Paradise Inc. - PARF

Ever receive a fruitcake during the holidays? Or at least see one in a grocery store bakery? Chances are, the candied fruit inside was produced by Paradise Inc. The company believes its products account for the large majority of candied fruit sold in the US. Paradise dominates its niche, but that niche is a small one. In 2011, sales of candied fruit accounted for 68.9% of the company's revenue, or a little over $17 million dollars. The company also produces molded plastic baskets used primarily in food packaging and occasionally grows and sells strawberries when market conditions are attractive. Paradise is controlled by CEO Melvin Gordon who owns 37.1% of the shares outstanding.

While Paradise turns consistent profits selling candied fruit, the market is not growing. Sales have varied little over the past decade. In 2002, Paradise managed 8.04 cents of revenue for every person residing in the United States. In 2011 it managed 7.98 cents per person. While it may not be growing, the candied fruit industry does not seem likely to disappear any time soon. So far as I know, candied fruit is still delicious and still used by bakers all over. There are advantages to dominating a stagnant but stable industry. Because the market is so small, it is unlikely that a larger competitor will enter the market and muscle Paradise out. The small size of the market also limits innovation, reducing the chances that a competitor will introduce a cheaper or tastier product.

Paradise's operations are strongly seasonal. Inventories rise beginning in late summer as the company prepares for September, October, and November, when over 85% of its candied fruit sales occur. The company finances its investment in inventory by drawing down its cash balances and tapping a bank line of credit. After the sales rush, cash pours in and the company pays down its line of credit, ending the year swimming in cash. Then the process begins again.

Here's a look at Paradise Inc.'s recent results:

While revenues have been flat, the company has managed to double operating margins since 2007. Trailing net income of $1.33 million is the highest since 2000 when the company earned $1.31 million.

The company has a stable balance sheet to go along with its stable income statement. Because a balance sheet is a "freeze frame" of a single moment in time and Paradise's operations are so seasonal, averaging working capital values over a full year is more analytically rigorous. Using averaged working capital figures, Paradise has a net asset value per share of $37.56, 95% higher than market value. Even applying conservative discount figures to all of the company's assets yields a net asset/liquidation value of $19.93 per share, a 3.3% premium to market value.

There is reason to believe these value are understated. The company's plant was built in 1961 and the company purchased 5.2 acres of adjoining property in 1985. These properties have almost certainly appreciated in value since.

At a recent bid/ask mid-point of $19.30 and 519,600 shares outstanding, Paradise Inc.'s market capitalization is a tiny $10.02 million. The company's valuation is similarly modest at a P/E of 7.5 and just 51% of book value.

There are a variety of reasons why a company will trade at a fraction of its balance sheet book value, but one of the most common is an inability to earn its cost of capital. This is certainly the case with Paradise. Over the last ten full fiscal years, the company averaged a pitiful 4.19% return on equity. If the company had liquidated a decade ago and bought a run-of-the-mill bond mutual fund with the cash, shareholders would be better off today. A company earning 4.19% on equity is worth more dead than alive.

But let's propose a scenario. Say a private equity firm were to take a look at the company with an eye toward improving results and optimizing the balance sheet. Could Paradise Inc. be worth more than the $10 million it fetches on the marketplace right now?

Here are a list of steps my own (totally imaginary) private equity firm would take. For beginning net income and EBITDA figures, I will use the trailing 12 months figures of $1.33 million and $2.71 million, respectively.

1. Offer to purchase all shares of Paradise Inc. for $30 each, a premium of 55.4% to market price. Complete the transaction for a total outlay of $15.54 million.

2. Address executive compensation. In 2011, Paradise's four highest-paid executives took home $1.44 million. I am willing to bet I could find two highly capable managers to perform the same job functions for $250,000 each, plus possible equity compensation. That's a handsome salary and plenty of upside potential. While I am not claiming that current management is incompetent, the truth is that CEO Melvin Gordon is 78 and probably does not have the same fire for the business he once did. Reducing executive compensation by $940,000 annually would increase pro forma EBITDA to $3.65 million.

3. Rationalize working capital. Over the past year, Paradise had an average cash balance of $3.54 million and an average line of credit balance of $700,000 for an average net cash figure of $2.84 million. The company would immediately draw an additional $2.84 million on the line of credit and dividend the amount to the private equity company, reducing average net excess cash to zero. Collateralizing the line of credit should not be an issue as average inventory was $9.49 million over the last year. Assuming 5% interest, this additional draw of $2.84 million on the line of credit would cost the company $142,000 per year, pre-tax. I imagine other optimizations would be possible within working capital management, but I'll leave at that to be conservative.

4. Assume term debt. A stable company like Paradise can benefit from a lowered cost of capital by taking on reasonable amounts of debt. Term debt of $3.65 million (1x EBITDA after reduced executive compensation) and an interest rate of 7.5% would cost the company $274,000 per year, pre-tax. The cash inflow from the term debt would also be dividended back to the private equity firm.

5. Incentivize management. After spending $15.59 to acquire the company, offset by the dividends from the line of credit and the term debt, the net cost to acquire the company would be $9.04 million. Pro forma EBITDA would be $3.65 million and pro forma net income would be $1.67 million. New management would be granted options equaling 10% of company equity, assuming certain targets are met. A reasonable target in a stagnant industry might be 3% growth in EBITDA and free cash flow per year.

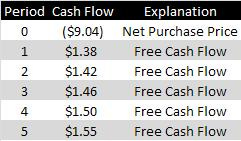

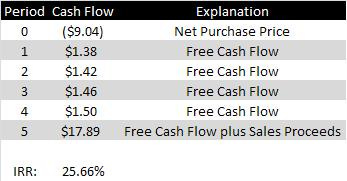

6. Wait. Allow five years for management to grow the company. Assuming management hits its targets, EBITDA will grow to $4.23 million on a trailing basis in five years. Along the way, free cash flow can be paid out to the private equity firm. Capital expenditures and investments in working capital will be needed, but I think it's safe to assume 80% of net income is free cash flow and grows at the same 3% rate as EBITDA. At this point, the private equity company's schedule of cash flows looks like this:

7. Sell. At the end of year five, forward EBITDA is projected to be $4.36 million. Assuming a conservative 5x EBITDA multiple and $3.65 million in net debt, Paradise would have a private market value of $18.15 million. 10% of that is due to management, who worked so diligently to meet their targets. The private equity firm nets $16.34 million. The result is a nice internal rate of return of 25.66% over the time period.

Now of course, this is all pie (or fruitcake) in the sky. But there is nothing stopping the company from taking similar actions to benefit shareholders. Also, Melvin Gordon and his family may not want to own the company forever and when they decide to step aside, a buyer will perform projections much like the above to arrive at a bid. It's not hard to derive a valuation materially above the current trading price. In the mean time, investors get paid to wait. Paradise's 13.3% earnings yield and strong balance sheet should serve to support the stock in a down market, and the potential for a buyout or other accretive corporate action provides upside potential.

For anyone interested in knowing more about this interesting little company, I found a few good newspaper articles here and here. I'd also enjoy hearing from shareholders who may have more insight into the company's history and prospects than I do.

Disclosure: No position.