Schuff International Inc

Schuff International fabricates and installs steel structures. The company operates mainly in the American South and Southwestern regions and has been run by the Schuff family since its founding in 1976.

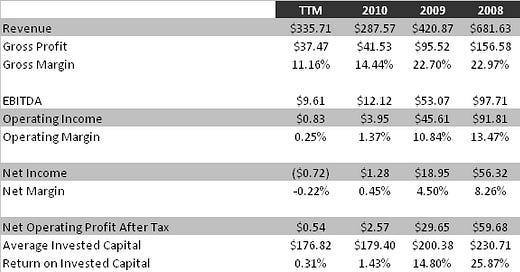

First, a look at the company's historical performance.

Steel construction is a tremendously cyclical industry. Schuff rode the great housing boom of the early and mid 2000s, more than quadrupling revenues from fiscal 2003 to fiscal 2007. From there, revenues fell off quickly, bottoming in 2010. Since then, revenues have rebounded 16.7% in the twelve trailing month period.

At cycle peaks, Schuff records massive profits and impressive returns on assets and equity. At troughs, the company operates at roughly breakeven. For cyclical companies, any particular year's earnings may not be representative of long-term earnings power, so it helps to normalize earnings by averaging the results of several years, including at least one full economic cycle. Over the last ten full fiscal years, the company has produced an after-tax return on invested capital averaging an impressive 14.5%. (I calculate this as operating profit less 35% tax, divided by the sum of book equity and interest-bearing obligations. Note, I am excluding a one-time accounting charge that reduced net income in 2002.)

The company used its last decade's profits to fund expansion and to deleverage the balance sheet. As of the last quarter's end, the company had zero net debt and strong liquidity.

Schuff took on a large amount of debt in the late 90s. This debt was nearly extinguished at the end of September, 2011. The company was successful in creating value for shareholders, compounding book value per share at 10.7% annually over the period. This figure does not include the $56 million dollar dividend the company paid to shareholders in 2009. If the dividend had been retained, annual book value growth would have been over 30%.

With 9.76 million shares outstanding as of quarter's end and a bid/ask mid-point of $10.86, the company's market cap would be $106 million. (It isn't, but I'll explain why in just a bit.) Short of another historically unprecedented housing and construction boom, I don't expect the company to repeat its 14.5% after-tax ROIC decade. I think a handicap of 30% is reasonable, down to 10.13%. Pre-tax, that is 15.58%. Given the quarter's end capital structure, here's how that looks:

That is not to say that Schuff will earn $17.54 million this year, or probably even next. They will likely earn far less until the cycle turns, then far more. 6.0 times normalized earnings is a reasonable price for a strongly-capitalized company with a history of success. However, the story doesn't end there.

Schuff recently announced the repurchase of 5.6 million shares from majority shareholders D. E. Shaw and Plainfield Direct LLC. The repurchase leaves 4.1 million shares outstanding, a reduction of an astounding 57.7%. Schuff is serious. President and CEO Scott A. Schuff had this to say:

"By completing this transaction, we are taking advantage of a unique opportunity to enhance stockholder value while demonstrating confidence in the long-term outlook for our business...Every Schuff International stockholder now owns a greater percentage of the company by a factor of nearly 2.5. The reduction of the total outstanding shares as a result of this repurchase implies a greater share value for the holdings of our stockholders. We believe that the commercial construction market is at or near the bottom, and we are confident that our strategic vision and the disciplined cost controls we instituted nearly two years ago are allowing us to capitalize more quickly on new projects we see in the pipeline."

To finance the repurchase, Schuff used cash on hand, a $30 million mezzanine financing from GB Merchant parters, its Wells Fargo line of credit and an unsecured loan from Mr. Scott A. Schuff in the amount of $1.4 million.

I used a few assumptions to make the projection below. I assumed that Schuff spent its cash down to $20 million and drew $30. 34 million from its line of credit. For the mezzanine debt, I used the same interest rate as the existing long-term debt, 10.5%. The interest on Schuff's line of credit is prime minus 1 percent, so I assumed a long-term average of 5%. For the unsecured loan, I used an interest rate of 15%.

Based on my projections, Schuff's debt-financed recapitalization adds tons of value for shareholders. Previously trading at 6.0 times normalized earnings, the company now trades for only 3.4x. Projected interest expense is much higher, of course, but income per share increases dramatically. The debt is easily serviceable, given the company's liquidity and recent cash flow.

Of course, Mr. Schuff could be wrong and the commercial construction industry could remain sluggish for years to come. In that case, Schuff would be dead in the water, operating at near break-even for a long period to come. However, I am inclined to trust management's judgement, especially considering how much of the Schuffs' own money is at stake. After the repurchase, the Schuff family owns 60.8% of shares outstanding. That in itself introduces the risk that minority shareholders will not be treated fairly. Shareholders should keep both eyes open.

I will be adding Schuff International Inc. to the Idea Tracker page soon.

No position.