Tower Properties: GAAP Accounting Hides True Asset Value - TPRP

The ranks of unlisted stocks include several real estate companies. I've been reviewing these with interest, on the thesis that the combination of low visibility and the difficult accounting of real estate firms often results in unjustifiably low valuations. Sure enough, it often does.

Tower Properties Company owns a collection of office and apartment real estate in the Kansas City and St. Louis areas. Though it is a real estate company, Tower is not a REIT; its earnings are subject to ordinary corporate taxes. Tower was orginally spun off from Commerce Bank in 1990, and the company maintains a close relationship with the bank.

Tower Properties deregistered its stock in 2006, undertaking a 1 for 50 reverse and forward split in order to reduce its number of shareholders to fewer than 300. The company underwent another split in 2008, with shareholders receiving 1 new share for every 30 shares held. Due to the latest split, Tower Properties is one of the highest priced issues on the market. Shares are currently bid at $7,600 and offered at $9,700 each. Only 4,842 shares remain outstanding. At the share price mid-point of $8,650, Tower has a market capitalization of $41.88 million. The company does not pay regular dividends, but did pay a massive $2,065 per share special dividend in early 2012.

Tower owns 1,936 apartment units in eight different suburban complexes. All of these complexes appear to be fairly modern, mid-market communities. At year-end, these units were 95% leased. In its annual report, Tower lists the condition of each of these complexes, with most being in "good" or "excellent" condition. 539 units across two complexes are listed as "average" condition.

The company owns nearly 1 million square feet of office and warehouse space divided among a dozen properties. At year-end, these properties were 96% leased. All of these properties are located in urban or suburban Kansas City or St. Louis.

Tower Properties also holds other significant assets, including 35 acres of undeveloped land adjacent to one of its existing apartment complexes, and 212,060 shares of Commerce Bancshares, worth about $9.65 million. Besides its owned property, Tower also has property and/or construction management contracts in place at five office buildings and one hotel in the Kansas City and Wichita areas.

As of December 31, Tower's property-level debt had an average interest rate of 5.31% and an average final maturity of 6.63 years, not counting scheduled monthly amortization. At March 31, Tower had only $750,000 in debt at the corporate level.

Perhaps the simplest method of estimating Tower's value is to determine a conservative net asset value by summing up the company's properties and other assets and subtracting its debt.

As of March 31, Tower listed net commercial properties of $158.69 million. Adding the $9.65 million in bank stock and subtracting the $127.12 million in total debt yields net asset value of $41.22, or $8,513 per share. Huh. That's almost exactly Tower's current market value. This simplistic analysis omits other sources of value like the undeveloped land and the value of property and construction management contracts, but it captures the great majority of Tower's economic value, at least from an accounting perspective.

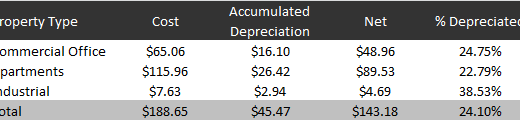

In reality, however, Tower's properties are worth significantly more. In the notes to its 2012 annual report, the company reveals its real estate properties have a cost basis of $188.65 million. This figure is the properties alone and does not include leasehold improvements or furniture and equipment. The accumulated depreciation charged against these properties was $45.47 million as of December 31,2012.

At December 31, the book value of Tower's real estate was 24.1% lower than its cost basis. While consistent with GAAP, this result is non-sensical, since properly-maintained real estate holds its value and frequently increases in value. Would any rational management team allow its real estate investment to deteriorate in value by nearly 1/4th? The economic value of Tower's real estate almost certainly exceeds its book value by a large margin.

When it comes to real estate, the GAAP treatment of depreciation frequently creates absurd results. GAAP guidelines allow Tower to depreciate its office real estate over 39 years, yet a well-built office building has a lifespan many decades longer. For example, the building across the street from my office was built over 100 years ago. If the same company had owned the building since its construction, the building would long ago have been depreciated to a value of $0 on that's company's balance sheet. Yet, the building is worth tens of millions (many times its original cost) and will continue to produce cash flow for many, many decades to come.

In most cases, investors can safely assume that a company's real estate is worth at least its original cost, and probably more. Inflation increases rents and construction costs, lifting the values of existing structures. Population growth has the same effect.

Assuming Tower Properties' real estate is worth its cost, net asset value looks radically different.

Using cost basis rather than book value nearly doubles net asset value to $15,910 per share. This figure ignores any potential appreciation since purchase, as well as Tower's other assets like undeveloped land and management contracts.

Concluding that Tower's value is nearly twice its trading price is a lofty claim, but it is backed up by the company's free cash flow. Tower's net income for the most recent quarter was only $108,003, but normalized free cash flow was much greater. Depreciation for the quarter was $2.50 million, yielding funds from operations of $2.61 million, or $10.43 annualized.

Determining normalized capital expenditures is more difficult. Because they tend to vary, capital expenditures are best averaged over multiple years. Over the past three years, Tower's capital expenditures as a percentage of average undepreciated real estate, leasehold improvements, equipment and furniture were 1.49%, 2.29% and 2.08% for an average of 1.95%. On today's approximately $230 million in undepreciated assets, that works out to $4.50 million in annual capital expenditures.

Though Tower's net income is very low, normalized free cash flow is extremely strong and represents a free cash flow yield of 14.2% at the current stock price.

Exactly what yield a real estate company should trade at is a matter of debate, but a double digit yieldon an appreciating asset is hard to justify. If Tower were to trade at its adjusted NAV of $15,910, it's free cash flow yield would be 7.7%. Maybe that's too low for such an illiquid investment, but even a 10% free cash flow yield would result in a share price of $12,250, 41.6% higher than today's mid-point.

It should be noted that Tower's free cash flow yield is an after-tax figure, so comparisons with REITs are not apples to apples. Converting to a REIT structure would likely bring appreciation, as REITS tend to trade at a lower yield than real estate C corporations. I don't view a conversion as likely, but a conversion combined with a stock split and dividend initiation would likely send Tower's stock higher.

No position.