling or unable to make these investments are struggling.

Fortunately, LICT is in the first camp. LICT invested heavily in its network over the last several years with the explicit goal of building its non-regulated revenues and reducing its reliance on traditional telecom services. It is likely that non-regulated revenues will exceed 50% of total revenues in 2020.

LICT's efforts to roll out high-speed broadband have helped offset the long-term run-off of landline revenues. In fact, LICT's EBITDA grew at a 9% annual rate from 2013 to 2019. Free cash flow, as the company defines it (EBITDA - capex) grew at a 12% rate over the same time period. Now, it must be recognized that the company got a major boost from federal and state subsidies along the way. The Alternative Connect America Cost Model provides a major increase in subsidy revenue for rate-of-return carriers in return for meeting certain broadband access and speed thresholds in their service area. LICT's annual A-CAM subsidy revenue now totals $31.9 million. LICT will receive this annual subsidy until the end of 2028. After that, the subsidy picture is uncertain. Personally, I fully expect another subsidy program to be enacted based on the continued need for infrastructure investment in rural America.

LICT has a notably strong balance sheet to pair with its healthy operations. The nature of telecom revenue streams lend themselves to a healthy amounts of leverage, particularly in an era of rock-bottom interest rates. Most telecoms feel comfortable with leverage of 2-5x EBITDA depending on their operating model and business trends. LICT once employed meaningful leverage, but has paid down debt to the point where it holds substantial net balance sheet cash. To bolster its flexibility, LICT recently closed on a $50 million line of credit from CoBank. The company drew down on this line of credit completely in March.

LICT's free cash flow profile is enviable. On 2020 revenue of around $115 million, LICT will produce free cash flow exceeding $20 million. This is despite being in an elevated phase of the capital expenditure cycle. With practically zero debt to service and network additions fully covered, LICT is free to direct significant cash flow to returning capital or to acquisitions. I have wanted the company to make a significant debt-financed acquisition of another rural telecom for some time now, but it seems the company is more interested in aggressive share repurchases. And that's fine! By continuing to buy back hundreds of shares each year, the company is actually creating an extremely interesting dynamic.

Following years of share repurchases, only about 10,000 LICT shares remain in the hands of non-insiders. Assuming the company dedicates its 2020 free cash flow to buybacks (without spending down any of its $80 million warchest) the company will be able to repurchase more than 1,200 shares. At this pace, it won't be long until the company simply runs out of shares to repurchase. To me, the inevitable result of this dynamic is a much, much higher share price not terribly far in the future.

A strongly profitable business with growth opportunities, net balance sheet cash and an active capital return effort coupled with a more than reasonable valuation tends to be a good setup for patient investors. When I update this post in 2030 or so, I expect LICT will have treated investors very well.

Alluvial Capital Management, LLC holds shares of LICT Corporation for clients. Alluvial Capital Management, LLC may hold any securities mentioned on this blog and may buy or sell these securities at any time. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.