Before I get going, here’s Alluvial’s Q4 letter for anyone interested. Thanks for reading.

I like royalties and royalty-like cash flows. I understand this is a bit like saying “I like ice cream” because honestly, who doesn’t?1 A good royalty investment offers an attractive current yield, potentially higher future cash flow, and tax benefits, all without any need for capital expenditures or other annoyances. Today, I want to look specifically at royalties derived from music and other media. Lately, a number of trading venues and fintech companies offering royalty investments have sprung up. But first, let’s look at one of the most venerable musical royalty trusts out there: Mills Music Trust.

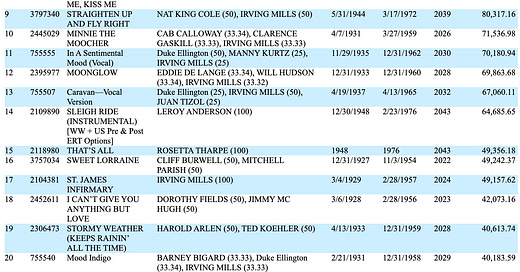

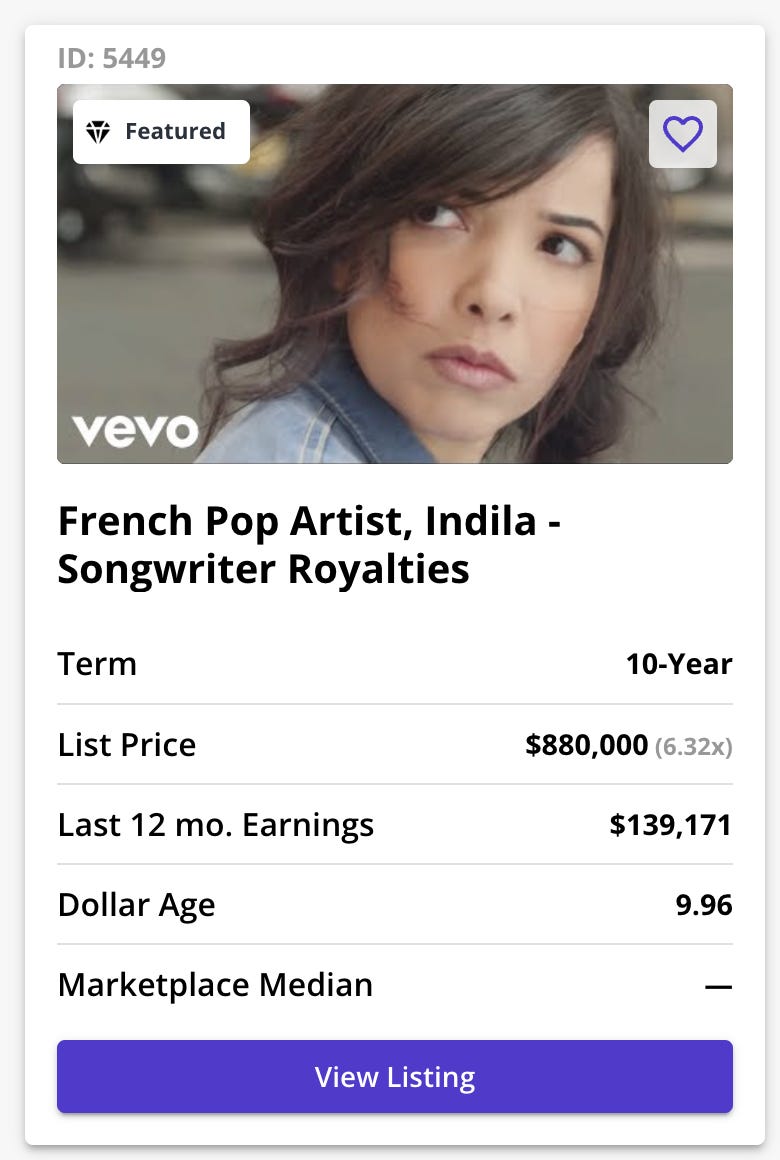

Mills Music Trust ,“MMT,” traded under the ticker MMTRS, was created in 1964 to own the rights to certain royalty income of a huge catalogue of songs with copyrights held by Mills Music Inc. Mills Music has its own fascinating history stretching back to the early 20th century and composer Irving Mills. MMT owns the rights to over 25,000 tunes, but only a handful continue to earn any meaningful royalties. The trust helpfully provides a list of their top-grossing tracks. Here are the top 20. Recognize any?

