Wilh. Wilhelmsen Companies – Part 2

Time now to examine Norway's other Wilh. Wilhelmsen company, Wilh. Wilhelmsen Holding Group ASA. "WWHG" is the parent company of the company I profiled yesterday, Wilh. Wilhelmsen ASA.

WWHG owns 72.73% of Wilh. Wilhelmsen ASA, as well as significant other assets. These assets include investments in logistics and maritime services, as well as holdings in a publicly-traded Australian logistics provider.

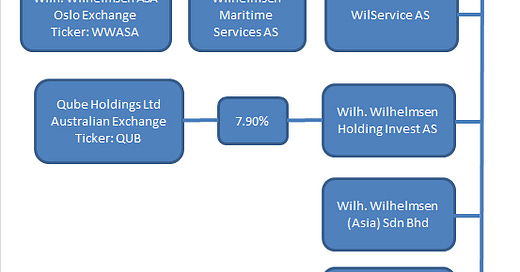

If anything, WWHG is even more complex than its subsidiary, Wilh. Wilhelmsen ASA. The parent company owns (in whole or via a controlling stake) many dozens of subsidiary companies, and has minority stakes in many more. The company provides a basic organization chart illustrating its major business lines. Tickers and ownership percentages are provided for subsidiaries and affiliates that are publicly-traded.

WWHG's value should be at least equal to the value of its publicly-traded holdings, but the market thinks otherwise. As of yesterday, WWHG's market capitalization is $1.29 billion USD, while the combined market value of its stake in Wilh. Wilhelmsen ASA and Qube Holdings Ltd is $1.41 billion. WWHG is currently priced at a discount of 9% to the value of its publicly-traded holdings alone, disregarding the value of its other operations entirely.

Remember, though, Wilh. Wilhelmsen ASA is itself considerably under-valued, based on the value of its own holding in Hyundai Glovis and its car carrier operations. In yesterday's analysis, I conservatively estimated WWASA's value at $2.556 billion. Using the adjusted value results in a 35% discount to the value of WWHG's shareholdings.

The company's main division is the 72.73%-owned Wilh. Wilhelmsen ASA business. In yeseterday's post, I estimated the company's worth at $2,556 million, of which $1,859 million is attributable to WWHG.

WWHG's second-largest line of business is Wilhelmsen Maritime Services AS. WMS produced operating profits of $68 million in 2012, and averaged $66.87 million in operating profit over three years. The WMS division operates many JVs, leading to some minority investors having a claim on its profits. Even though WMS recorded nearly no minority interest in 2012, I am assuming a 20% average reduction to operating income for minority interest. Valuing the division at 8x that conservative figure results in a valuation of $428 million.

WWHG's remaining operations are lumped together as the "Holdings and Investments" segment. This segment operates in an eclectic mix of business lines, not all of them profitable. The segment is the "forward-looking" part of the company, charged with advancing the industry. Profits for the division are lumpy, and largely related to the Qube Holdings investment. Backing out gains and losses related to Qube leaves operating losses of $14 million in 2012 and an average loss of $20.37 million over three years. The 2010 loss of $35.1 million was affected by expenses due to the IPO of Wilh. Wilhelmsen ASA and an office relocation.

Despite the ongoing losses at Holdings and Investments, I value the segment at book asset value, less the value of its stake in Qube. The Holdings and Investments segment's operations benefit the remainder of the company through technological and managerial advancements, many of which will never be reflected in the division's financial statements. In addition, the division purchased 35.4% of Norsea Group in 2012. This investment is performing well and delivering greater and greater profits to Holdings and Investments.

My value estimates of WWHG's shareholdings and operations sum to $2.64 billion.

That's the value of the firm. Determining the value of the firm's equity requires adjusting for cash, other securities and debt.

WWHG carries $2,008 million in interest-bearing debt. However, $1,534 million is attributable to the WWASA subsidiary, leaving $472 million at the company's other segments. WWHG has $576 million in cash. WWASA's portion is $344 million, leaving $232 million at WWHG. Finally, WWHG holds $84 million in various Nordic stocks and bonds at the parent company level.

Adjusting for WWHG's net debt and securities yields an equity value of $2.42 billion, or $52.09 per share. This estimate of fair value is 88% above current prices.

WWHG appears to be even more under-valued than its subsidiary, WWASA. But why? Both companies appear to suffer from the classic holding company discount. The market abhors complexity, and firms that utilize extensive crossholdings and joint ventures are penalized by investors who can't or won't take the time to dig deep into the financial statements.

In addition to being a holding company, WWHG is a controlled company. Three Wilhelmsen siblings control 60% of voting power, giving them unassailable control. Some investors shy away from controlled companies, but I look at the situation differently. In my view, the Wilhelmsens could not be more highly incentivized to manage the company well. Their reputations and the fate of a 150 year family legacy depend on it, as does the lions share of their personal wealth.

The track record of both Wilhelmsen companies speaks in their favor. WWHG has returned over 15% annually for the last decade, while WWASA has more than doubled since its 2010 IPO. Both companies are well-positioned, reaping profits from the strong car carrier market and investing in logistics and maritime services that will help them weather the ups and downs of the deeply cyclical shipping market. Neither firm employs excessive leverage, and both firms pay regular dividends.

Investors in both companies will likely do extremely well as the world's population and economy expand. The expansion of the global middle class will require more vehicles than ever before, and the Wilhelmsen companies will be there to ship them.

No positions, plan to buy shares in each company soon as I can transfer funds to a broker that allows trading on the Oslo Exchange.