Wilh. Wilhelmsen Companies - Part 1

The Wilh. Wilhelmsen companies are the world's largest operators of car carrier ships. The companies also provide a host of logistics and marine industry services, independently and in conjunction with other major shipping companies. The Wilh. Wilhelmsen companies trace their history back to 1861, when Morten Wilhelm Wilhelmsen began with a single ship in Tønsberg, Norway. Today, the Wilhelm companies operate in 73 countries and employ nearly 28,000, including joint ventures.

In their present form, the Wilh. Wilhelmsen companies operate as two legally separate, yet related entities. Both the Wilh. Wilhemsen companies are complex operations, with dozens of joint ventures and minority partners. Both of the companies are also extremely undervalued, trading at large discounts to their earnings power and net asset values.

Shares of the Wilh. Wilhelmsen companies are traded on the Oslo exchange. The Wilhelmsen family continues to own majority stakes in each company.

Today I'll address Wilh. Wilhelmsen ASA and tomorrow I'll tackle the parent company, Wilh. Wilhelmsen Holding ASA.

Wilh. Wilhelmsen ASA

Wilh. Wilhelmsen ASA operates in the shipping and logistics sectors, and also has a significant shareholding in Hyundai Glovis, a South Korean logistics company. The company is 72.73%-owned by its parent company.

Times have been good for the car carrier industry, even as the broad shipping market remains stuck in the doldrums. The global economic recovery has boosted vehicle shipments, with the US set to import the most vehicles since 2008. Shipbroker Clarkson Plc estimates global trade in vehicles will rise 7.2% in 2013. WWASA's strategy is to own a base number of ships, then add capacity by chartering additional ships as needed.

The company has managed strong profits as the global auto industry rebounds.

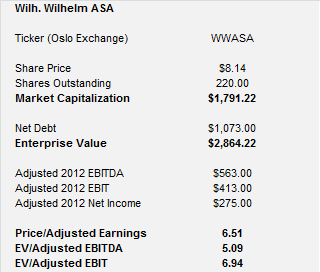

Excluding a $134 million gain on the sale of an investment, WWASA earned $563 million in EBITDA and $275 million in net income in 2012. WWASA trades at a very modest multiple of these figures. From 2009 to 2012, consolidated revenues rose at a 5.1% rate, and adjusted EBITDA rose at 10.7%. WWASA's reported valuation multiples are quite reasonable for a financially healthy, growing firm, but they hardly tell the full story.

WWASA owns a 12.5% stake in Hyundai Glovis Co. Ltd. Glovis is worth $6.4 billion, making WWASA's stake worth $799 million, or 44.6% of WWASA's market capitalization. Yet, Glovis contributed only $58 million in operating income in 2012. Excluding Hyundai Glovis from WWASA's market capitalization and EBIT shows what an extremely low multiple the market is assigning to WWASA's core operations.

Excluding the value of WWASA's stake in Hyundai Glovis and the associated share of profits, the market values WWASA's other car carrier and logistics operations at only 4.6x 2012 net income and 5.8x EBIT.

Wilh. Wilhelmsen ASA is also cheap on a price to book value basis. Book value at the end of 2012 was $1,553 million, yielding a price to book ratio of 1.15. However, the true value of WWASA's joint ventures and affiliates does not appear on its balance sheet. At the end of 2012, the book value of WWASA's investment in joint ventures and affiliates was $976 million. Yet, these assets contributed an average of $198.65 million in income over the last three years.

The implied valuation of the company's JVs and affiliates is 4.91x 3-year average income, which is far too low. A more realistic, yet still conservative valuation of 8x average income would value the JVs and affiliates at $1,589 million, which would increase adjusted book value to $2,166 million and reduce WWASA's adjusted price to book ratio to 0.83.

Assigning a reasonable valuation multiple to WWASA's operations and giving the company full credit for the value of its investment in Glovis yields a fair value much higher than the current share price.

A reasonable valuation of 8x 2012 EBIT, plus the value of the company's Glovis stake provides an enterprise value estimate of $3,639 million. Subtracting net debt of $1,073 million leaves equity value of $2,566 million or $11.66 per share, 43% above the current price.

Shipping companies all face certain risks, chiefly low charter rates caused by a supply and demand mismatch. Combined with high debt levels, many shipping companies swing widely between huge profits and equally enormous losses from year to year. WWASA is relatively conservatively financed and does not engage in speculative newbuild activity, making it a lower risk player in the attractive car carrier market.

No position.