Two classic holiday tracks and two variations on the most popular earned a large majority of the trust’s total 2022 revenue. In a way, MMT can be thought of as a royalty on holiday nostalgia.

Trust units have experienced some large swings in valuation, ranging from $15 to $60 over the last decade as interest rates rose and fell. Units currently yield 8.5%. Is that enough to reward investors sufficiently? Possibly not, and here’s why. See track number 3 above? “Stardust.” It’s a lovely tune. And unfortunately for Mills Music Trust, it is now in the public domain. “Stardust” royalties accounted for about 6% of the total royalties earned by the top 50 songs in Mills’ catalogue. Most other high earners have copyrights expiring in 20+ years, but with 3% contributor “It Don’t Mean A Thing (If It Ain’t Got That Swing)” entering the public domain in 2027, it seems likely that Mills Music Trust distributions will be charting a downward path from here. Perhaps if Mills Music Trust were yielding 12% or so, I could see a path to realizing a 10% IRR or something from here, but with multiple significant tracks ceasing to produce royalty revenue, I think the best holders can hope for is high single digits. And maybe that’s enough! This is, after all, a nice non-correlated investment that should not see its cash flow stream affected by the vicissitudes of the economy. But personally, I would only become interested if these units trade down to the mid-$20s.

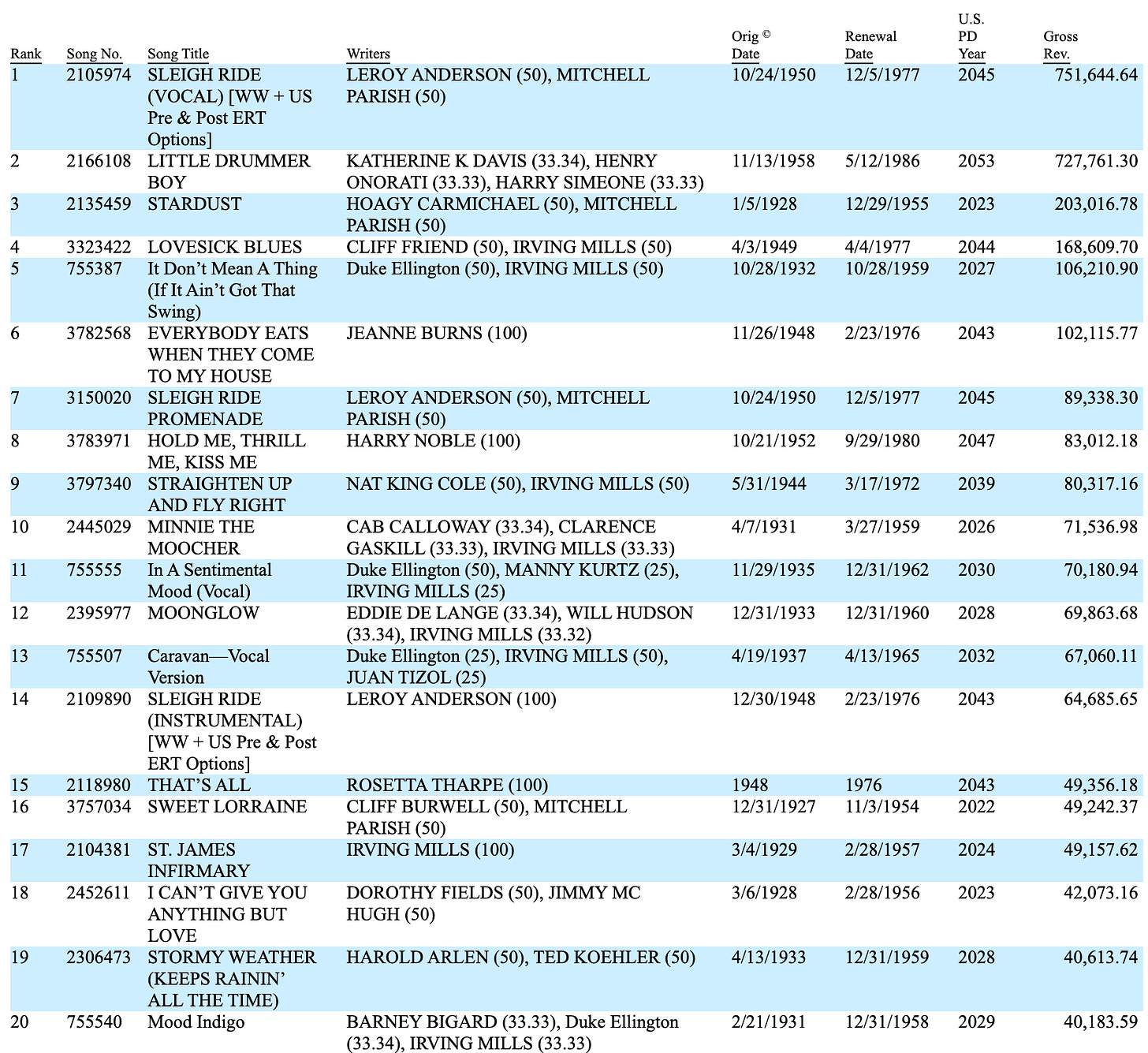

On to more modern royalties! I enjoy perusing the Royalty Exchange at Royaltyexchange.com. While I have yet to pull the trigger on actually bidding, I am endlessly intrigued by the sheer variety of royalty assets available. There’s everything from movie soundtracks to Swedish hip-hop to punk and indie rock. And the royalties come in several flavors. Some are “life of rights,” others limited-term, domestic vs. international or otherwise carved up and