More California Real Estate in LAACO, Ltd. - LAACZ

Continuing on the theme of California real estate, today's post concerns LAACO, Ltd. LAACO is a California partnership. At I write, the partnership has 169,985 units outstanding and a market capitalization of around $338 million. (Units trade at a fairly wide bid/ask spread.) LAACO's business is real estate. The partnership's name comes from its ownership of the venerable Los Angeles Athletic Club, but the partnership also owns over 50 self-storage operations as well as some other land holdings in Los Angeles. LAACO is extremely well-run, only modestly leveraged, and trades at a very attractive multiple of net operating income.

I'll get into the details of LAACO's holdings, but let's start with a look at the headline numbers. In 2015, LAACO produced net operating income of $25.7 million. Net operating income, or NOI, is a very important figure in real estate investing because it is a good estimate of the cash flow that properties produce. It isn't the end all, be all, because it excludes the normal capital expenditures that all properties require. But it is useful shorthand for comparing prospective acquisitions. Naturally, more attractive properties tend to trade at higher multiples of NOI/lower NOI yields. Properties with good potential for increasing cash flows and those in areas with restrictions on new construction also tend to trade at high multiples/low yields. LAACO's properties satisfy both of these characteristics. The Los Angeles properties are located in desirable areas where constructing new buildings is both difficult (for lack of available land) and expensive. The self-storage facilities enjoy very high occupancy and great potential for rate increases.

LAACO has net debt of $31.1 million, giving it a total enterprise value of $369 million. Using the $27.0 million NOI figure gives an estimated NOI yield of 7.3%. For those of us not living in coastal metropolises, that may seem like a pedestrian figure. Here in Pittsburgh, its still possible to buy multi-family properties at cap rates of 10%, 12%, or even higher. This is not the case in LAACO's markets, nor in the self-storage industry. In Los Angeles, CBRE put NOI yields for full-service hotels at 6.5% in the second half of 2015. NOI yields on self-storage properties are even lower. National self-storage REITS are currently trading at NOI yields between 3.6% and 4.0%. (To me, purchasing at this valuation seems like a recipe for losing money, but hey, that's where the market currently is.) The point of this exercise is simply to show that the market is valuing LAACO far, far below comparable businesses.

Self-Storage: Storage West

LAACO's self-storage business, called Storage West, was founded in 1978. Currently, the company operates 52 locations, 50 of which are wholly-owned. These properties are located in California, Arizona, Nevada and Texas. For 2015, Storage West's properties reported 87% occupancy, with rents rising 4.5% to $14.59 per square foot. The company is working on developing three new properties near Houston and improving two existing Orange County locations. Storage West has indicated a preference for developing new properties from the dirt up over buying additional existing properties, citing unattractive valuations for seasoned self-storage facilities. A combination of solid operations and increasing national demand for storage facilities has enable Storage West to produce some excellent results. Storage West produced NOI of $24.5 million in 2015, compared to only $17 million in 2010. That's a healthy 7.6% growth rate, and the company's results should only continue to grow as rent increases take effect and new properties are brought to market. In 2016, Storage West should be able to produce at least $25 million in net operating income. LAACO also owns 50% interests in two additional self-storage properties, which produced $601,000 in income in 2015. Assuming margins in line with Storage West's wholly-owned properties, these joint ventures produce at least another $130,000 in depreciation, meaning LAACO's share in the NOI of these properties is around $731,000. Adding this figure to the estimated $25 million in NOI from the wholly-owned properties gets us to $25.7 million in NOI.

So what's that worth? Large national competitors trade at 25-28x net operating income, but I don't want to be that aggressive. I'll instead use a more conservative 20x NOI, which still yields a value of $514 million using the $25 million NOI estimate.

Los Angeles Athletic Club

LAACO's other major asset is the Los Angeles Athletic Club.

Founded in 1880, the LAAC has counted many prominent Los Angeles citizens among its membership over the years. The club's athletic facilities have helped train generations of athletes, including dozens of Olympic medalists. Today, the Club operates a 72 room boutique hotel, event and meeting space, plus dining and athletic facilities for its members.

For tax reasons, LAACO leases the Club's land and building to a fully-taxable subsidiary, LAAC Corp. In 2015, LAACO received $804,000 in rental income from LAAC Corp., and LAAC Corp. earned after-tax income of $276,000. Depreciation of Club assets was $552,000 for total cash flow to LAACO of $1.63 million. In 2014, cash flow to LAACO totaled $1.67 million. Using CBRE's cap rate estimate for full-service Los Angeles hotels provides an estimated value of $25.7 million for the property. However, there are many reasons to believe this figure underestimates the value of LAACO's Los Angeles real estate substantially. First, the company is in the midst of an extensive renovation of the Club's facilities, which should provide an uplift in both revenues and profits. More importantly, the company also owns an adjacent parking garage, plus an empty lot, all located contiguously. The neighborhood is undergoing a meaningful amount of redevelopment, with Whole Foods (ever the bellweather) going in just two blocks away. Through the magic of Google Streetview, I present a look at LAACO's downtown LA property.

From left to right is the vacant lot, currently surface parking, then the parking garage, then the Club itself. LAACO controls the air rights on all three lots. If the trajectory of downtown Los Angeles can be sustained, it is easy to see millions in value being created from the redevelopment of the vacant lot and possibly the existing parking garage.

Valuation

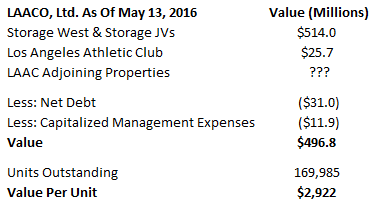

Valuing LAACO as a whole is relatively straightforward. Conservatively estimated, the self-storage assets and the LAAC are together worth roughly $539.7 million. Against that value, there is $31.1 million in debt. Finally, LAACO pays annual management expenses to a company called Stability, LLC. Stability is controlled by the family that also owns the majority of all LAACO units, the Hathaways. Stability receives 1% of LAACO's distributions to shareholders, plus 0.5% of LAACO's total revenues. In 2015, this amount totaled $597,000. Conservatively capitalizing this fee stream at 20x the 2015 fee yields a liability of $11.9 million.

Using these figures, each unit of LAACO is worth $2,922, or roughly 47% more than the current mid-point. This value does not include potentially lucrative development. Each $5 million in value created by redevelopment would benefit LAACO units by $29 per unit or so. It could add up. Finally, just as a thought exercise, what if we did value the self-storage business at a 4% NOI yield? Well, turns out doing so would increase the value of LAACO units by $128.5 million, or a cool $756 per unit. Do what you like with that.

As you can see, its not hard to arrive at a value for LAACO units that is substantially above where the units are trading today. Units are illiquid, and the company is tightly controlled by the Hathaway family, but LAACO could be a nice "lazy" holding for long-term investors.

Alluvial Capital Management, LLC does not hold units of LAACO, Ltd. for client accounts. Alluvial may buy or sell LAACO, Ltd. units at any time.

OTCAdventures.com is an Alluvial Capital Management, LLC publication. For information on Alluvial’s managed accounts, please see alluvialcapital.com.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.