What's New With Retail Holdings NV? - RHDGF

Long-time readers may remember previous posts on Retail Holdings NV. "ReHo" is one of my longest-held and sadly, most stubbornly lackluster performers. Still, I remain convinced that Retail Holdings' collection of profitable and growing Asian businesses and large discount to NAV will eventually result in substantial appreciation. ReHo recently published its first half 2015 results. Let's take a look at how they did, and how the company's earnings and NAV have developed.

Reho's semi-annual report (available here) reveals a few major changes in the company's assets and operations. First, Singer Thailand is no longer a Singer Asia subsidiary. In June, Singer Asia sold its 40% stake in Singer Thailand for $44.8 million. In CEO Stephen Goodman's words,

"The sale reflects the unique circumstances of Singer Thailand: the Company only had a 40% stake compared to the very much larger, majority stakes in the Company's other operations, and Singer Thailand employs a very different, direct selling business model, as compared to the retail and wholesale business models employed elsewhere."

Mr. Goodman went on to say there are no plans for any immediate disposition of the company's remaining subsidiaries, and the use of the proceeds of the Singer Thailand sale is yet to be determined.

The second major revelation is a large writedown in the value of the SVP notes that ReHo holds. These notes have been distressed for a long while and have undergone multiple restructurings. In June, SVP failed to make a full cash interest payment on the notes, and Retail Holdings moved to classify the notes as impaired, writing down their value from $25.9 million to $13 million. This large impairment necessarily took a toll on ReHo's reported EPS for the half year. I must admit that the degree of the writedown surprised me. I had long valued the notes at less than par, but declaring the notes impaired by a full 50% indicates a great deal more financial difficulty at SVP than I had expected.

Operational results were good. ReHo's consolidated revenues rose 14.3% year over year in US dollar terms. Retail Holdings' two largest subsidiaries (via Singer Asia) are Singer Sri Lanka and Singer Bangladesh, and their fortunes moved in opposite directions. Revenues at the Sri Lanka company soared 26% with pre-tax income up 66%. The Bangladesh division struggled with the country's continued political and economic instability, and revenues declined 7.6%, dashing earnings. Nonetheless, Singer Bangladesh remained profitable. Singer India also turned in a profit, while Singer Pakistan and the newly-established Singer Cambodia lost money.

ReHo's reported first half EPS was $1.13 compared to $0.73 a year ago, but the figures are hardly comparable due to the SVP notes impairment and the gain on the Singer Thailand sale.

There are two ways to evaluate Retail Holdings NV's worth: via its assets and via its earnings power. These are, of course, just the two sides of one coin. Still, a separate look at each is useful. Evaluating Retail Holdings from an asset perspective is easy. Retail Holdings owns 54.1% of Singer Asia, which in turn owns five business units in Asia, four of which are traded on local stock exchanges. Additionally, both Retail Holdings and Singer Asia hold unencumbered cash at the company level and Retail Holdings holds high yield bonds, the SVP notes. Neither Retail Holdings nor Singer Asia has any company-level debt.

Here's a look at ReHo's current NAV breakdown.

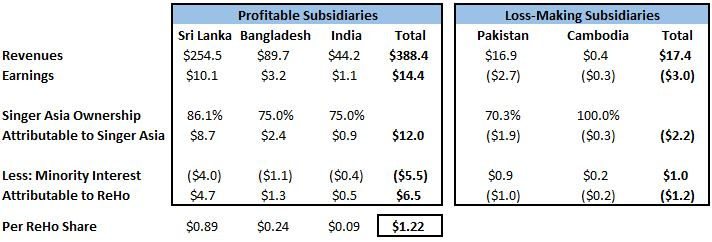

At a current mid-point of $18.63 or so, ReHo shares trade at a 38% discount to NAV. No surprise. This discount has persisted for years in various degrees. Now let's take a look at the underlying earnings of Retail Holdings' subsidiaries. The chart below presents trailing twelve months results for the various Singer entities, divided between the profitable and unprofitable segments.

By buying one share of Retail Holdings, you're purchasing $1.22 in attributable earnings from Singer Asia's profitable subsidiaries. The losses of the Pakistani and Cambodian subsidiaries can be ignored because they are separate legal entities that Singer Asia is not obligated to support. After backing out the value of the enterprise's corporate cash, the SVP notes, and the stock market value of the loss-making Pakistani subsidiary, you're paying a very reasonable multiple for these fast-growing and profitable businesses, Singer Sri Lanka in particular.

As if there weren't enough tedious explanations in this post already, here's the breakdown of the components of Retail Holdings' share price.

Just to emphasize, Retail Holdings' share price implies a 9.3x earnings multiple on profitable subsidiaries growing at well over 10% annually with no slowdown in sight. The Sri Lankan subsidiary in particular is attractive. The Sri Lankan economy is one of the world's fastest-growing following the end of the decades long civil war in 2009.

With all that said, one question remains: why? Specifically, why does Retail Holdings NV trade at 62% of NAV and under 10x the earnings of its fast-growing subsidiaries? I don't think the answer is difficult to find. ReHo's corporate configuration could hardly be more awkward. What sensible company would be headquartered in a Caribbean tax shelter, operate solely in South-East Asia, and have its stock traded only in the US? On top of that, Retail Holdings' stock is highly illiquid and the company is not an SEC filer. The cherry on top is repeated broken promises by management to IPO Singer Asia, only to see the IPO process abandoned each time.

I do have some small amount of sympathy for management. It seems that each time the company begins preparing the Asian operations for an IPO, some market or political crisis erupts that torpedoes the IPO market. But the fact remains that Retail Holdings NV is not likely to achieve its full value until an IPO is achieved.

If all Retail Holdings had going for it was the hope of a future convergence to NAV via an IPO of its Asian operations, I would not be interested. There are hundreds of holding companies that trade at a discount to NAV, and many times these discounts persist for decades. But in Retail Holdings' case, the NAV is growing rapidly and will continue to grow as the Asian subsidiaries grow revenues at 10-15% annually. It doesn't take long for serious value creation to result at those rates of growth. 9.3x earnings is a silly valuation for companies on this trajectory.

For that reason, I am happy to hold Retail Holdings for as long as its subsidiaries' values continue to build. The Singer brand remains exceedingly strong, especially in the company's primary Sri Lanka market. In the mean time, ReHo will continue to pay out most of its free cash flow in annual distributions, with the possibility of special distributions from asset sales, like Singer Thailand.

Alluvial Capital Management, LLC holds shares of Retail Holdings NV for client accounts. Alluvial may buy or sell shares of Retail Holdings NV at any time.

OTCAdventures.com is an Alluvial Capital Management, LLC publication. For information on Alluvial’s managed accounts, please see alluvialcapital.com.

Alluvial Capital Management, LLC may buy or sell securities mentioned on this blog for client accounts or for the accounts of principals. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com.