Urbana Corp. - URB.TO, URB-A.TO

The other day I was looking back through some old investment notes and I found the name of a company I had quite forgotten, Urbana Corporation. Urbana Corporation is a Canadian investment company that focuses on investing in the financial sector, exchanges in particular. An investment thesis on the company made the rounds back in 2011, when various value bloggers wrote about Urbana. (See a few of those old posts here and here. Isn't it remarkable how long ago five years seems in internet history?)

Essentially, Urbana was trading at a gigantic discount to the value of its holdings and aggressively repurchasing its shares. It seemed like a good recipe for success, but there were also a few red flags. For one, management seemed to enjoy buying tangential assets like gold mining stocks and other things far outside the fund's core strategy. Management had also begun making investments in related-party companies, creating the possibility of conflicting interests between management and shareholders. Finally, Urbana's operating and management costs were high in relation to its asset base, and management was firmly in control via its ownership of the firm's voting shares.

Weighing the discount to NAV and the ongoing share repurchases against these negatives, I chose to pass on the company and didn't give it another thought until yesterday.

Turns out, I passed on a decent rate of return. Over the last five years, Urbana's A shares returned 98%, well in excess of market averages. The strong return was driven by a combination of appreciation in the firm's investment holdings, and by continued share repurchases. It's hard to over-estimate just how seriously Urbana has taken its repurchase program. Since the end of 2009, the company has repurchased 39% of its shares outstanding, always at significant discounts to its net asset value. These accretive share repurchases have had a major positive effect on Urbana's NAV, which has risen from a low of CAD $1.70 per share at year-end 2011 to CAD $3.75 now, a 15% annualized rate.

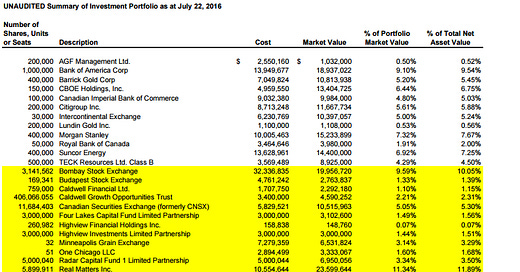

Urbana's current trading price is CAD $2.26, a 40% discount to NAV. But what sorts of holdings does that NAV include? Unfortunately, the proportion of non-traded assets in Urbana's portfolio has grown, and that makes it more difficult to pin down a precise value for Urbana's holdings.

Urbana reports its holdings and NAV on a weekly basis. Investments in publicly-traded assets make up 56% of Urbana's assets. Large American and Canadian banks and securities exchanges represent the majority of these public holdings, though Urbana also has holdings in Canadian materials stocks. Despite my dissatisfaction with Urbana's propensity to invest outside its wheelhouse, I must admit the investments in "Canada, Inc." (management's terminology) were well-timed and have performed well.

The private side of Urbana's investment book is more interesting. The largest of Urbana's private holdings is Real Matters Inc. Real Matters is a real estate technology company providing appraisals and valuations to banks and insurers. Real Matters has been a home run investment for Urbana, though Real Matters is strongly levered to the potentially over-heated Canadian real estate market.

The second largest private investment is the Bombay Stock Exchange. This investment has not done as well for Urbana, though the Bombay stock exchange has received approval to conduct an IPO and may receive a higher valuation if and when it does so. (It appears that Urbana invested in several private securities exchanges when their valuations were higher. These include the Budapest Stock Exchange and the Minneapolis Grain Exchange. Value investor favorite [perhaps former favorite] FRMO Inc. has also invested in the Minneapolis Grain Exchange.)

Most controversially, Urbana has invested in a private financial company owned by Urbana's CEO, Thomas S. Caldwell. The company maintains that investments in Caldwell Financial Ltd. are done at valuations of one-third to one-half of what Caldwell Financial would fetch in private sales. I have no reason to believe this is not so, but these related-party transactions introduce an element of additional uncertainty in evaluating Urbana's holdings, and require investors to exercise a greater degree of trust in management.

Urbana management has indicated it will continue to buy back shares aggressively, but also notes that large blocks of class A shares are becoming more difficult to source and that the pace of repurchases may slow.

Shares at current prices offer a way to purchase an otherwise inaccessible collection of private exchanges and other intriguing assets at a large discount to NAV. I don't know if these underlying assets will provide strong returns in coming years, but continued share repurchases should help grow Urbana's value per share. Investors will have to judge for themselves if the 40% discount to reported NAV is large enough to overlook the company's high management costs and complicating related-party transactions.

Alluvial Capital Management, LLC does not hold shares of Urbana Corporation for client accounts. Alluvial may buy or sell Urbana Corporation shares at any time.

OTCAdventures.com is an Alluvial Capital Management, LLC publication. For information on Alluvial’s managed accounts, please see alluvialcapital.com.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.