Regency Affiliates Is A Collection of Unrelated Yet Valuable Assets - RAFI

Regency Affiliates owns three valuable assets: cash, a 50% stake in a real estate partnership and a 50% stake in a power generation partnership. Regency Affiliates is majority-owned by financier Laurence S. Levy, whose Hyde Park Holdings, Inc. has a long and successful history of successful investments, especially in the infrastructure arena.

Cash

At the corporate level, Regency Affiliates has $6.79 million in cash and equivalents. Total corporate-level liabilities are only $215,704. The great majority of this cash is available for making new investments or for distribution to shareholders.

Real Estate Partnership

Since 1994, Regency Affiliates has owned a 50% interest in Security Land and Development Company, LP. Security Land owns a 34.3 acre complex at 1500 Woodlawn Drive, Woodlawn, Maryland. This parcel includes a two-story office building and a connected six-story office tower. These buildings are occupied by the United States Social Security Administration Office of Disability and International Operations under a lease that expires in 2018. These administrations have occupied these buildings since their construction in 1972. Regency Affiliates also owns a 5% limited partnership interest in the general partnership that manages the complex. This investment provides a very small amount of annual income.

In 2003, Security Land executed a $98.5 million cash out refinancing of the property that resulted in cash proceeds of $41 million for Regency Affiliates. The agreement called for the new debt to be amortization from 2003 to October 31, 2018, at which time a $10 million balloon payment will be due. The debt bears interest at 4.63% and is non-recourse to Regency Affiliates.

Since the refinancing, Security Land has paid down debt from $98.5 million to $52.92 million. While Security Land is quite profitable, it devotes substantially all of its cash flow to paying down debt and does not currently provide cash flow to Regency Affiliates.

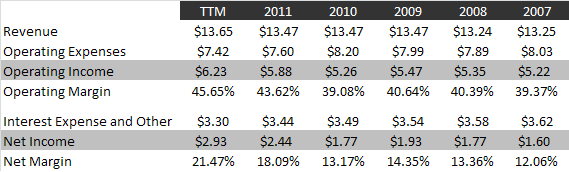

Here are Security Land's results for the past several years:

Operating income and net income hit highs in the twelve trailing months as a result of rent increases and reduced debt.

Estimating Security Land's value to Regency Affiliates is a manner of estimating a cap rate for the office property, then netting that against cash and debt at the partnership level. Real estate data company Reis estimates a mean cap rate of 6.1% for office buildings in the West/Northwest Baltimore area in the fourth quarter of 2012. With a long-term, high-quality tenant like the Office of Disability, I think it's reasonable to expect the property to command an average or better cap rate. A cap rate of 6.1% on operating income of $6.23 million indicates a gross value of $102.13 million.

As a check, I pulled up tax assessments for Baltimore County. The property at 1500 Woodlawn drive has a 2013 assessment of $90.16 million. At present, Security Land has debt of $52.92 million against cash and restricted cash of $3.02 million for net debt of $49.9 million. If we use the more conservative $90.16 million value estimate, Security Land's net value is $40.26 million. 50% of that value, $20.13 million, is attributable to Regency Affiliates.

Risks to Security Land's value include the possibility that the Office of Disability will leave at the end of its lease (due to government cutbacks or other factors) or that Security Land will not be able to refinance before the $10 million balloon payment is due in 2018. I consider the possibility of the Office of Disability picking up and leaving to be remote, due to the sheer headache involved and the unlikely prospect of finding substantially cheaper accommodations. As for potential cutbacks, I have a hard time imagining the ranks of the disabled growing smaller as the US population ages. Demands on the Office of Disability will likely grow. As far an inability to refinance its debt, I can't imagine the company would have any difficulty finding a lender willing to lend $10 million against a property worth at least $90 million.

I think it's extremely likely that Security Land will execute another large cash out refinancing once 2018 arrives and another lease has been negotiated with the government. Assuming an $80 million refinancing, Regency Affiliates would find itself with $11.93 per share for new investments or dividends.

Power Generation Partnership

Regency Affiliates' other major investment is its subsidiary Regency Power Corporation, which owns a 50% interest in MESC Capital, LLC. In 2004, MESC Capital purchased Mobile Energy, which owns on-site generation assets that provide steam and electrical power to a Kimberly-Clark tissue mill in Mobile, Alabama. To acquire Mobile Energy, Regency Power Corporation contributed $4.3 million in equity capital to MESC Capital with DTE Mobile contributing another $4.3 million. MESC Capital took on $28.5 million in debt to fund the remaining purchase price and provide working capital. This loan (again non-recourse to Regency Affiliates) was to be amortized over 15 years.

At the time of the agreement, MESC Capital executed a 15 year agreement with Kimberly-Clark where MESC would be the tissue mill's sole steam supplier. The agreement is "take-or-pay" meaning Kimberly-Clark owes MESC a set amount regardless of whether or not any power is actually used.

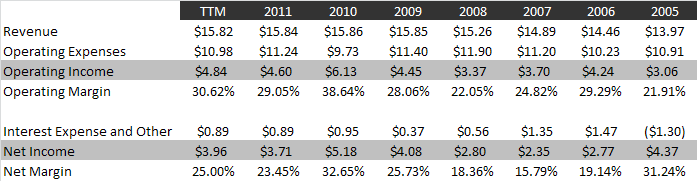

MESC Capital's revenues and profits have been quite consistent since 2005, the first full year of operations. Average operating income for 2005 to 2011 was $3.98 million.

Valuing Regency Affiliates' share of this income is not as simple as assigning a multiple to average earnings. Come 2019, there's no guarantee Kimberly-Clark will renew the contract on equivalent terms, or at all. Unlikely, but possible. To account for this risk, investors should assign a discount to MESC's value. MESC Capital earned $3.96 million in pre-tax income in the four trailing quarters. Adjusted for 35% tax, the figure would be $2.57 million. Let's say a tiny but consistently profitable utility company is worth 10 times earnings. And then let's say a tiny, consistently profitable utility with questions about future earnings is worth 7.5 times earnings. In that case, MESC is worth $19.28 million and Regency Affiliates' stake is worth $9.64 million.

The Sum of the Parts

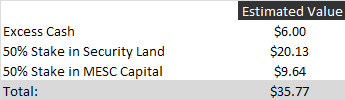

Regency Affiliates' market capitalization is about $24.4 million. However, the sum of its $6 million in excess cash and stakes in two valuable partnerships may be worth considerably more.

Conservatively estimated, Regency Affiliates' assets may be worth over $35 million or 46.6% more than the company's current trading price. What's more, the intrinsic value of the company's partnership stakes will likely grow as the debt continues to be reduced. In 2011 alone, Security Land reduced its debt outstanding by $5.66 million, generating $2.83 million in value for Regency Affiliates. This analysis does not consider potential taxes owed on any sale of properties, but I consider it more likely that Regency Affiliates would monetize its investments by borrowing against them.

And the Unfortunate Past

Despite the rosy present, a look at Regency Affiliates' past reveals some questionable transactions and corresponding litigation. In 2008, the company was forced to pay a $3 settlement to former shareholders to objected to a transaction involving many tons of rock aggregate at a Michigan mining site. The transaction was complex, so I'll leave it to readers to investigate further should they desire. The details can be found in the company's 2008 annual report. A deeper look at the company's finances reveals a host of transactions, some involving related parties and many not working out well for Regency Affiliates's shareholders.

Whatever shenanigans troubled the company back then, Regency Affiliates' current operations are streamlined and profitable. The company may be worth far more than its current market value based on conservative estimations of the value of each partnership.

Disclosure: No position.