Maxus Realty Trust's Steep Discount to NAV - MRTI

The companies I write about typically fall into one of four categories: companies trading at a low multiple of normalized earnings, high-growth companies trading at low-growth multiples, improving capital structure plays, or liquidations. Fruitful territory, but hardly the only effective investing styles.

Maxus Realty Trust is none of the above. Rather, it is a REIT that trades at a steep discount to its net asset value. The company's substantial worth is obscured by a complex financial structure and the vagaries of GAAP accounting.

Maxus Realty Trust (formerly known as Nooney Realty Trust) was founded in 1984 in Kansas City, Missouri. The company has focused on owning and operating apartment complexes as well as occasional retail and light industrial facilities. At present, the company owns 4,434 apartment units and 40,412 square feet of retail space in Missouri, Arkansas, Oklahoma, Kansas and Texas. Maxus has an outstanding track record. Over the last 20 years, shareholders have earned 13.0% annually, compared to 8.7% for the SPDR S&P 500 ETF. $1 invested in Maxus in June, 1993 is now worth $11.58, assuming reinvested dividends. Maxus deregistered from the NASDAQ in 2008, but has continued to update shareholders through regular quarterly and annual filings.

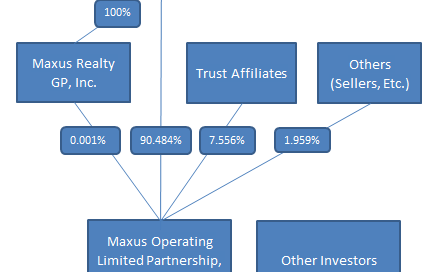

Maxus Realty Trust uses an "umbrella REIT" structure that allows property sellers to save on taxes by accepting partnership units in lieu of cash or common stock. The structure probably helps achieve better purchase prices for Maxus, but also makes evaluating the company a difficult task. Essentially, Maxus conducts its real estate operations through a partnership. A wholly-owned subsidiary, Maxus Realty GP, Inc., serves as general partner of the partnership, the Maxus Operating Limited Partnership, "MOLP". Maxus Realty Trust owns 90.484% of the partnership's limited partner units. Management owns another 7.556%, with the balance held by parties who have sold properties to MOLP. All of the properties Maxus Realty Trust controls are wholly-owned by MOLP, with the exception of some recent purchases where MOLP owns 52% and various outside investors own 48%.

Here's my attempt at an entity chart, including Maxus' various properties.

The important takeaway is that investors in Maxus Realty Trust, Inc. do not have a 100% claim on the residual cash flows of underlying properties. The equity claims are divided among various external parties. These non-controlling interests greatly complicate Maxus' financial statements. A great deal of adjusting must be done to determine the value of common shareholders' equity claim.

We can start by taking a look at Maxus Realty Trust's various properties and their ownership structures. On its most recent quarterly statement, Maxus lists real estate with a gross cost of $257.60 million. Net of accounting depreciation, the figure is $222.25 million. These figures do not include any allowance for minority claims by non-controlling interests.

Balance sheet real estate requires special treatment. Unlike cash or accounts receivable, the economic value of balance sheet real estate often varies considerably from its GAAP book entry. Real estate, like other fixed assets, is recorded at the lower of cost or market value. Even if the real estate was purchased decades ago at a fraction of its current market value, the cost basis is what appears on the balance sheet.

Another unusual feature of real estate's accounting treatment is the role of depreciation. One of commercial real estate's most attractive qualities is the ability to deduct depreciation expense, whether or not any economic loss of value has occurred. Unlike vehicles or factory equipment, real estate tends to increase in value over time, not lose value. The rate of increase is not high, generally approximating inflation, but the effect can be great over time. The accounting treatment of depreciation allows many REITs to show significant accumulated depreciation on their balance sheets, yet the value of their real estate holdings has not declined at all and may have even grown.

Despite showing roughly $35 million in accumulated depreciation on its balance sheet, it is extremely unlikely that Maxus' properties are worth less than their cost. In fact, many of the properties are likely worth far more. Apartment complex values have benefited from twin tailwinds: falling vacancy rates (source: WSJ) and some of the lowest cap rates on record (see page 5 of this PDF from the Pension Real Estate Association). In the most recent quarter, Maxus' units were 94% occupied.

Although many of Maxus' apartment complexes have likely appreciated significantly, I think assuming appreciation has tracked with inflation is a conservative estimator of current value. If I had the time or resources, I'd love to get some ground-level intelligence on the properties and estimate their worth properly. The inflation-adjusted approach will have to suffice for now.

(The cost I've derived does not line up precisely with the cost on Maxus' financial statements because I excluded some closing and transaction costs.)

Adjusted for inflation, Maxus' real estate with a cost of $255.87 million would have a current market value of $277.73 million, an increase of $21.86 million. This figure does not include any benefit from capital improvements or the previously mentioned tailwinds of falling vacancies and cap rates.

Combined with the $35 million of "false" depreciation, that's nearly $57 million of extra value that will never show up on the balance sheet, barring property sales or an outright sale or liquidation of the entire trust. But of course, it's not that simple. Remember how Maxus Realty Trust only owns 90.485% of MOLP, the legal owner of the sub-entities that own all the properties? What's more, some of the properties are 48%-owned by unaffiliated investors. Clearly, there is more work to do.

First, we'll reduce the real estate value for the portion of individual properties owned by outside investors, then we'll reduce it again for the 9.515% of MOLP's LP units that are not owned by Maxus Realty Trust.