parceled out. In other words, it’s a rich marketplace for someone with some knowledge and work ethic. (I could do the work but the knowledge isn’t there for me at this juncture, hence my wallflower status2.) The reason why so many music royalty assets are available is a 2006 change to the US tax code. Specifically, amendments to Section 1221(b)(3) allow sellers of self-created musical works to take capital gains treatment on the sale rather that pay taxes at personal income rates. The reason music royalties were being taxed at personal income rates in the first place is thanks to President Eisenhower, who successfully used a tax loophole to save on taxes related to selling the rights to his World War II memoirs3.

Royalty Exchange currently has over 700 different royalty listings. The highest-earning collection produced royalty income of $139,171 in the last 12 months.

At the other end of the spectrum, the lowest-earning royalty asset brought in just $163 in the last year.

The seller rejected an offer of $1,950 last year. Given the current earnings rate and the remaining life of the rights (5 years) this seller may be a bit delusional. But that’s the fun of this marketplace!

Beyond music, Royalty Exchange also occasionally auctions off other royalties. The most notable, so far, was a portion of the royalties relating to the sale of Listerine. The history of this royalty asset goes all the way back to 1881 when the Listerine inventor sold the rights to a distributor. Ever since, pieces of the royalty have changed hands occasionally, often accompanied by litigation and strife. Interestingly, the royalty is not based on the total sales volume of Listerine but the actual liquid volume of product sold. The listerine royalty auctioned on Royalty Exchange changed hands in 2022 at $1.8 million, or 15.7x trailing cash flow. I have to imagine that given the move in interest rates since, the asset would fetch a lower valuation today.

