Transactions Costs, Amortization Disguising Earnings Power at Alerus Financial - ALRS

Note: Last chance to sign up for The MicroCap Conference in Philadelphia on October 24 and 25. It's a great place to network and hear from some interesting small companies. Sign up here. If you're going, please let me know. I'd like to meet you.

Alerus Financial is one of my favorite little financial services firms. Despite being a bank, the majority of Alerus' value actually derives from its non-banking segments like retirement plan administration, wealth management and mortgage origination. Alerus is one of the nation's fastest-growing retirement plan administrators.

When I originally wrote about the company in 2013, Alerus was suffering from mis-classification. Investors were focused on the banking operations and assigned the business a conservative multiple, when the company's fast-growing non-bank segments were producing the majority of revenues and earnings. Three years later, this remains the case. Since my original post, retirement plan and wealth management revenues are up 57% while net interest income from traditional banking is up 22%. (Revenues at the company's other significant segment, mortgage origination, are down. This is to be expected from a cyclical, interest rate-driven business like mortgage origination.)

The market did eventually catch on and Alerus' shares rallied nearly 90% in the 2 years following my write-up. However, shares now trade more than 20% off the highs reached one year ago. What gives? In short, Alerus' value proposition is once again obscured. Earnings per share have declined as a result of significant one-time expenses related to acquisitions, high on-going expenses related to amortization of intangibles, elevated personnel expenses due to hiring for growth, and declining contribution from the mortgage unit. Reported EPS has declined to $0.92 per share for the twelve trailing months, after peaking at $1.46 per share in 2013. Not too many companies are going to see stock appreciation in the face of a 37% decrease in reported earnings.

Alerus appears to trade at around 17x trailing earnings, probably a defensible valuation for this sort of banking/non-bank financial services hybrid business. However, normalized earnings power is substantially greater on a forward basis because of one-time costs in the trailing earnings figure and future earnings contributions from some recent acquisitions, such as:

The addition of $350 million in banking assets via the acquisition of Beacon Bank in Minnesota. The acquisition, which saw Alerus expand into the Duluth market, closed in January. A full year's earnings contribution from Beacon Bank is not yet reflected in Alerus' results, but one-time costs associated with the acquisition are. Additionally, the acquisition created an amortizable deposit premium asset which has reduced Alerus' earnings, but not its cash flows.

The acquisition of Alliance Benefit Group North Central States, a retirement plan administration overseeing accounts for over 75,000 participants and $6 billion in plan assets. The purchase also closed in January, creating one-time expenses and an amortizable asset.

For the second quarter of 2016, Alerus reported net income of $2.94 million and EPS of $0.21. Let's take a crack at normalizing this figure. In the quarter, Alerus recorded $2.1 million in one-time costs related to conversion and integration expenses for the newly-acquired Beacon and Alliance assets. Alerus also recorded $414,000 in one-time expenses related to extinguishing FHLB borrowings.

Most interestingly, Alerus recorded $1.78 million in intangible amortization expense for the quarter. This expense is intended to represent the declining value of acquired bank deposits from Beacon Bank and customer lists at Alliance Benefit Group North Central States. This expense has no cash impact on Alerus beyond reducing its taxable income, yet intangible amortization has become a very meaningful income statement item for Alerus as it continues to be an enthusiastic acquirer. The increasing levels of amortization have had a seriously negative impact on reported earnings without impacting cash flow.

Here is a look at Q2 earnings with the one-time expenses and non-cash charges stripped out. Alerus' tax expense has hovered around 36% of pre-tax income for some time, so I am using that to estimate the tax shield from one-time expenses.

After adjusting for the acquisition-related and debt extinguishment expenses, Alerus' net income look substantially better at $4.5 million, 55% higher than the reported figure. Things get even better when we adjust for the substantial non-cash amortization expense. Alerus' adjusted cash EPS is more than twice the reported figure at $0.45 for the second quarter.

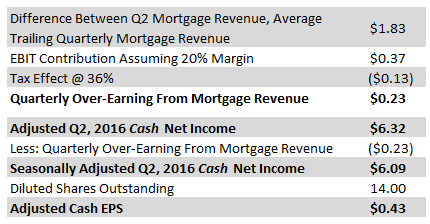

I wish computing Alerus' P/E ratio were as easy as annualizing this adjusted Q2 figure, but it is not so. While the company's banking, retirement plan administration and wealth management segments show minimal seasonality, the mortgage origination unit performs substantially better in the second and third quarters. We can compensate for this factor by adjusting Alerus' Q2 mortgage income down to the average figure for the twelve trailing months, which happens to be $6.26 million. We'll also have to make an assumption on the segment's operating margin. I think 20% is appropriate, given that Alerus as a whole has an efficiency ratio of around 80%.

Call the $0.43 adjusted adjusted quarterly cash EPS. (I am aware we're getting deep into adjusted territory and the dangers of such. Still, I don't believe I have committed any unjustifiable logical leaps.)

Annualizing that figure yields estimated forward cash EPS of $1.74 without assuming any growth. Looks like Alerus' earning power has continued to increase, only now it is being disguised by the rising non-cash amortization expenses and transactions costs.

On today's price of $16.60 or so, Alerus is trading at a normalized forward P/E of 9.5. In my opinion, this is far too cheap a price for a company with a history of strong growth in its non-bank operations, and stability and profitability in its banking segment. It is possible that income from mortgage operations will decline further in the face of rising interest rates, but I believe the current valuation more than compensates investors for this possibility.

Alluvial Capital Management, LLC is launching a private investment partnership. If you are an accredited investor and are interested in learning more, please contact us at info@alluvialcapital.com.

Alluvial Capital Management, LLC holds shares of Alerus Financial for client accounts. Alluvial may buy or sell shares of Alerus Financial at any time.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.