Finding Value in Faraway Places

It's a long way to Port Moresby

I like looking at companies operating in far-flung places. (No surprise there for any long-time readers.) To me, the attraction is simple. It’s not so easy for a competitor to come in and dislodge a long-established business on some Pacific archipelago or alpine duchy. Besides the sheer geographic remoteness and the particularities of local cultures, the potential reward is just too small. For the most part, these are tiny economies with limited population growth. So local companies go on profiting year after year, little affected by the machinations of huge multinationals.

There are numerous examples. Føroya Banki dominates the banking sector of the Faroe Islands, a Danish autonomous territory situated north of Scotland and home to 54,000 intrepid souls. Over 8,000 miles to the southwest, the Falkland Islands are home to a single public company, FIH Group plc. Granted a British royal charter in 1851 as the “Falkland Islands Company,” FIH accounts for 60% of retail sales on the islands and is traded in London. It is also a major landowner. And who could forget the North West Company, which operates general stores in isolated outposts in Northern Canada, the Caribbean, and the South Pacific?

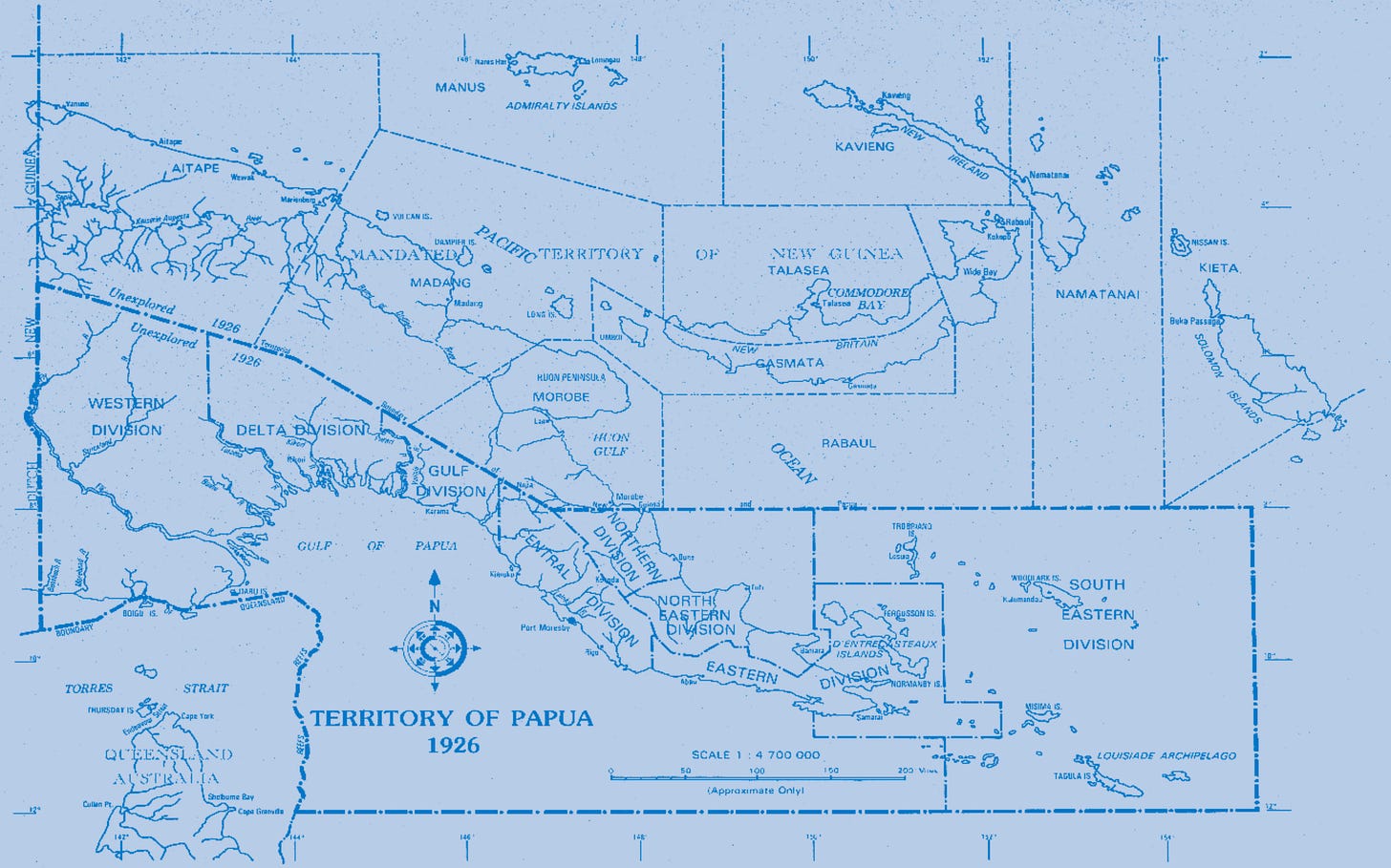

As remote and obscure as these places and companies may be, I recently spent time looking at the stock market of a place that may be even more so: Papua New Guinea. Could there be some crown jewel of the Pacific waiting to be discovered?