Finally, various fintech companies are trying to get into the royalties game by packaging up royalty assets and offering them to the platform users. I view most (ok, virtually all) fintech companies with suspicion. I have yet to see one that truly offers a service most people couldn’t access at lower all-in costs from an existing brokerage or bank. But hey, if people enjoy using a sleek app to buy marked-up financial assets, who am I to stop them?

One such platform is “Public.” The company offers users the ability to buy traditional stocks, bonds, and ETFs, plus cryptocurrencies and now, a royalty asset. Enter everyone’s favorite grouchy green ogre: Shrek.

Public purchased a 25% royalty in the musical scores of the various Shrek films. Now, Public offers its users the ability to purchase an interest in the royalty. The company provides a good bit of info about the royalty structure, including a pitch deck, podcast, and even a hub where holders can track the performance of their royalty invest and discuss its prospects.

Deck: https://public.com/documents/royalties-investment-deck

Podcast: https://public.com/live/alternative-assets/deep-dive-shrek-royalties

Hub: https://public.com/alts/SHREKROYALTIES?m=royalty-onboarding

And for the real nerds, the offering circular: https://www.sec.gov/Archives/edgar/data/1947158/000194715823000007/f253g2091223_publicshrekroya.htm

Lots to talk about here. I have so many issues with how this investment is being structured and marketed, I don’t quite know where to begin. First, while Public is careful to highlight the risks of investing in alternative assets, its users are clearly buying into the Shrek royalty with the idea that the value of their interest will rise, both quickly and significantly. “Number go up.” And that’s not how a typical royalty investment functions. Sure, it’s always possible that royalty revenues experience an unexpected increase and their present value increases materially, but in most cases these are wasting assets. The return stream is the current cash flow, which will tend to decline over time before eventually vanishing with zero terminal value. So when I see the trading price of these Shrek royalties nearly doubling since they were issued, it tells me somebody does not understand what he or she is buying.

This should not happen! Outside a collapse in interest rates and/or rate expectations or a giant increase in Shrek’s popularity, the value of this royalty should be relatively constant, not up 80% since issuance. Public’s users have pushed up the price of this royalty to the point that it yields just 5.6% on trailing results, a valuation that is sure to disappoint those buying in at this level.

Then there is how Public characterizes the risk profile. In the pitch book, they state that “The asset has low correlation with traditional markets—for example, its performance is not tied to interest rates.” This is, at best, a half-truth. While the cash flows of the royalty may not be directly affected by the movement of markets and interest rates, the value of the royalty itself absolutely is. The value of every risk asset is! A royalty is nothing more than the contractual right to a series of cash flows, and the value of those cash flows is inextricably tied to the level and movement of interest rates.

Finally, there’s the typical layering of fees atop the royalty asset. Public gets 5% of the royalty distributions, and 10% of the proceeds if the royalty is ever sold. Yes, Public is providing a service and should get paid accordingly, but this is just excessive.

For my money, I think investors should stick to places like Royalty Exchange. After all, that’s where Public acquired the Shrek royalty in the first place. No middleman required.

Anywhere else I should be looking for royalty assets? I know the world of energy-related royalty assets is huge, but that’s not a market for beginners. But if anyone knows of other platforms offering royalties related to music or consumer products or film or pharma or whatever else, I’m all ears!

One possible answer: investors. Schmitt Industries pivoted to ice cream with the purchase of Ample Hills in 2020, but melted in the face of high operating costs and production issues. Schmitt shares recently changed hands at $0.031. Hershey Creamery, on the other hand, is a fantastic ice cream business that trades on the expert market.

As yet, there are no listings relating to royalties from The Wallflowers.

The very under-rated Bloomberg Tax enlightens us on the subject. https://news.bloombergtax.com/tax-insights-and-commentary/capital-gains-election-will-keep-driving-music-catalog-sales

nicely adjacent to the recent squabble on UMG vs tiktok (who simply seems just too cheap to pay).

Hipgnosis fund in the UK is pretty interesting