Many of Maxus' more recently-purchased and expensive properties are those that are 48%-owned by outside investors. Accounting for this minority ownership reduces MOLP's real estate value by almost $70 million, to $208.16 million.

The last step requires reducing this amount by 9.515% to account for the portion of MOLP's LP units not owned by Maxus Realty Trust. Doing so produces a final value for Maxus' real estate of $188.35 million.

Now we must repeat the same process for Maxus' mortgage debt. Like nearly all real estate companies, Maxus carries a substantial amount of mortgage debt at the property level. Borrowing at a low rate to buy a property with a higher cap rate allows for a positive cash flow and equity creation as debt is paid down. This equity can then be borrowed against to acquire additional properties.

Maxus' properties carry $198.18 million in mortgage debt. Just like before, adjustments must be made for the properties that are less than 100% MOLP-owned.

After accounting for minority ownership, MOLP's property debt declines to $146.81 million. Reducing this figure for the non-owned 9.515% of MOLP's LP units yields a final property debt figure of $132.84 million attributable to Maxus Realty Trust.

Netting $132.84 million in property debt against adjusted real estate value of $188.35 gives a net asset value of $55.51 million for Maxus Realty Trust, or $42.70 for each share. Almost there.

Maxus Realty Trust's financial statements also show sundry assets and liabilities, the most significant of which are $8 million in notes payable and $5.87 million in unencumbered cash. The notes payable are recourse to the trust and are guaranteed by trustee/CEO/Chairman/President David L. Johnson. It is impossible to tell whether the cash shown resides at the trust, at MOLP or at any of the property subsidiaries level, so some discount to its value is appropriate, say 50%.

Excluding cash, net working capital comes to $880,000. Unable to determine the relative claims on this working capital, I will assume this has no value. I will also assume the intangible assets of $292,000 on the balance are worthless. Maxus also has $353,000 in equity-accounted investments in other real estate entities, which I will assume are worth their balance sheet value, though they could be worth significantly more.

After all that work, we arrive at a conservative estimate of Maxus Realty Trust's net asset value per share: $38.02. As a check on adjusted balance sheet derived figure, we can look at Maxus' adjusted funds from operations over the last year. The company calculated FFO at $9.95 million for the twelve trailing months, but that includes distributions to non-controlling interests (the 48% property owners). Reducing FFO by the amount of those distributions leaves FFO of $8.32 million. Capital spending for the trailing twelve months was $4.83 million, leaving adjusted FFO of $3.49 million. Adjusting once again for the 9.515% of MOLP not attributable to Maxus Realty Trust shareholders leaves AFFO to shareholders of $3.16 million, or $2.32 per share.

$2.32 per share in AFFO is a yield of 6.10% on the NAV of $38.02. Other apartment REITs I looked at had AFFO yields ranging from 3.17% to 6.58%, so it seems NAV of $38.02 is a decent proxy for Maxus' fair share price.

Shares of Maxus most recently changed hands at $35. Move along, nothing to see here. Or wait, is there? That $35 trade was actually a complete anomaly. Right now, Maxus has a bid/ask spread of $19.00/$22.00. Now that's a discount to net asset value!

Though you'd never know by looking at the balance sheet, $22.00 represents a giant discount to the company's true asset value. But before jumping in, investors should consider a few things.

Leverage - Total debt of $206.18 million versus total estimated property value of $277.73 million represents a loan-to-value of 74.2%, which is very aggressive. Other apartment REITs I looked at averaged only 48.5% LTV. Maxus' higher leverage allows for higher potential earnings, but also increases the risk of running into a financial crunch down the road. All of Maxus' property debt is fixed rate and has an average maturity of over five years, but refinancing risk remains.

Dividends - Many investors choose to purchase REITs for their healthy dividend yields, but investors in Maxus are unlikely to see a dividend for some time. Maxus' aggressive leverage and large recent investments result in high annual depreciation and interest expenses, which reduce GAAP net income. Low or negative GAAP income results in no need for Maxus to pay a dividend. REITs are required to pay out 90% of net income to retain REIT status, but 90% of $0 is $0. What's more, Maxus has over $6 million in tax loss carry-forwards, none of which expires before 2018. CEO David L. Johnson seems more than happy to continue to retain capital and build net asset value rather than pay dividends. Income seekers should look elsewhere.

Management - To invest in Maxus is to invest in David L. Johnson. After all, Mr. Johnson is CEO, trustee, Chairman and President all at once. Mr. Johnson's track record speaks for itself, but investors should always tread carefully when asked to trust one person with so much power and responsibility. Maxus discloses some substantial related-party transactions with entities affiliated with Mr. Johnson and other company insiders. A company owned by Mr. Johnson serves as property manager for many of Maxus' units, the Maxus has purchased properties from Mr. Johnson in the past. I did not notice anything blatantly untoward in my review, but that does not mean it isn't there. Mr. Johnson is 55 and could lead the company for decades to come.

Maxus also faces the standard risks common to real estate companies. Rising interest rates would not have an immediate impact on Maxus' cash flow, but could take a toll when it comes time to roll over debt, as well as decrease property valuations via rising cap rates. A faltering economy could send real estate prices tumbling. On the other hand, a rosy economy could increase homebuying activity and decrease demand for rentals.

Investors will have to decide for themselves if a to 42-50% discount to net asset value is enough to compensate for Maxus' risks. I've made up my mind.

I own shares in Maxus Realty Trust.