“PNG” is not exactly a tourist destination. Nor is it an easy place to live for most. The island nation is impoverished and violent crime is common. Economic growth is hindered by rough terrain and poor infrastructure, and governance is made difficult by the sheer number of spoken languages (over 800) and people groups, some of which are embroiled in ethnic conflicts stretching back many generations. Corruption is rampant, with some estimating that 20% of annual government spending is lost to graft and waste. Indeed, even the members of PNG’s Independent Commission Against Corruption (consisting of two Australians and a New Zealander) are levying charges of corruption against each other.

The country, independent since 1975, does have abundant natural resources. But developing these resources in a manner that balances the competing interests of mining concerns and local populations is an unresolved problem.

Despite its numerous issues, Papua New Guinea does have a small stock market, located in the capital, Port Moresby. The exchange has just a handful of issuers. And like most frontier markets, almost all trading takes place in just a few of these names. Still, just for fun, here’s a look at each of the stocks that trades on the PNGX.

BSP Financial Group Limited - BSP

“BSP,” known of Bank of South Pacific until 2021, operates in 9 different countries in the South Pacific and Southeast Asia. The company proudly notes that 97.8% of its shareholders are local to the region. A PNG government entity owns 24.8%. BSP faces the unique challenge of operating in 9 different currencies, but it manages the challenge well. Indeed, BSP is strikingly profitable. Despite operating on thinly-populated islands spread across thousands of square miles of ocean, BSP regularly posts a return on equity in the mid-20%s.

At present, loans make up 44% of BSP’s assets, with securities representing another 27%, cash and equivalents 23% and the remaining 6% physical premises and minor miscellaneous assets. BSP earns a good rate of return on its cash, loans, and securities, recording a 6.1% yield on average earning assets in 2024. Against this BSP paid only 0.4% on its deposits and borrowings. That’s a nice spread. I guess you can get away with that when you’re the only bank in town. This strong net interest margin explains the bank’s consistently high return on equity.

BSP has been a nice returner for shareholders, up 55% since June 2023 and yielding almost 7%. While BSP is listed on the PNG Exchange, it also has a much more liquid listing on the Australian Stock Exchange, should anyone be interested in doing some more work on this company.

Credit Corporation - CCP

Credit Corporation is another major PNG finance company with an estimated market share in loans and leasing of 33%. Credit Corporation was founded in 1978 with assets of 500,000 Kina, the equivalent of $120,000 at today’s exchange rates. The company was profitable from the beginning and was an early investor in Bank of South Pacific. Credit Corporation still owns a 5.7% stake in BSP. Shares of Credit Corporation are thinly-traded, but at the bid/ask midpoint, the company has a market capitalization of 1,558 million Kina. Interestingly, Credit Corporation’s investment in BSP is worth 1/3 of its market capitalization.

Unfortunately for Credit Corporation, it manages only a middling return on equity, ranging from 2.8% to 11.1% in recent years. Despite this, Credit Corporation trades at a premium to book value. The company does have assets that do not currently contribute much in the way or earnings or cash flow, like real estate and CreditBank PNG, a digital-first bank launched in 2024. Still, Credit Corporation shares don’t look interesting to me from a valuation perspective.

PNG Air Limited - CGA

What would an Asia Pacific nation be without a national carrier? Papua New Guinea is no exception. In operation since 1987, PNG Air’ fleet of 15 aircraft provides service to 23 domestic destinations, plus Cairns Airport, Australia. PNG also has among the best liveries I have ever seen. Witness:

Sadly, that’s where the good ends. PNG Air is chronically unprofitable with its last operating profit recorded in 2019. The company has been unable to produce audited financial statements for the last several years. A recapitalization plan was approved in late 2023, but the success of the plan is difficult to assess without current financial data. Safe to say PNG Air is not much closer to financial stability, given there are currently zero shares bid or offered on the exchange.

CPL Group - CPL

CPL (“City Pharmacy,” historically) is a pharmacy and general retailing group with numerous locations across PNG. Its 2024 annual report opens with perhaps the most quintessentially Frontier Markets statement I have ever read.

Believe me, I have had a lot go wrong at companies I have invested in in my time as a professional investment manager. But I am relieved to say none of our investments has ever suffered losses due to mass looting and arson.

While 2024 was especially difficult for CPL, operating results had been trending negatively for a few years running. Profits peaked in 2020 at K0.07 per share, falling to K0.029 per share in 2023 and to losses for 2024. The company has released a restructuring plan intended to streamline operations and improve profitability.

There are no bids for CPL shares on the exchange, but shares are offered at K0.7. This represents 87% of book value and 10x 2020 peak earnings. Looks like wishful thinking by the seller.

Kina Asset Management Limited - KAM

“KAM” is an investment firm which owns a diversified portfolio of domestic and international equities. 32% of the portfolio is allocated to PNG securities, 37% to Australian securities, 20% to US and global securities, and the rest to cash. I went through the list to see if there were any interesting private or difficult-to-buy securities in the portfolio, but it’s a fairly vanilla roster with a large allocation to PNG and Australian banks. NAV at the end of May was K2.01 per share. The exchange website shows no shares offered, while the best bid stands at 1.80. I know a few US and UK closed-end funds that would love to trade at only a 10% discount to NAV.

Kina Securities Limited - KSL

Kina Securities is the third and final bank/finance company on the list. I promise. And Kina Securities, like BSP, has a much more liquid and active listing in Australia. Kina Securities is PNG’s fourth-largest bank and largest wealth manager. It also handles more than 60% of trading volume on the PNG stock market. I guess I’ll be calling Kina if I ever decide to get involved.

A look at Kina Securities’s financials reveals PNG’s second-best business after BSP. Kina regularly earns a mid-teens return on equity. Revenue grew at a 17% annual pace from 2016 to 2024, and operating income expanded at a 15% annual rate. Despite this, Kina shares have gone mostly sideways over the last decade, albeit with a nice dividend yield along the way.

Newmont Corporation - NEM

Yes, this is the NYSE-listed gold mining giant with a $64 billion market capitalization. I guess you could try buying it on the PNG market, but there is no liquidity. Anyway, even trying would make you a real sicko.

NGIP Agmark Limited - NGP

NGIP Agmark is a cocoa producer, and by far the most intriguing stock on the entire exchange. If you’ve seen any headlines about cocoa prices in the last year, you’ll very quickly grasp what this means for profits at a company like NGIP Agmark. Indeed, profits increased sixfold, from K0.11 per share to K0.67 per share. The company chose to reward shareholders with a K0.16/share dividend.

2025 is looking like another incredible year for NGIP Agmark, with cocoa prices remaining extremely robust.

Despite the strong outlook, NGIP Agmark shares trade at just K1.00, or 1.5x trailing earnings and one-third of book value. Now, volume is very light, but the shares do occasionally change hands. And that means that someone out there is willing to let go of these shares at absurdly low prices. And my question is simply “why?” The seller(s) either see(s) something the rest of the market does not, or they do not know what they own. Maybe they cheer for a different rugby team, not the one that NGIP Agmark sponsors.

Niuminco Group Limited - NIU

Niuminco is a junior mining company, hoping to strike it rich. In other words, not so very different than the dozens of junior resource plays traded in Vancouver and Sydney. Niuminco has been at it by various means since 2011. I suppose there’s always a chance it works, but the base rates are unflinching.

Steamships Trading Company Limited - SST

Steamships, also traded in Australia, has the most colorful history of any PNG stock. Steamships is a conglomerate with operations in shipping, real estate, retailing, manufacturing, and IT. Steamships also owns 50% of Colgate Palmolive PNG. The company was founded in 1918 when a retired sea captain, the wonderfully-named Algernon Sydney Fitch, launched a salvage business in what was, at the time, an almost ludicrously remote part of the world, at least from a Westerner’s perspective. As the 20th century progressed, Steamships expanded into nearly every sector of the PNG economy. To celebrate 100 years of operations, the company commissioned a lovely book entitled “Steamships Trading Company 1918-2018.” Obviously I have purchased this work for my collection of obscure corporate hagiographies, but the company also kindly provides a PDF copy of the 239-page tome.

Steamships has enjoyed a lot of good years in its long history, but unfortunately, recent years have offered little to smile about. Operating margins have been pinched by sagging revenue and surging costs, and the resulting lack of free cash flow combined with heavy investment has caused leverage to rise. Perhaps this is a prelude to a recovery, but in many ways Steamships appears to be a typical underperforming conglomerate: an unfocused collection of good and bad businesses, with the sub-par assets sapping both capital and management attention from the gems. Despite its grand history, I think Steamships would be better off letting go of a few of its segments and refocusing on those it knows and likes best. Whether or not that happens is entirely up to its majority owner, Hong Kong conglomerate Swire Pacific.

Santos Limited - STO

Santos is a large liquid natural gas-focused company, also listed in Australia. Santos shareholders are a long-suffering bunch, but it appears that Santos will be bought by a consortium led by Abu Dhabi National Oil Company. So long!

And there you have it. An entire frontier markets stock market. 11 names, two of them just local listings of huge multi-nationals. And only 3 or 4 with both a bid and ask. Still, while there might not be much opportunity for investors today, I like to check in with these markets now and again. You never know what could happen. Thanks for reading!

Alluvial Capital Management, LLC holds shares of North West Company and Føroya Banki for client accounts it manages. Alluvial Capital Management, LLC may hold any securities mentioned on this blog and may buy or sell these securities at any time. For a full accounting of Alluvial’s and Alluvial personnel’s holdings in any securities mentioned, contact Alluvial Capital Management, LLC at info@alluvialcapital.com

It would not be easy to find an investor who looks under more rocks than Dave Waters.

Steamships Trading Company Limited.. What a find!

May I suggest CAFOM, and CBO Territoria (paris) if you like remote islands.